Market Update: Investment Climate Change

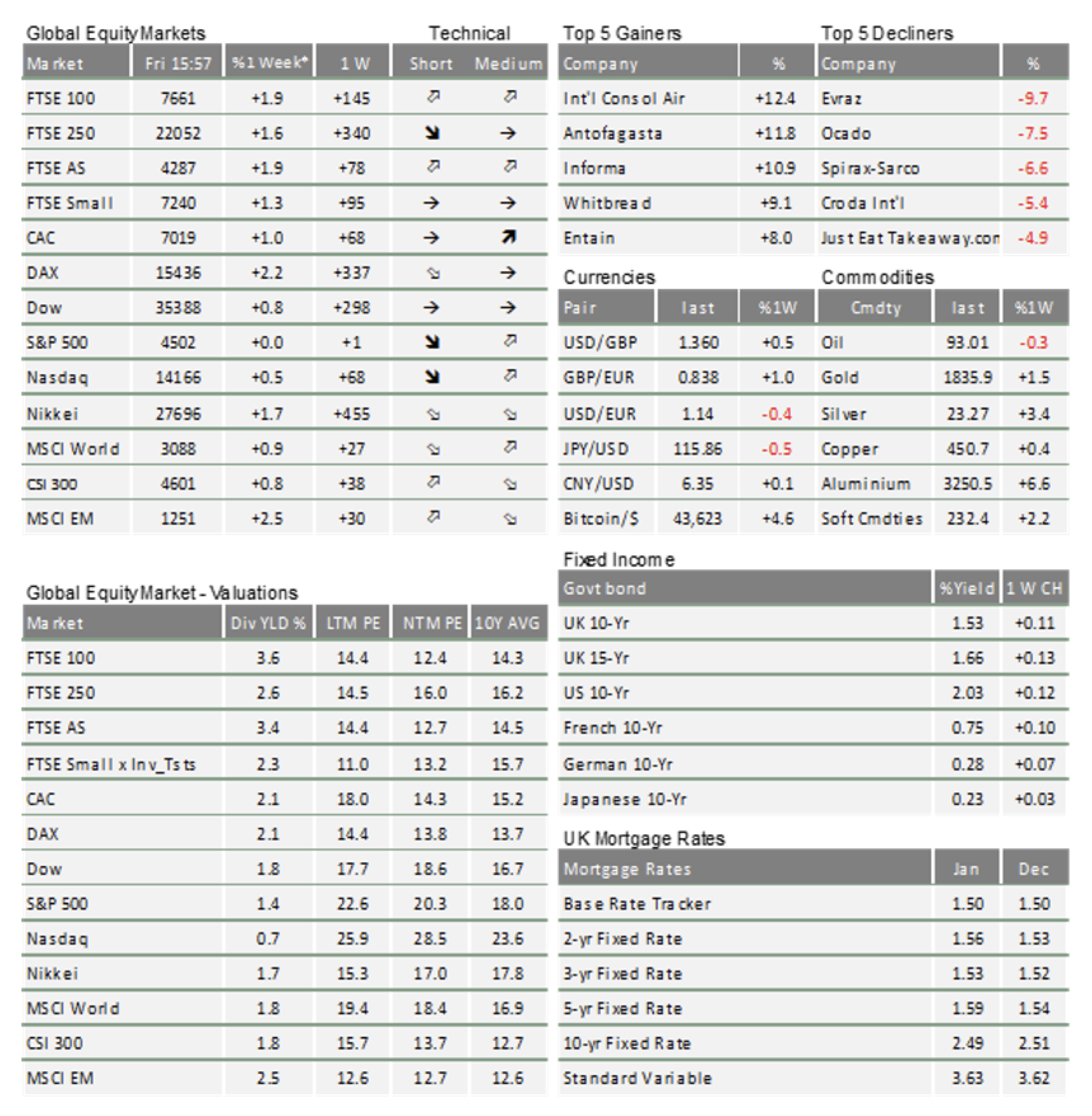

Stock markets around the world continued their volatile trading pattern over the past week, although compared with January, trending slightly up rather than down. Bond markets, on the other hand, continued to retreat as yields continued to rise. This type of market action has now become characteristic for capital markets this year, as they experience their very own climate change, now that the coronavirus appears to have lost its lethal impact on the majority of the population.

