Special Market Update: Putin’s Recognition of Donbas

Putin’s Donbas move triggers ‘starter’ sanctions

Russia’s aggression towards Ukraine reached a new level this week after Russia’s president Putin officially recognised the two self-proclaimed separatist ‘republics’ in Ukraine’s Donbas region. Most importantly, he ordered official troops to move in for what he declared to be ‘peacekeeping operations’. This has triggered the West to announce a stepping up of sanctions. Meanwhile Ukraine’s president Volodymyr Zelenskiy said Putin had merely “legalised” troops already present in the republics.

At the time of writing on Wednesday, the media reaction to the escalation of the conflict has been more alarmed than that of stock and other asset markets. This ties in with what we saw last week with historical observations of the impact of regional wars on stock markets. Price moves tend not to be particularly pronounced once hostilities have actually started. Indeed, downswings occurred when tensions were building up beforehand and hostilities have more often marked the beginning of a medium-term upswing in markets.

The explanation for this apparently uncaring market action is that economic activity beyond the area of conflict usually continues as before. However, in this specific instance, there is a risk of energy supply disruptions to the pan-European region in the form of Russian gas, or at least that energy prices will remain high for longer or rise higher than had been anticipated in 2022’s general economic recovery scenario. This would explain some of the recent weakness in stock markets as they had priced in further increases in the cost of gas and oil putting a dampener on the 2022 economic upswing.

We suspect that if Putin’s latest move had indeed constituted a full-on invasion of Ukraine – as some of the news media seemed to suggest – then the market reaction would not be as benign as it was this Tuesday morning, with only the price of oil and gas in Europe trading notably higher than yesterday.

The subdued market reaction tells us that there is a recognition or at least suspicion that with this latest move, Putin may have revealed his true goals/intentions in this conflict; namely, explicit control of the Russian speaking parts of the Donbas region after Russian supported separatists seized the area in 2014. A military protectorate may not be an outright annexation like the Crimea, but few would draw a distinction. This would be similar to the outcome of the 2008 conflict where Russia succeeded in turning the two Georgian regions of Abkhazia and South Ossetia into such military protectorates.

It also suggests that there is an assumption in markets that Putin has once again been successful in outmanoeuvring western interests and achieved his aim of extending Russia’s area of influence and control at an acceptable cost to his country. This assumption is based on previous indications by the Biden administration that they would not deem a move in the frozen conflict in the Donbas as a trigger for imposing the full force, of what would be very painful sanctions on Russia.

This relative market optimism is heartening, and some may even describe it as wishful thinking, given it is not at all certain that Putin will be content with what he has gained so far. Whether the US and European governments will indeed refrain from imposing significant sanctions and whether the Ukrainian government will accept Russia’s occupation of part of its rightful territory, rather than strike back is unclear. Its basis is the assumption of rational actors on both sides, which at a time when the pressures of the pandemic are easing should want to shy away from risking the economic recovery and contain the economic fallout to what is deemed an acceptable minimum.

Our view is that the above is a possible outcome, but that it is too early to expect this conflict to be beyond its peak. We recall that in the run up to Greece’s 2012 sovereign debt crisis there was also a widespread market expectation that political actors in Greece and the EU would act rationally from an economic point of view, and not let the situation deteriorate to the point where the Greek public no longer had access to their bank accounts. In the end, what was deemed unthinkable was allowed to happen in order to pave the way for a lasting resolution to the debt crisis.

We believe we are faced with a similar situation today, except that one of the main actors in the current conflict – President Putin – is much harder to gauge, even if it has to be said that up to now, in apparently achieving his aims he looks to have been clever and rational, rather than dogmatic or irrational.

As a result of the fluid situation, we are for the time being satisfied that our central investment position, aligned with a continued, albeit more gradual global recovery during 2022 remains sound in the prevailing political and market environment. However, should Russia aim for a significantly bigger landgrab than the already rebel occupied areas of the Donbas and/or the reaction of the Ukraine and the West’s sanctions become more severe, we will re-evaluate our investment portfolio positions. On the other hand, if Russia signals that they are content with what they have achieved, along the lines of ‘we believe our brothers and sisters in the Donbas are now save’ could trigger a genuine relief rally.

