Market Update May 2020: May Ends With Optimism & Promise of Further Stimulus

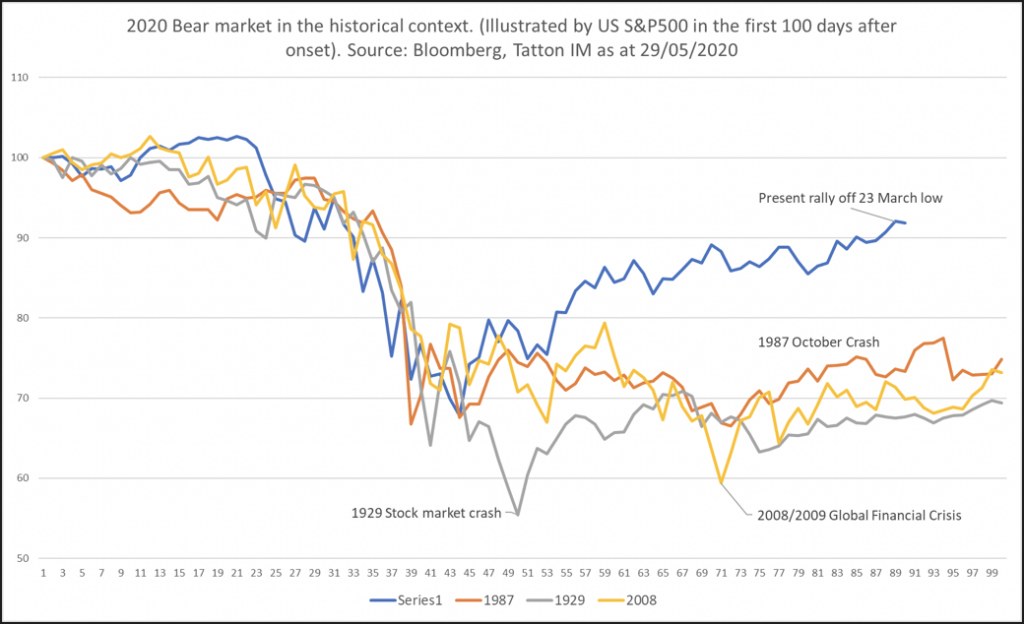

The stock market recovery that started on 23 March – and was widely regarded as little more than a soon-to-falter bear market rally – consolidated further over this last week of May. By now it is either the most pronounced bear market rally in history, or we have indeed already witnessed the turning point of the equity bear market that accompanies recessionary periods (see chart further down). In this context, it was notable that the recovery broadened over the past week, with small cap stocks, markets beyond the US and cyclical stocks all finally enjoying a day in the sun as well.

The stock market recovery that started on 23 March – and was widely regarded as little more than a soon-to-falter bear market rally – consolidated further over this last week of May. By now it is either the most pronounced bear market rally in history, or we have indeed already witnessed the turning point of the equity bear market that accompanies recessionary periods (see chart further down). In this context, it was notable that the recovery broadened over the past week, with small cap stocks, markets beyond the US and cyclical stocks all finally enjoying a day in the sun as well.

With the cost of corporate credit remaining stable, despite the sobering readings of economic output in freefall, there was real optimism in the air that with the gradual and persistent reopening of western economies, the worst may be over and a strong recovery in sight.

But what has happened to concern over a second wave of COVID infections in the autumn, and the extraordinary economic damage the lockdown has already inflicted? We observe that a market consensus appears to be forming that even if a second wave was to occur, a second round of lockdowns to the extent we just witnessed would be unlikely. Either a vaccine will be available – at least to those groups shown to be most vulnerable – or a South Korea-style Track, Trace and Isolate regime will prevent the excessive damage of a full economic lockdown having to be repeated.

Some may regard this as delusional optimism, but there is some logic in the argument, given a) the working age population has only been marginally affected, b) much-improved defence mechanism are introduced every week and c) there may just simply not be the necessary public support for a second round of total lockdown.

Regarding the economic damage, compared to the last world-wide recession caused by the Global Financial Crisis of 2008/2009 this time there are – beyond the obvious – a number of variables which are following a very different playbook. On the one hand, European countries (including the UK) are aggressively pursuing fiscal stimulus to restart and reinvigorate their economies, rather than repeating failed austerity program approaches. On the other, the US is painting the opposite picture. Instead of effective political leadership uniting global efforts to fight the issues (as occurred under the Bush and Obama administrations), Donald Trump is mishandling the domestic response to the crisis, in politically destructive ways that would have been unimaginable only a few years ago.

China has unfortunately also recently changed direction, and this time cannot be counted on as a strong supporting contributor to recovery as it did back in 2009. Its political calculation to never let a good crisis go to waste – using it as an opportunity to further its own political agenda – may well backfire spectacularly. As we noted last week, the move to end Hong Kong’s quasi-independent status in order to finish off the freedom protest movement is likely to make the resumption of economically vital global trade that much harder.

That said, stock markets proved surprisingly resilient on the week’s more disconcerting news flow (which included Trump’s latest petty grievances against Twitter’s attempts to add balance to his most subjective tweets). Once again, it seems capital markets are being overly optimistic about recovery prospects. Or are they simply concluding any missteps during this crisis time will lead to approval of even larger fiscal recovery packages for Hong Kong, China and the US? Given the game-changing developments in Europe’s fiscal stimulus position, it is worth looking at this aspect a bit more closely.

