Market Update June 2020: Support balances increasing strains – but for how long?

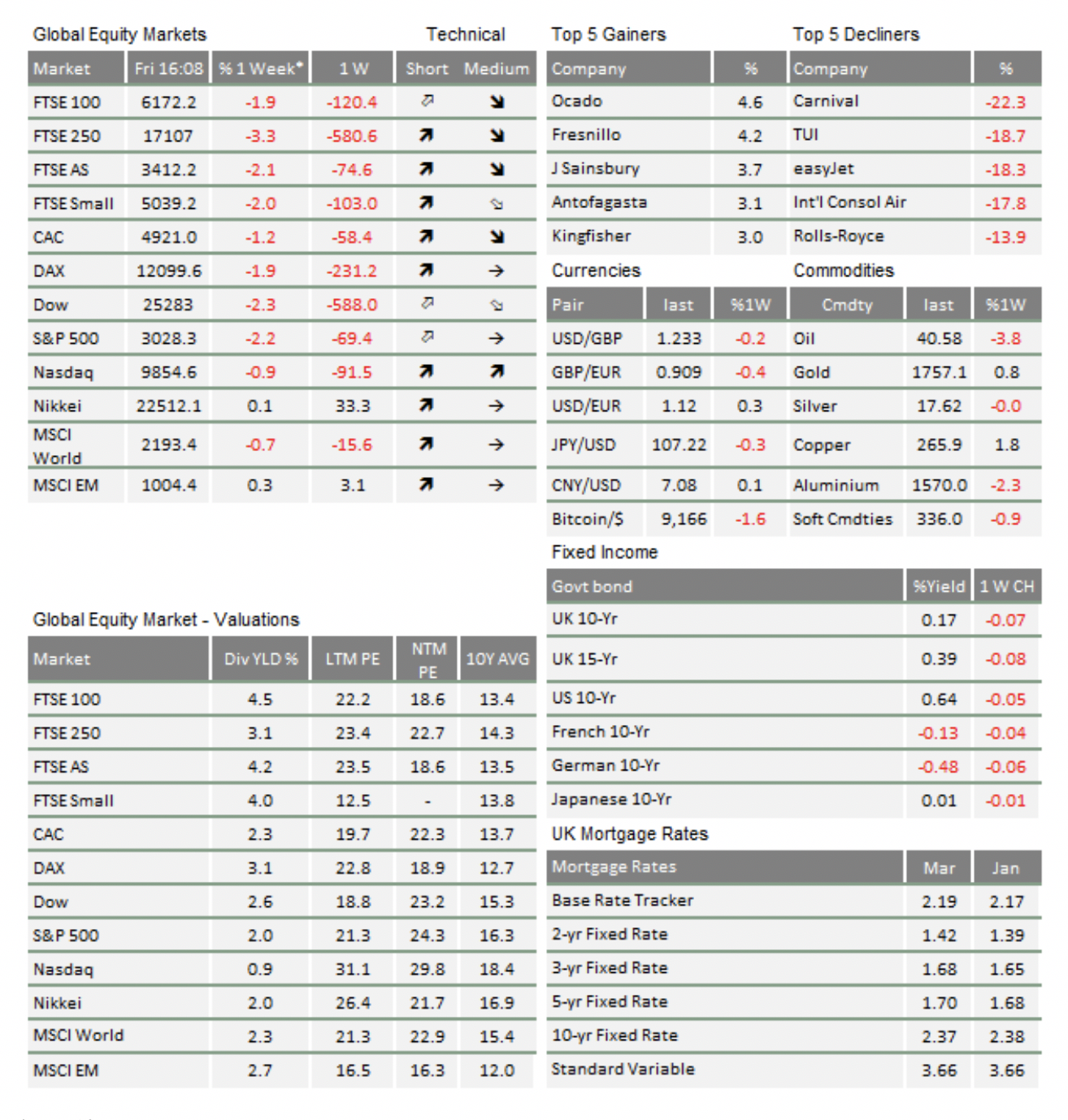

The consolidation in stock markets continues. After a brief sell-off at the beginning of the week, capital markets staged a recovery to leave things almost unchanged from a week ago. All in all, markets are now just slightly above where they were after the significant recovery rally throughout April and May.

The consolidation in stock markets continues. After a brief sell-off at the beginning of the week, capital markets staged a recovery to leave things almost unchanged from a week ago. All in all, markets are now just slightly above where they were after the significant recovery rally throughout April and May.

That is, in large part, down to the immense support provided by governments and central banks all over the world. This reliance on policy leaves markets particularly sensitive to the political or virus-related news flow. Recent weeks have seen markets rally on the back of better-than-expected recovery news and then sell-off on new COVID flare-ups or political tensions. This week we saw all of the above, so the market gyrations are unsurprising. Importantly however, neither direction gained the upper hand – hence the consolidation or sideward movement.

