Market Update July: How negative are yields?

Investors chase returns. That statement may seem too obvious to be interesting, but over the last decade it has had a special significance. For a year and a half now, central banks around the world have pinned interest rates down and poured historic amounts of liquidity into the global financial system. But the era of loose monetary policy long predates the pandemic. The financial world has experienced an era of low rates since the global financial crisis. More ingredients have been added in the last 18 months, but the recipe is the same: Central banks prescribe zero or even negative interest rates, coupled with vast and seemingly unlimited asset-purchase programs, in the hope of reflating their economies. There have been exceptions to this (such as China, which has remained relatively tight throughout the pandemic) but the policy has been ubiquitous in major developed markets.

Investors chase returns. That statement may seem too obvious to be interesting, but over the last decade it has had a special significance. For a year and a half now, central banks around the world have pinned interest rates down and poured historic amounts of liquidity into the global financial system. But the era of loose monetary policy long predates the pandemic. The financial world has experienced an era of low rates since the global financial crisis. More ingredients have been added in the last 18 months, but the recipe is the same: Central banks prescribe zero or even negative interest rates, coupled with vast and seemingly unlimited asset-purchase programs, in the hope of reflating their economies. There have been exceptions to this (such as China, which has remained relatively tight throughout the pandemic) but the policy has been ubiquitous in major developed markets.

Not all central banks apply their easing in the same way, however. We wrote last week about the Federal Reserve’s (Fed) raising of rates in money markets to above 0%, in order to stop cash from leaking out of money market funds and destabilizing the financial system. The Fed opted to give money market funds a dividend so that they would not dry up from a zero-rate policy – essentially a recognition that rates cannot fall to or below the zero bound without negative consequences. Similarly, the Bank of England (BoE) has refrained from negative interest rates even during the pandemic.

In Europe, the situation is different. The European Central Bank (ECB) has long pursued a policy of negative interest rates, instead shoring up financial stability by offering banks incentives to lend to particular borrowers. Interestingly, Sweden’s central bank – one of the first in the world to allow benchmark rates to fall below zero – lifted rates from their negative level just ahead of the pandemic, and has kept them at 0% despite the world being in its sharpest recession on record. Elsewhere on the continent, however, rates have been allowed to go negative – effectively forcing banks to pay for their deposits.

As we have seen in Europe over the last decade, negative interest rates make life very difficult for banks, who increasingly pass on the cost to consumers. To avoid losing out on deposits, investors look for any avenue that might offer positive returns, even just marginal ones. Positive yields, particularly for relatively safe assets, are snatched up as soon as they come on offer. This is what we referred to above: Investors of all varieties are forced to chase yields because the alternative is a cost on cash.

This yield-chasing has pushed credit spreads – the difference between ‘risk-free’ government bonds and private debt – down to extreme lows. The opposite was true in the beginning of the pandemic, as capital markets panicked over the financial health of the corporate world, but spreads came steadily down as traders realized the financial system was awash with liquidity and government support curtailed the risk of widespread corporate failures. The result of this is that investors of all stripes and colours are moved up the risk ladder: With risk-free rates pinned down, the relative attractiveness of risky assets increases. To avoid being lumped with negative rates, investors therefore have to take on increased levels of risk.

As the past few years have shown, this can lead to some painful adjustments when the backdrop changes. At the moment, there is more than enough liquidity to go round, pushing down the cost of capital for all. But when liquidity tightens, it can have an outsized effect on more risky assets, as investors quickly move back down the risk ladder. We have seen this many times in European bond markets, with the spread between German and Italian bonds swinging at various points over the years. Fortunately, a tightening of liquidity is not something we see on the radar, but we should be aware of the dangers that could come with it.

As mentioned, nominal rates in the US and Britain have not been allowed to fall into negative territory. That does not mean that yields are positive from an investment perspective, however. Real interest rates – adjusted for expected inflation – are negative almost everywhere, including in the US. This is why, even in those areas where central banks are keeping some semblance of positive yields, investors are pushed into riskier markers. This is reflected in the tightness of credit spreads and generally rising equity markets.

In fact, when you look at real yields, the difference between US returns and those elsewhere is much less impressive – given the higher inflation expectations in the world’s largest economy. This factor speaks against a sharp appreciation in the dollar: Even with higher nominal yields, the difference between short-term US real yields and those of its global counterparts is much smaller. This is because the Fed keeps short-term rates anchored to zero while inflation readings continue to come in strongly.

