Market Review October 2019

Global stock markets continued to march on in October, with the US market posting a series of new all-time highs amid several positive catalysts including a US interest rate cut, positive news flow around US-China trade negotiations, and a raft of upbeat corporate results. Tensions between the US and China appeared to be mellowing with commentary suggesting that both nations were looking to roll back tariffs on traded goods. Elsewhere, more governments are talking about using historically low interest rates to borrow for long-term infrastructure spending. The optimistic environment helped ease concerns that global economic growth is losing momentum.

UK

The UK equity market provided a negative return during October. The market fell sharply at the beginning of the month, with the FTSE 100 index posting its worst single day return in more than three years. The market was volatile due to renewed concerns around economic growth, supported by the release of worse-than-expected Purchasing Manager’s Index (an indicator of economic activity) data for the UK’s services sector. Equity markets recovered losses throughout October to end the month slightly lower overall.

UK politics continued to dominate the domestic agenda and influence currency markets during October. The value of Sterling rose sharply mid-month on news that the Prime Minister Boris Johnson had negotiated a revised Withdrawal Agreement with the European Union. The markets took comfort from the decreased likelihood of a no-deal exit on 31 October 2019. However, uncertainty persisted as the Government agreed an extension to Article 50 at month end and succeeded in calling an early general election.

Europe

European markets made modest gains in October as investor confidence was underpinned by alleviating US-China trade tensions, talk of increased government spending in Europe and reduced chances of a no-deal Brexit.

In economic news, the eurozone grew by 0.2% in the third quarter of 2019, beating consensus estimates who were expecting growth to stagnate. The positive figure was largely driven by robust growth in France (0.3%) and Spain (0.4%), the second and fourth largest economies in the union. Latest data out of Germany also indicates that the country avoided a technical recession (two successive quarters of negative economic growth), which many suggested had been likely.

Whilst November has historically been a volatile month for stock markets, European shares are sitting on gains of 18% year to date. If maintained for another two months, 2019 would become the best year in a decade for European markets.

US

The US equity market ended the month in positive territory after the US Federal Reserve (Fed) cut interest rates as expected and signalled that it was unlikely to move in either direction any time soon. Jay Powell, chairman of the Fed, said uncertainty on the economic outlook justified the third interest rate cut this year, but a tentative US-China trade deal and the reduced risk of a no-deal Brexit helped support business confidence.

While not a uniformly positive picture, earnings season has helped ease concerns about the outlook for global economic growth. About 80% of companies in the S&P 500 index topped expectations, though Texas Instruments and Caterpillar both highlighted the uncertainty caused by trade tensions and global economic weakness.

US Gross domestic product (GDP) – the value of all goods and services produced by the US – exceeded expectation in Q3 coming in at an annualised expansion rate of 1.9% during the third quarter, this compares with 2% growth in the second quarter.

The month came to a close with the tech-heavy Nasdaq index exceeding its record high for the first time since July, and the S&P 500 index achieving four record highs in the space of a week.

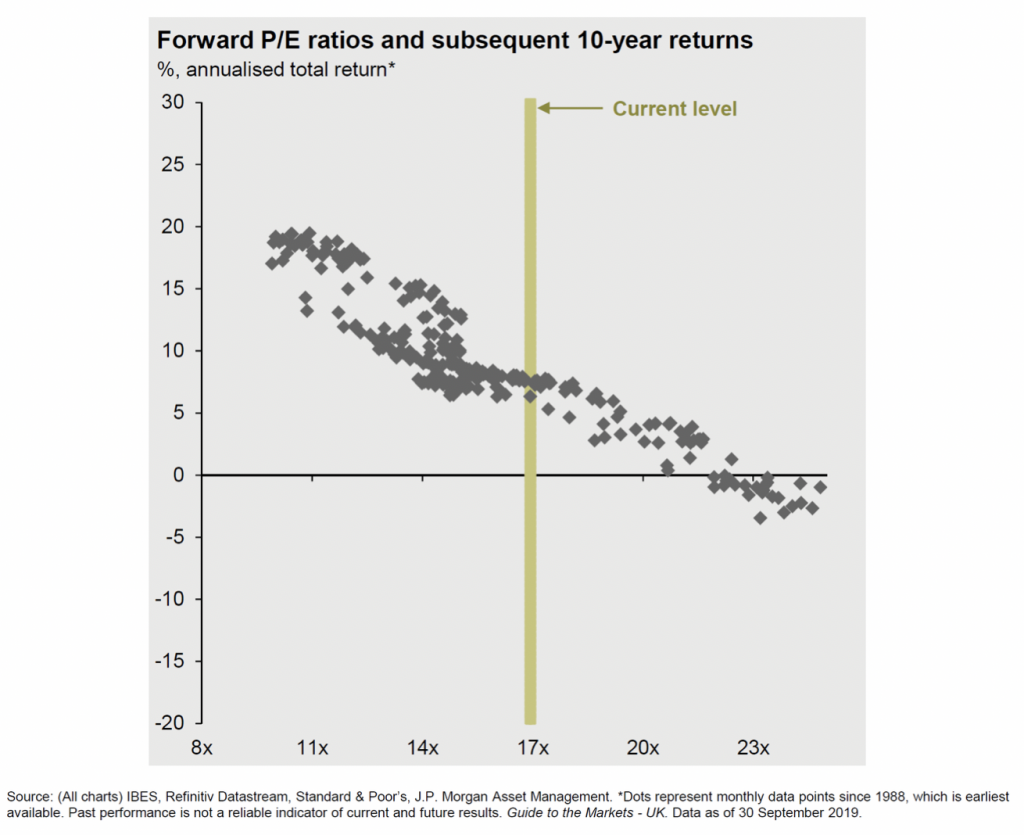

With indices continuing to hit all-time highs and S&P earnings continuing to top earnings expectations there are some concerns about future growth, however as the chart below shows the range of subsequent 10 year returns for the S&P based on the forward PE ratio at the end of Q3 (30/9/2019) still look attractive when compared to other asset classes such as cash, fixed interest and commercial property.

Asia

Asian equity markets rallied in October driven by a tentative truce in the US-China trade war. Within the region, Taiwan outperformed as optimism on the technology outlook grew, while Indian equities were helped by a positive corporate earnings season and expectations for further tax reductions.

Chinese equities ended the month higher as factory output rose at its fastest rate in more than two years, beating analyst expectations.

Japan also ended the month in positive territory as the partial trade agreement between the US and China eased concerns about a global economic slowdown. Within the equity market, second quarter 2019 reporting by Japanese companies began with negative surprises having slightly outweighed positive surprises to date. Meanwhile, the Bank of Japan decided to leave monetary policy unchanged, refraining from taking interest rates deeper into negative territory.

Emerging Markets

It was a positive month for emerging equity markets with all the regions recording gains. Asia led the advance, followed closely by Latin America. Sentiment towards Asian EM was given a boost as hopes for a US-China Phase I trade deal resurfaced and a raft of lower interest rates were announced – with India, Korea and Indonesia all announcing rate cuts.

After many false dawns Brazil finally approved its landmark pension changes that will see the retirement age rise to 65 for men and 62 for women. The move is likely to significantly improve the government’s finances – the pension overhaul is expected to save almost US$200 billion over the next ten years. In other developments, interest rates were cut for the second consecutive month in Brazil, taking them down to 5%, a new historic low.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.