Stock markets around the world continued their volatile trading pattern over the past week, although compared with January, trending slightly up rather than down. Bond markets, on the other hand, continued to retreat as yields continued to rise. This type of market action has now become characteristic for capital markets this year, as they experience their very own climate change, now that the coronavirus appears to have lost its lethal impact on the majority of the population.

We have written at length about the U-turn of the central banks, which have swung from downplaying (if not ignoring) inflationary pressures to seemingly becoming more concerned about fighting inflation than ensuring the continued wellbeing of the economy. This week continued very much in the same vein, but several new data points are beginning to offer more clues into the direction of travel beyond central bank action.

In the UK, GDP growth of 7.5% was reported for 2021, which put the economy roughly back to where we were before the pandemic started back, this time two years ago. The chart below illustrates how the V-shaped recovery has not only taken place in the UK, but also Europe, while the US is the outlier that has surpassed the starting level. As we know, this was substantially achieved by larger and less targeted handouts by the US government that resulted in a significant consumer demand boost. The increased levels of inflation are, to a large extent, the undesired side effect of this necessary, but hard to fine-tune, bridging support for the affected population.

The latest monthly inflation data for the US was therefore keenly awaited and, when it came in higher than hoped at (also) 7.5%, US stocks sold off as they quickly priced in that the US Fed will tighten and raise rates even faster than previously anticipated. Looking at the granular inflation data though, the strong market reaction felt counterintuitive, given all the major inflation-driving components of last year had continued to decline in their contribution, especially durable goods (the things we were most keen to order during the pandemic). What may have caused the negative surprise is that inflation appeared to have started ‘leaking into’ areas broadly unaffected by supply chain issues, and which are seen as more ‘sticky’ (not tending to reverse prices easily), especially the services sector.

On the other hand, there was some good news from the data on wage rises. While overall US wage growth has picked up to an uncomfortable 5%, this is very much concentrated among the very lowest earners. While this means wage growth is not sustained across the whole of the labour market, it also suggests the forces of capitalism are currently addressing the problem of inequality that has become such a divisive force – not just for American society.

Given bond yields are now broadly back to where they stood before the pandemic, equities have not in fact performed too badly so far this month. It appears markets are getting their collective heads around the ‘investment climate change’, and one could argue that by now quite a lot of rising yield headwind has been priced in without causing the substantial ‘damage’ the doomsayers had predicted.

This may be, because the inflation headlines this week were flanked by more positive data from the real economy, which would also explain why implicit long-term growth expectations as expressed by certain parts of the bond markets (ten-year yields, ten-year forward) communicated increasing optimism as they did not mirror the negative vibes from the flattening of the yield curve as they usually do, but went the other way.

To this end, January monetary data from China indicated that the leadership there had once again opened the credit stimulus taps – which has in the past resulted in growth stimulus spilling over into the rest of the global economy. On the trade side, volumes improved in the stream of goods with China which should reduce supply chain issues and stimulate the Eurozone economy.

In the wider world of emerging markets, we may see similar central bank loosening tendencies as in China, given they have already been in a tightening cycle since early last year and are therefore far more likely at the end of it compared to western central banks. This would add to China’s demand stimulus and bring positive growth impulses to global trade (we touch on this in this week’s article on commodities).

In Europe and the UK, strong 2021 growth came about despite significant reductions in inventories. This means that the rebuilding of those inventories in 2022 should carry some of the 2021 demand boost into GDP growth this year. Most surprising, perhaps, was data showing that despite all post- Brexit trade regulation frictions, the trade volumes between continental Europe and the UK are returning to pre-Brexit levels. As observed in the past, when Europe’s economy does well from resurgent global demand, so does the UK and, with the trade linkage seemingly healing, this is good news for domestic growth prospects.

Of course, not all is well and there are plenty of dark clouds still on the horizon, be they the cost- of-living challenge from energy prices reducing aggregate consumer demand, or Russia’s President Putin still threatening to extend the fossil fuel shortage that is now the main driver of inflation. However, the overall mix of data this week provided positive evidence that the current economic slowdown may not be as deep-seated as feared, and that capital markets appear to expect subsiding inflationary pressures will also lower the pressures on central banks to tighten too fast and too soon. The Bank of England’s chief economist’s remarks this week to that end were positively received.

Judging from the significant relative moves between different sectors and investment styles like Growth and Value, the message of change in the investment climate appears to be getting through. Positive returns may no longer be as readily available across all asset classes, sectors and styles, but for those who analyse, search and skilfully anticipate the progress of this uncharted post- pandemic economic cycle, there should be ample opportunities.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.