Market Update: Another inflation driver turns over

Source: MATT, 19 July 2023

Last week’s markets have, yet again, revolved around inflation, wages and profit margins. In the UK, we finally got a little of the good news that has been stoking US markets. Inflation wise, June turns out to have been not so bad. Inflation data showed a notable slowing while retail sales were perky, possibly because we were all pinky from the hot weather.

Regarding inflation, Sam Tombs of Pantheon Macroeconomics described June’s consumer price index (CPI) print of 7.9% year-on-year as being a watershed moment. He thinks this gives the Bank of England (BoE) Monetary Policy Committee (MPC) the green light to increase the Bank Rate by only 0.25% on 3 August, rather than by 0.50% (which Tuesday’s markets were pricing).

In addition, he said “the headline rate in June matched the Committee’s forecast in May’s Monetary Policy Report, a massive improvement from May’s figures… and our seasonally-adjusted measure of the core CPI increased at a month-to-month annualised rate of 3.4% in June, well below the 8.1% average of the previous six months. Headline CPI inflation will probably average about 7% in Q3 and 4.5-to-5.0% in Q4”. Tombs thinks there will only be one further 0.25% rise (in September) and expects the base rate will stay at 5.5% before falling back next year. We hope he is right.

Key to his view is that service inflation will follow the calming of goods prices. In normal times, this would be the usual relationship, however, services are still running above projections at an annualised 8.4% rate of inflation over the quarter. Even so, looking back a little further, service prices have underperformed good prices by 9% since 2019, and history shows service prices have always tended to move back up.

Nevertheless, UK equity markets stormed higher, egged on by sharp falls in medium-term gilt yields (and concomitant gilts price rises!). Sterling retreated from its recent highs against the US dollar, but UK stocks are closing the week leading the rest of the world higher – even in common UK sterling-based terms.

Ahead of next week’s Federal Open Market Committee (FOMC) meeting on Wednesday 26 July, the US second quarter earnings season is providing as much information as the usual economic data. Tesla is a case in point. It is now engaged in a grab for market share, partly trying to win share from weaker western manufacturers, partly trying to defend itself against Chinese manufacturers that have over-produced and are finding domestic demand weaker than expected. (Beijing is preparing a set of support measures specifically for domestic electric vehicle producers. We write on China’s real estate developer woes below).

Tesla withdrew its previous statement that margins would “remain among the highest in the industry,” and a cautious commentary leaves the door open for another round of price cuts soon.

It’s not just Tesla. Margins are coming under pressure across the board. They have weakened substantially in areas like freight and trucking. Sales growth is now expected to be tepid but general inventories are high. According to our calculations, they are substantially higher than is comfortable while financing rates are high (see our article on freight this week).

As the first half of the earnings season has unfolded, we have seen US analysts moving their forecasts for ‘top line’ sales up in line with recent trends. In Europe, sales are expected to show no change. However, in both areas, profit margins are being revised down.

Large inventories are a big price depressant, especially if demand is waning, as prices are cut to reduce them. This is not just a phenomenon of western economies as we are seeing signs that China is also selling its goods more cheaply. We may get to talk of ‘dumping’ goods soon. All this is backed up by the sharp downswing in goods prices. If it were not for food prices, which are being propped up by weather and war, we might be in full-blown deflation territory.

However, as we noted earlier when discussing services in the UK, central banks will not know how they should treat labour’s current exercising of its pricing power.

We have become used to the UK headlines about strikes. Rail strikes began over a year ago (the first was on 21 June 2022) and have become a feature of British life. Indeed, they have become a big factor in the work-from-home shift and, paradoxically, we believe the strikes are one of the reasons why London’s property prices have been falling faster than elsewhere in the UK.

Interestingly, labour relations are also deteriorating in the US. The Teamsters Union activists are back and United Parcel Services (UPS) and other freight companies are being pressed. We write about this in the article about freight and inventories.

Members of the US Federal Reserve (Fed) are now in their quiet period but, recently we had two members positing almost diametrically opposite views. Richmond Fed Chief Tom Barkin said: “Inflation is too high. If you back off too soon, inflation comes back strong, which then requires the Fed to do even more.”

Barkin said that a large part of what’s keeping inflation elevated – as well as powering the rest of the economy – is a resilient labour market. Employers continue to add jobs at a robust pace and wage gains are still strong, enabling Americans to keep spending.