As we have said from the outset of the crisis, substantial government and central bank support is crucial in seeing the global economy through the current crisis. And as such, the changing tide of policy is more important than ever to capital markets. On that front, the big news this week came from Europe and Japan. The Japanese government has approved a second supplementary budget for the fiscal year worth 6.2% of the nation’s GDP. That brings Japan’s total fiscal deficit for this year to 14.9% of GDP – the biggest stimulus boost in decades. Meanwhile, the European Commission has put forward a plan for a €750 billion (€500 billion grants, €250 billion loans) Eurozone recovery fund. This is notably bigger than the Merkel-Macron plan that had financial news outlets gushing before – with the Commission’s plan amounting to 6.2% of Eurozone GDP. Once the previous €540 billion package of April is added in, we are even looking at fiscal stimulus worth up to 10% of GDP.

Fiscal action on the European front is particularly noteworthy because, until now, Europe’s political setup has been notoriously obstinate and resistant to the idea of fiscal union. The Commission’s offered solution is, as ever, a fudge of various measures rather than a comprehensive reform. But it is promising, nonetheless. The Commission will now be able to call upon each Eurozone country to contribute 2% of its GDP towards a common budget and, crucially, it can use that future revenue as a guarantee to dip into bond markets in the short term.

There are drawbacks. The money raised by the commission will not be available to spend until 2021. And the bureaucratic sleight of hand used in getting these measures past Europe’s politicians mean the repayment schemes and exact clauses are somewhat open to interpretation. But while it is just a kicking of the can down the road, it is an almighty kick. Repayments on the debt raised will not start until 2028 and can last until 2058.

From our perspective, this signals that we are moving from fiscal stimulus being just a means to plug pandemic holes in the short-term, to a realisation that the road to recovery is one that will need long-term fiscal investment. Both Europe and Japan’s measures are emblematic of this, with a focus on long-term rebuilding, and we saw similar spending measures announced in Britain even before the pandemic hit.

For capital markets, the key thing to watch here is whether the US follows suit. So far, federal spending measures have been focused entirely on keeping businesses and individuals afloat, while the Trump administration has squandered valuable time with playing blame games rather than making plans for a decisive fiscal restart investment program. But with a presidential election in less than six months, commitments to long-term spending are still likely. If that does happen, markets will be more confident of a rebound to strong growth over the next two or three years. The initial support package to see the US economy through the COVID activity suppression void amounted to around 8% of GDP. On that measure, if the US decides to repeat the ‘shock and awe’ created back in March, there could be some interesting longer-term fiscal support package dimensions in the pipeline.

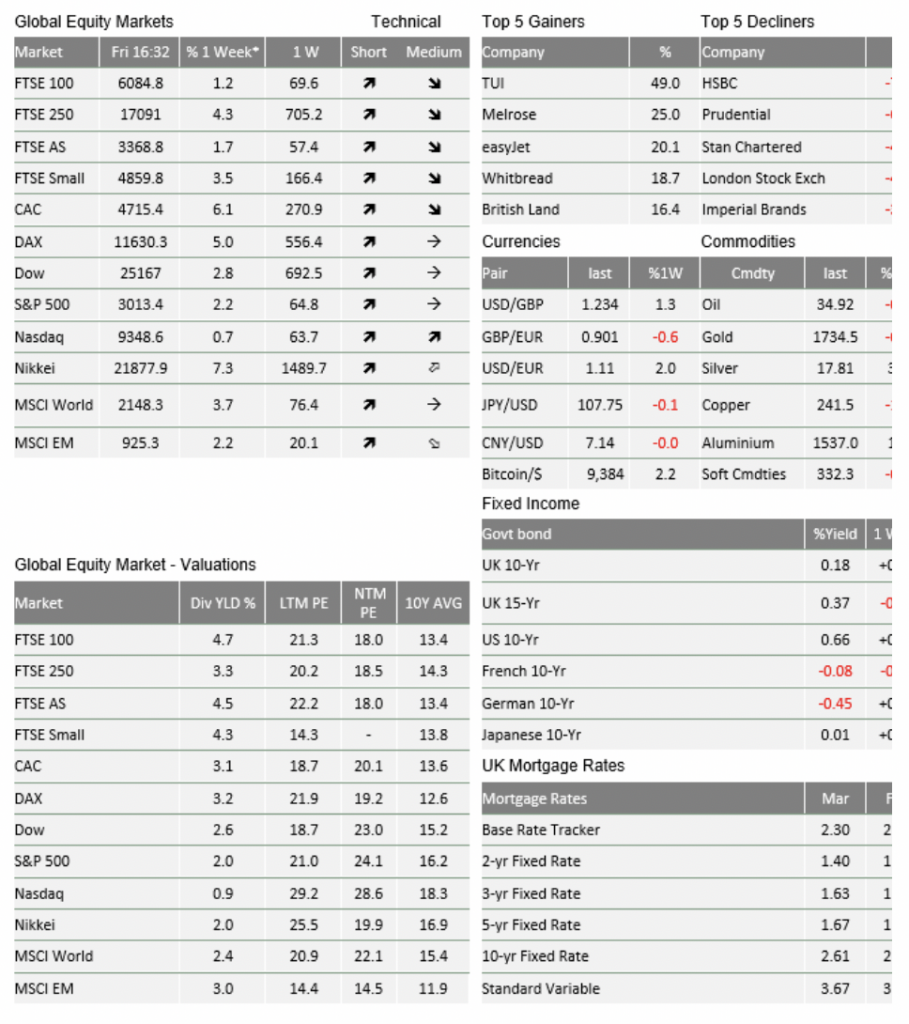

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earningsPlease note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

Please note:

Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document. The value of your investments can go down as well as up and you may get back less than you originally invested.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.