The situation remains fluid and uncertain, but as it currently stands, we are seeing an almost equal probability for a possible option to increase exposure to a pro-cyclical recovery position or a more defensive reduction in our overall risk exposure should the geopolitical situation deteriorate rather than improve from here. Should you wish to benefit from an immediate update to your portfolio in line with our current recommended portfolios please contact your adviser about Discretionary Portfolio Management Service.

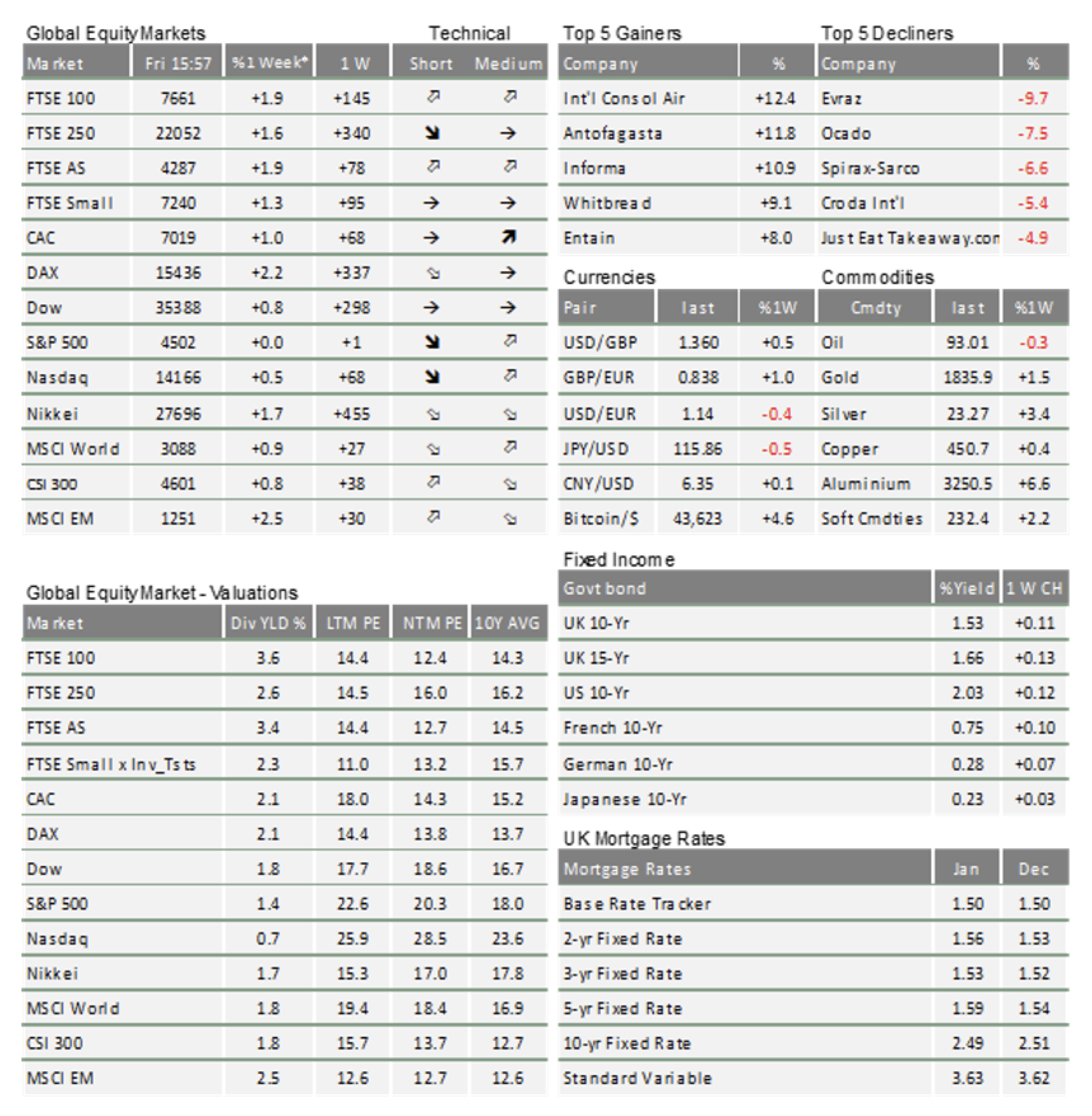

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.