Market Update July: Don’t Look Down

Global equities have been on a pretty rapid ascent since the start of the year. This week the world’s investors had a bout of looking down, and a mild attack of vertigo. This dizzyness has been prompted by some reasonable worries. Do we have enough food (earnings growth) to carry on? Is the strong tailwind (in the form of liquidity) about to turn into a headwind? Has one of our party (China) already started slipping back down?

Global equities have been on a pretty rapid ascent since the start of the year. This week the world’s investors had a bout of looking down, and a mild attack of vertigo. This dizzyness has been prompted by some reasonable worries. Do we have enough food (earnings growth) to carry on? Is the strong tailwind (in the form of liquidity) about to turn into a headwind? Has one of our party (China) already started slipping back down?

We’ve been going through these thoughts in our quarterly investment committee meetings, and the main conclusion is that things are generally likely to remain supportive for markets. But that is not to say it will be a gentle and comforting climb up the hill.

We have good reason to think the current vaccines are – and will remain – effective. But with the ongoing increase in case numbers, and the Delta variant spreading across both vaccinated and unvaccinated regions, there is a chance of a mutation which could be less impacted by vaccines. Still, in our view, this is not the greatest risk to markets.

There is a potential for monetary and fiscal support to be removed too early, tightening financial conditions before we have moved beyond the COVID bounce. At its last meeting, the policy committee of the US Federal Reserve (Fed) made noises about interest rate moves coming into the far-end of its two-year horizon, and that bond purchases might be less necessary. However, some of the worries revolve around its operational ability, marshalling the day-to-day circulation of money in the US financial system. We take a look at this aspect in an article below.

The slowing of US monetary growth is a mild worry for us. It’s not that liquidity will tighten in an overall way but small disruptions can create risk vortices.

For the developed world, and particularly the US, the increase in the stock of savings has come from government cash handouts and from the rise in asset price values. The US is going through another cash handout at the moment, with a disbursement of child support tax credits. This programme will be longer-lasting than federal support for unemployment, but is also the last of these sorts of payment.

Workers everywhere have been comfortable enough to not rush back into the workplace, but that period is ending. Jobs are plentiful across the developed world, but workers/consumers have shown a little wobble in confidence as they are faced with making sometimes uncomfortable choices. We think this will pass and is at the heart of the path towards normality, and a transition in the mid-phase of an economic growth cycle.

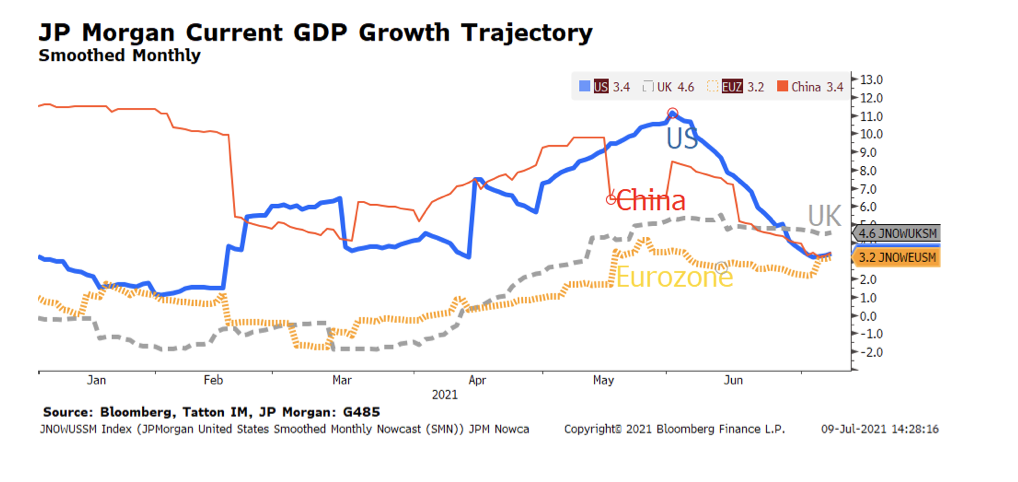

Nevertheless, this easing down from the very strong growth seen in April and May is a factor in slower growth of US earnings expectations, especially in cyclical companies. The chart below shows JP Morgan’s current run rate of GDP growth estimates and how they’ve changed over 2021.

