Market Update May 2020: Big Trouble in Big China

Over the past week, it felt as if the new normal of enforced idleness paired with less stringent lockdown rules and summer weather would lead to a happier mood across Western Europe, including the UK. The same applied for investors, whose portfolios also enjoyed some time in the sunshine. However, the outlook began to cloud over somewhat again towards the end of the week.

Over the past week, it felt as if the new normal of enforced idleness paired with less stringent lockdown rules and summer weather would lead to a happier mood across Western Europe, including the UK. The same applied for investors, whose portfolios also enjoyed some time in the sunshine. However, the outlook began to cloud over somewhat again towards the end of the week.

Stock markets jolted upwards at the start of the week on news that a viable coronavirus vaccine may become available before the start of the next cold season. A surprise announcement by Germany and France that they supported the issuance of quasi-joint European bonds – to the tune of half a trillion €-Euros – with the aim of pump-priming the European Union’s post-COVID-19 recovery added to the positive air within markets. Some thought such Eurobonds could become a very powerful counterweight to US Treasury bonds, and help overcome one of the core fiscal and monetary weaknesses of the Eurozone.

Economic news flow later in the week cheered up economists, who have recently been expecting the worst. As a result, data that is only ‘really quite poor’ rather than outright ‘devastating’ is being greeted more warmly than we ever thought recession-indicating numbers possibly could. That, combined with oil prices stabilising at levels above $30 per barrel (see separate article) does tell the story of a tide turning, after so many weeks of economic doom and gloom.

The positive stock market movements of the past weeks have all but anticipated this turning already and it takes considerable, optimistic imagination to see stock markets rising higher without considerable risk of ‘altitude sickness’ hounding capital markets once more. It is undeniably positive that the loosening of lockdown restrictions across Europe has led to an already notable rise in levels of economic activity, but without – thus far – a rebound in the rate of infections. Quite the contrary, many formerly strongly affected areas are not registering any new cases.

Given the rate of infections is still growing in countries blessed with permanently warmer climes, like India and Brazil, we cannot be sure whether COVID-19 is following the seasonal pattern of influenza, but for the moment it would appear that the coronavirus’ decline, together with the prospect of a vaccine before the winter, is providing a better near-term outlook than we could recently have dreamed of.

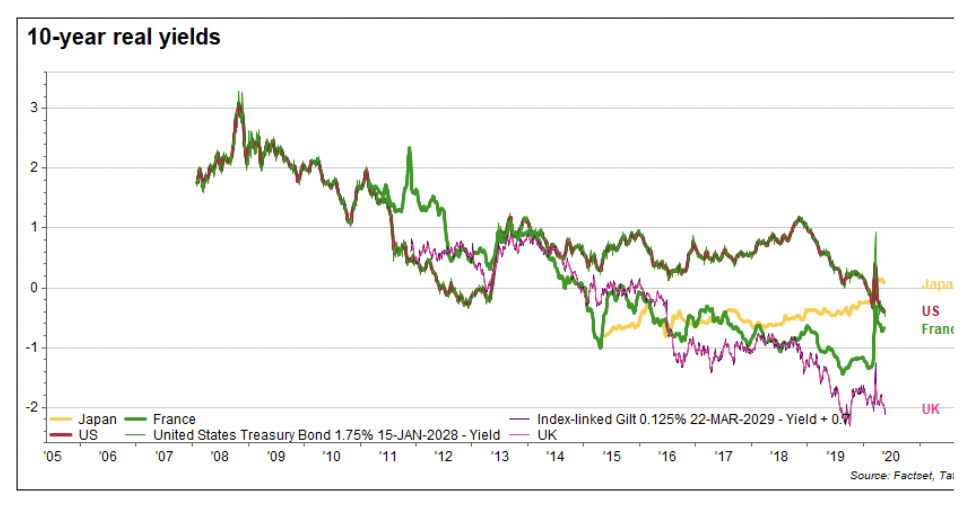

That’s where the ‘onward and upwards’ narrative ends and pressing concerns have to be discussed. First comes the prospect of negative interest rates and bond yields in the UK. This may be a new and alien concept to UK investors, but it has been the norm across the Eurozone, Switzerland, Sweden and Japan for considerable time (and they have coped with this relatively well in recent years). To put this prospect into perspective, for institutional investors the ‘real’ interest rate is far more relevant than the ‘nominal’ rate (i.e. the yield after the impact of inflation).

As the chart below shows, holders of UK inflation-linked government bonds have endured ‘negative yields’ since 2015, lower than other major nations’ inflation-linked bonds. Another way to think about this is that investors expected UK inflation to be higher than elsewhere – so nothing really new there.

On the positive, the lower the rate at which the government can borrow to pay for all the coronavirus expenses right now, the less of an interest burden this constitutes for the future. And, given all western nations are increasing their borrowing at a similar rate versus their GDP, there is much less pressure to reduce the national debt levels in the near future in order not to be shunned by the bond markets for ‘profligate spending habits’. This is why economists are currently far less concerned about austerity coming back to bite us in quite the same way as after the global financial crisis more than ten years ago.

The other concern is once again that of international politics. Following Donald Trump’s tirades against China of the past weeks, this week was China’s turn to strike back. Their once-a-year parliamentary session rubberstamped a proposal to align Hong Kong’s legal status much more closely with mainland China, which will give the Chinese authorities far-reaching powers to crack down on the freedom-defending people of Hong Kong. Sadly, this also entirely devalues their parallel announcement of intending to honour the US-China trade truce of January (Phase 1 trade deal), because the US would never be able to do the same if China effectively annexed Hong Kong.

Against this new and unexpected development, we will be assessing whether this move is as much a domestic manoeuvre driven by domestic political needs as Trump’s election campaign anti-China rants are. We are not overly optimistic at this point and may have to revise our previous optimism towards China – that has benefitted portfolios nicely so far over the course of this year.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earningsPlease note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

Please note:

Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document. The value of your investments can go down as well as up and you may get back less than you originally invested.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.