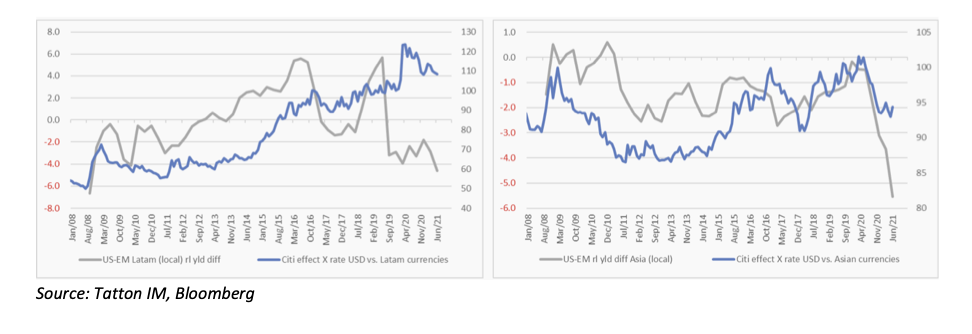

There does seem to be a limit to the extra risks investors are willing to tolerate, however. This is seen in the popularity of emerging market (EM) assets, or lack thereof. EMs currently offer an advantage when it comes to real yields which are significantly higher than been historically available (see grey line in the chart below has to be red ‘upside down’). This is partly linked to their less accommodative monetary stance (some central banks have even tightened monetary policy this year), but EM currencies have had a mixed performance this year, and EM equities have gone mostly sideways.

There is a similar situation playing out in so-called ‘value’ stocks in the US (and globally) which, after their strong rally at the beginning of the year, are underperforming once again. Both For both EM and value assets, investors show a reluctance to go too far down the risk spectrum. We suspect that markets may need assurance that reflationary policies have done more than just support them through tough times – and instead will support the real economy over the next few years. In the EM case specifically, there is almost certainly a virus factor too: With relatively lower vaccination rates, developing countries – as India experienced already – are potentially in an extremely difficult position as the Delta variant surges through the world.

If policymakers can offer that reassurance, the good mood should spread to riskier parts of the market and the world. In any case, these regional and style areas are where the world’s ample liquidity has not yet led to a relative re-pricing of assets. They therefore represent a pool of investment opportunities that should be kept in mind as the transition progresses.

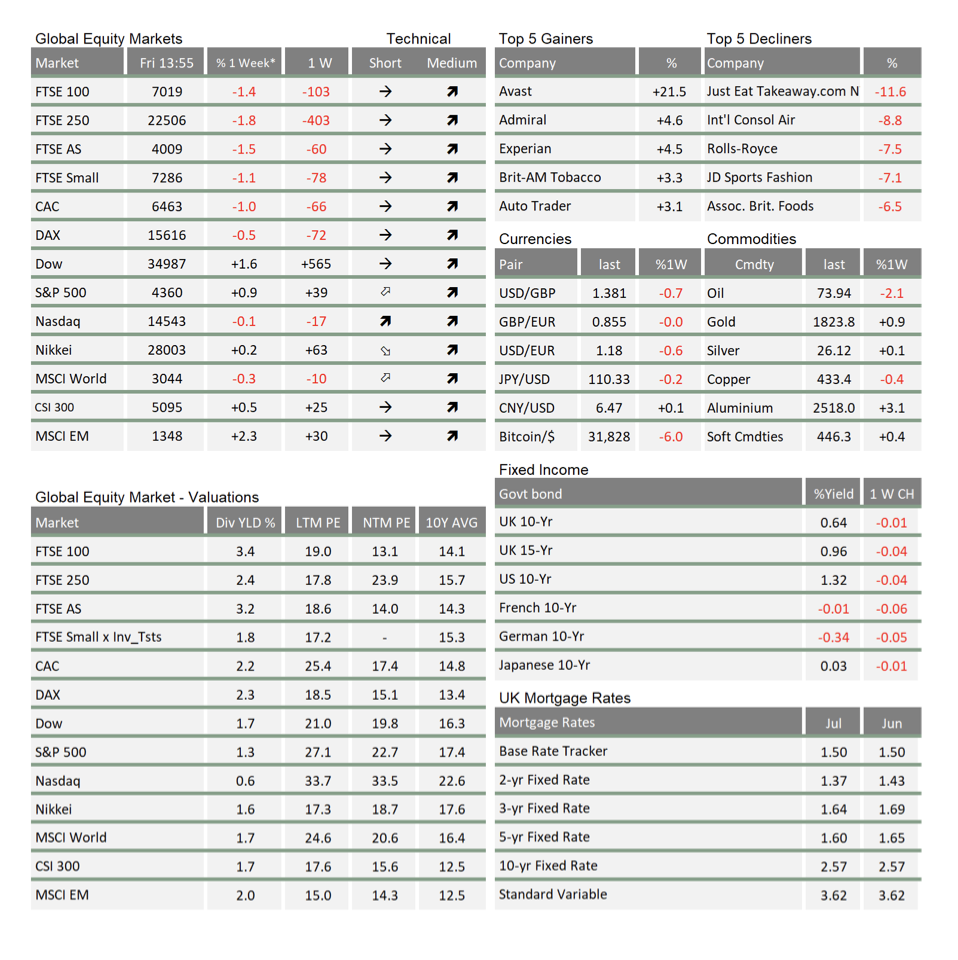

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.