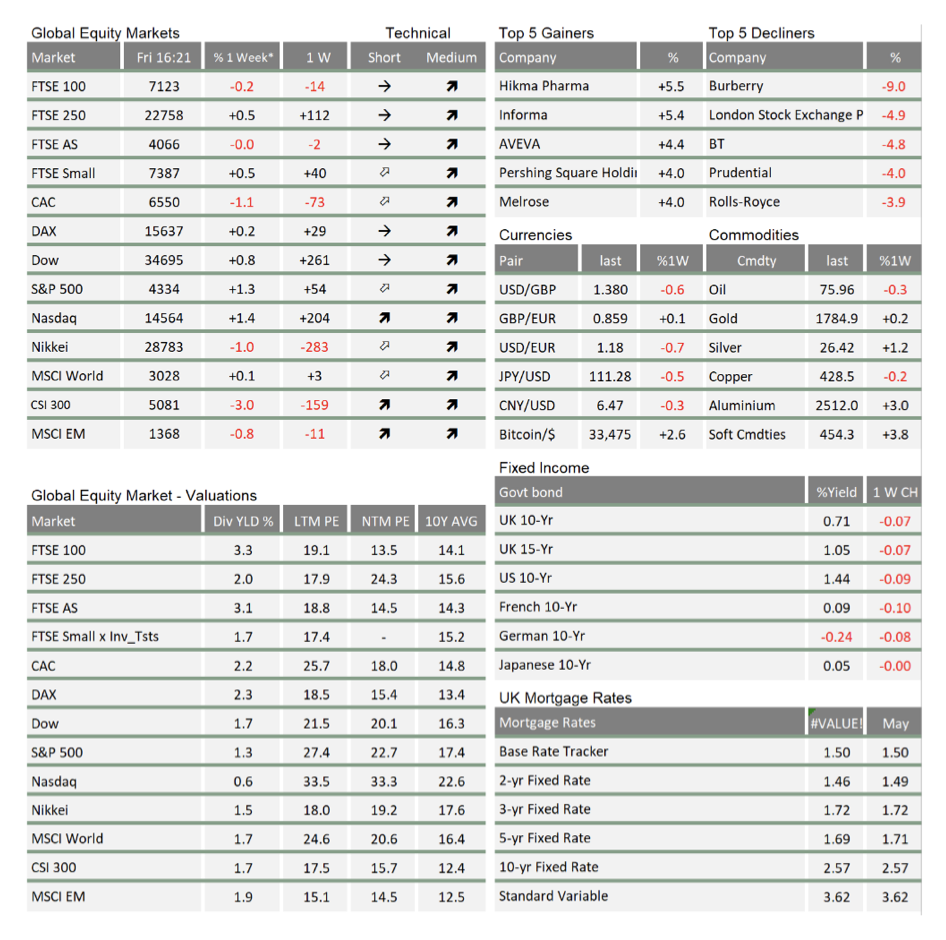

Liquidity is still plentiful and, even if it is also slowing, it is not contracting. We think that the recent rise in risk aversion has rapidly translated into some quite sharp falls in longer bond yields. At one stage yesterday (Thursday 8th July), the 10-year US bond yield dropped to 1.25%, 30 basis points below the yield after the June Federal Open Market Committee (FOMC) meeting.

Bond yields elsewhere dropped, and virtually all developed world 10-year government bond yields are lower than a week ago by about 10 basis points (-0.1%). Interestingly, such moves have barely touched credit spreads, a situation which provides support for equities despite the slower growth expectations. Relative to corporate bonds, developed market equities look better value than they have done than at any time this year.

This is not true is in China. The slide in growth has been worrying, as much of it has been policy- induced. The sharp unwind of equity markets this week has come immediately after the 100-year Communist Party celebrations, and is fuelled by the authorities’ compression of some large companies. Credit spreads have widened sharply here, unlike the rest of the world.

We had been expecting a reversal in policy direction, and so it came to pass when the People’s Bank of China announced a further reduction in the capital banks need to provide for lending (known as the reserve requirement ratio). The rest of the year is likely to be a bit easier for a lot of the private sector, although perhaps not for companies or owners that become too visible.

Slower growth passages following on from the vibrant bounceback of opening up periods is to be expected. Market worries about central bank policies and declining liquidity growth are also likely to cause some volatility. It could be that a sharp feedback loop provokes worries about “wealth effects” especially in the US, where the more highly valued stocks are abundant.

However, we feel these worries are likely to prove temporary. Growth should stabilise at a strong level during the second half, buoyed particularly by an accelerating Europe. Global jobs growth should become entrenched at a strong level. Equities should remain well supported by continued upward earnings revisions, even if yields start heading somewhat higher again.

The greatest risks centre on hopes for continued global government policy support for investment in infrastructure, jobs markets and training. Investors have less scepticism than usual about governments’ ability to drive the agenda, and the execution. There is no doubt such policies are needed if profit and earnings opportunity are to generate growth above the insipid levels of the past decade. Markets are partially priced for such an outcome, and they could be disappointed.

A final note; we write about the private equity bidding for WM Morrison below. For the first time in a long time, a significant number of UK companies have begun to look more attractive in relative valuations than their European counterparts. This is important to private equity investors who have a lot of “dry powder” (their phrase for cash to waiting be deployed) and therefore currently find the larger targets to be quite attractive. Much depends on UK corporate bond yields remaining low but, should they do so, UK equities could see the end of this long period of under-performance.

We remain hopeful, and watchful.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.