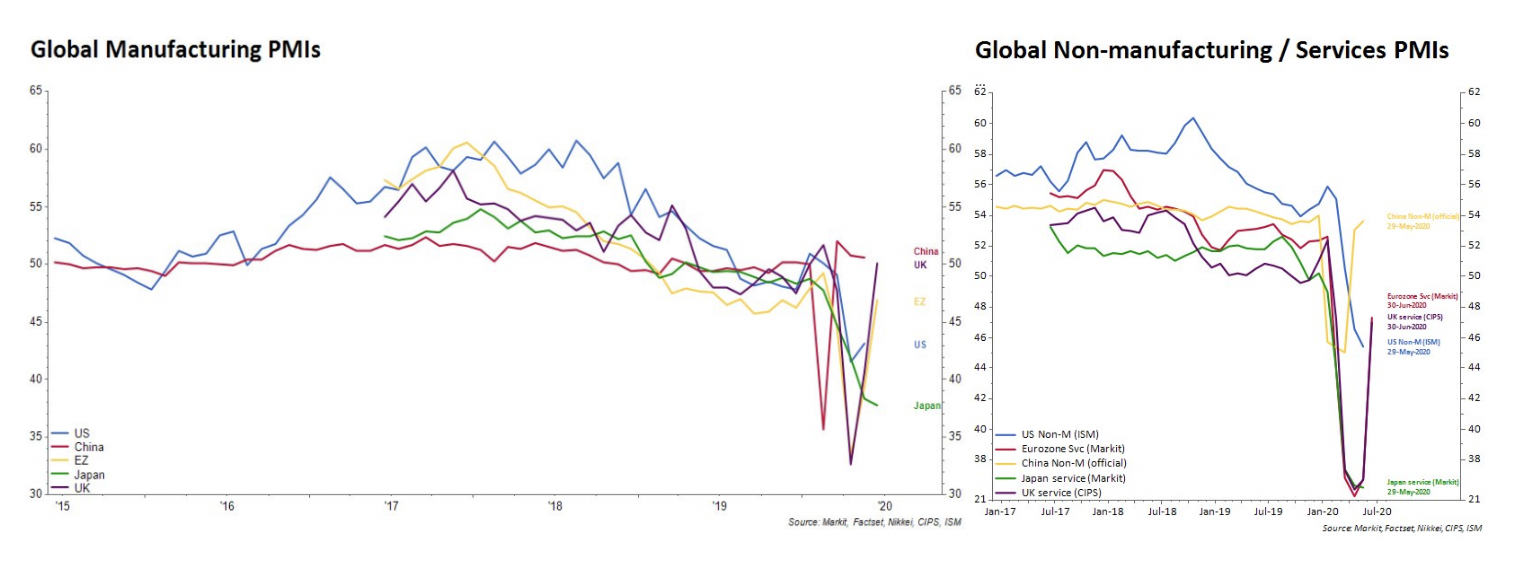

On the positive side, we saw a recovery of economic sentiment across Europe and the US (see chart further down). On the negative side, there is increasing talk that the handsome V-shaped rebound we are already seeing may not take us back up to where we were before the coronavirus shuttered the global economy. The fear is that the recovery could level off while still in recessionary territory – with activity staying depressed until a long-term solution to the virus is found. Only after the virus is well behind us will sectors like hospitality, mass entertainment and travel be able to fully reopen, and likewise more virus-vulnerable parts of the population may continue to curb their consumption as they prefer to stay at home more. At that point, governments would have to decide whether to continue with their support programmes. If they do not, we will experience a rise in unemployment which will turn what currently looks like a sharp but short economic blip into a full-blown ‘classic’ recession, with all the attached negative ‘scarring’ that governments have been so desperate to avoid.

Continued, concerted supportive actions by governments worldwide (as shown by central banks and inadvertently governments up to this point) would be a vital crutch for those large parts of the productive economy that cannot operate. Unfortunately, this is where the week brought disappointment. The Trump administration once again swung its populist tariff-threat club against China and the European Union (EU). Clarifications from the White House quickly dispelled and contradicted the apparent threat to China, but the tariff threat against the EU remained. Markets wobbled for a day and then moved on – perhaps thinking this is just more of Trump’s sabre rattling. Hopefully there is still a more constructive way forward, even if that means a series of bilateral agreements between the US and China, China and the EU and then EU and US.

It is a positive that markets are taking these news stories in their stride, rather than looking for things to get upset about. As we wrote last week, the groundswell of positive sentiment remains. Nevertheless, a minimisation of political tensions would be very helpful. Some market media commentators blamed the loss of upward market momentum on Joe Biden – the Democrats’ 2020 presidential candidate – increasing his lead in opinion polls over Donald Trump. We are doubtful for that to be the case, given the economic policies of a populist Republican (conservative) are very similar to the traditional redistribution tendencies of a Democrat lead administration. Added to this, markets may well prefer a less erratic US President.

On the corporate side, the news of German Fintech giant Wirecard’s collapse into insolvency due to a multi-billion euro accounting fraud (see separate article) tells us that we have witnessed the first hallmark of a more standard recession. Every crisis has its corporate collapse scandal: what was Polly Peck in the late 1980s, WorldCom and ENRON for the 2000-2003 recession appears to be Wirecard for the 2020 economic crisis. We are not sure whether we should take comfort from the fact that the biggest of past recessions – the 2008/2009 global financial crisis – went without a major corporate fraud scandal (Bear Stearns, Lehman Brothers and Northern Rock collapsed on incompetence rather than deliberate fraud – only Bernie Madoff’s hedge fund collapse would count as fraud but that was not a company). For the time being, we observe that the risks of a classic recession are increasing, and will continue to do so until a vaccine or effective treatment against COVID-19 is found. For us, the question is whether the enormous up-forces of the ‘re-start stimulus’ programs drawn up around the world, together with the continued positive sentiment will be enough to counter-balance the negatives inflicted on businesses by social distancing. For the time being, they remain finely balanced. Governments and central banks remain committed to tying all parts of the economy over to the post-pandemic world.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.