Against this, Chicago Fed Chief Austan Goolsbee said “Our…overriding goal right now is to get inflation down – we’re going to succeed at it. And to do that without a recession would be a triumph, and that’s the golden path – and I feel like we’re on that golden path.”

Goolsbee’s golden path notes there are signs that companies have started to cut some costs, margins and prices, but not cutting labour costs. His path requires that labour demands are responsive quickly to that underlying environment. But if the US turns out to have a more entrenched inflation path because labour relations have worsened it may face the same worries as have faced us here in the UK.

As the earnings season progresses, we appear to be in a new phase; one where companies have lost pricing power but sales should hold up because they are not cutting labour aggressively. Gavekal Research refers to this phase as a disinflationary boom, a time when equity markets do reasonably well. One of the reasons equities can do well is because bond yields also tend to fall. That happened this week and, hopefully over the next two weeks, it can go further if the central banks will feel confident labour will respond to signs of lower inflation. We will be listening to what the Fed will be telling us next week very closely.

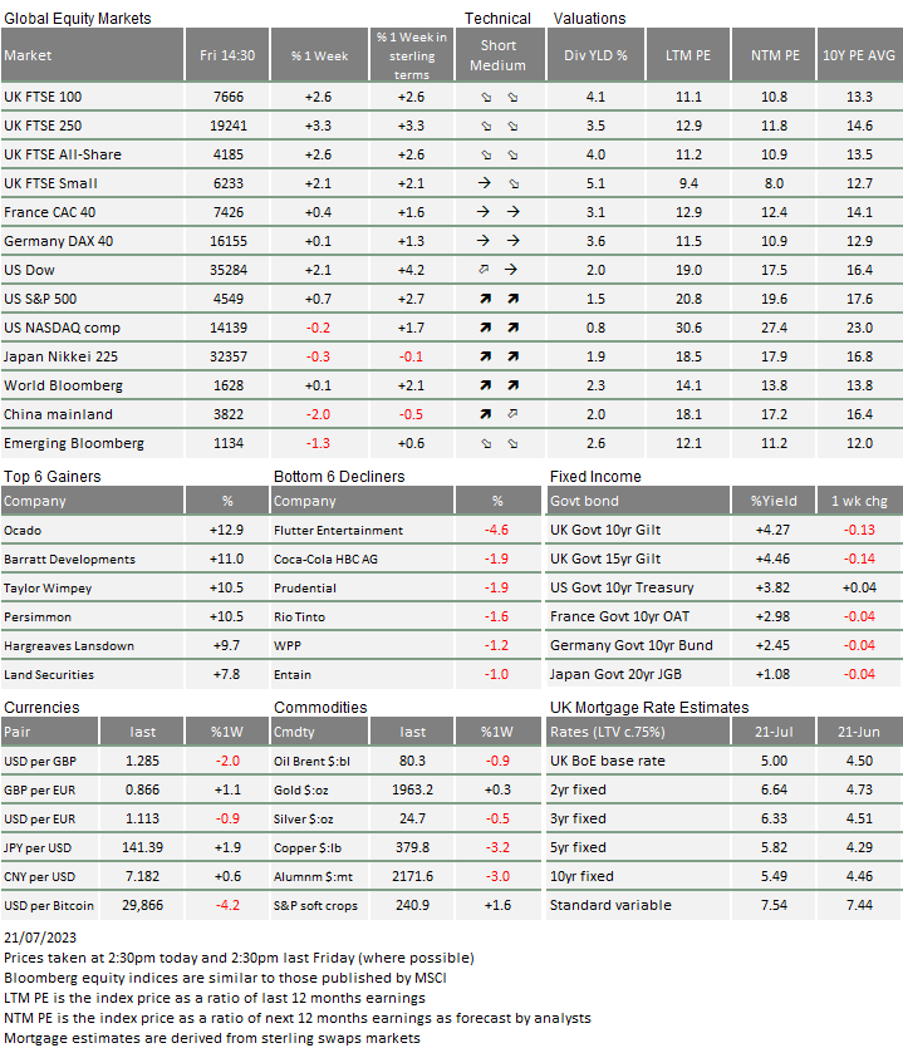

The arrows in the table represent the strength or weakness of the different asset prices in table over the short to medium term relative to historical averages

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.