DPMS Portfolio Commentary

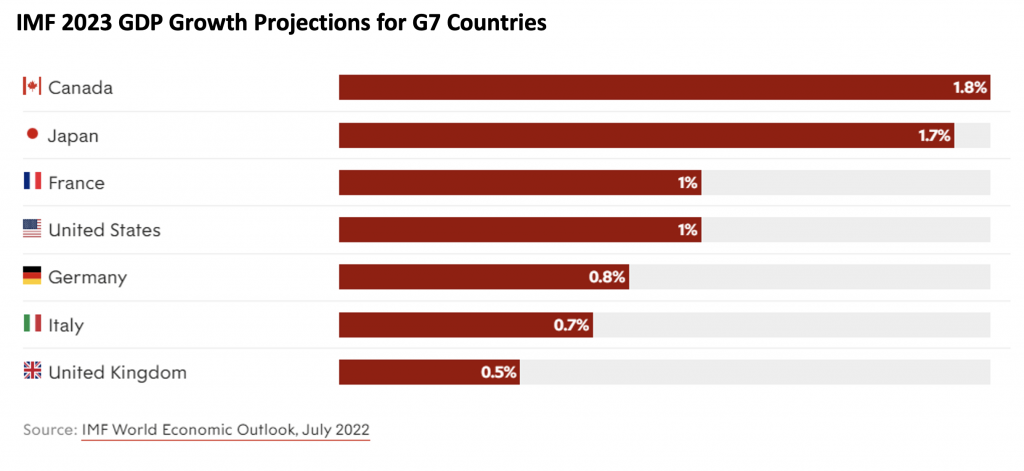

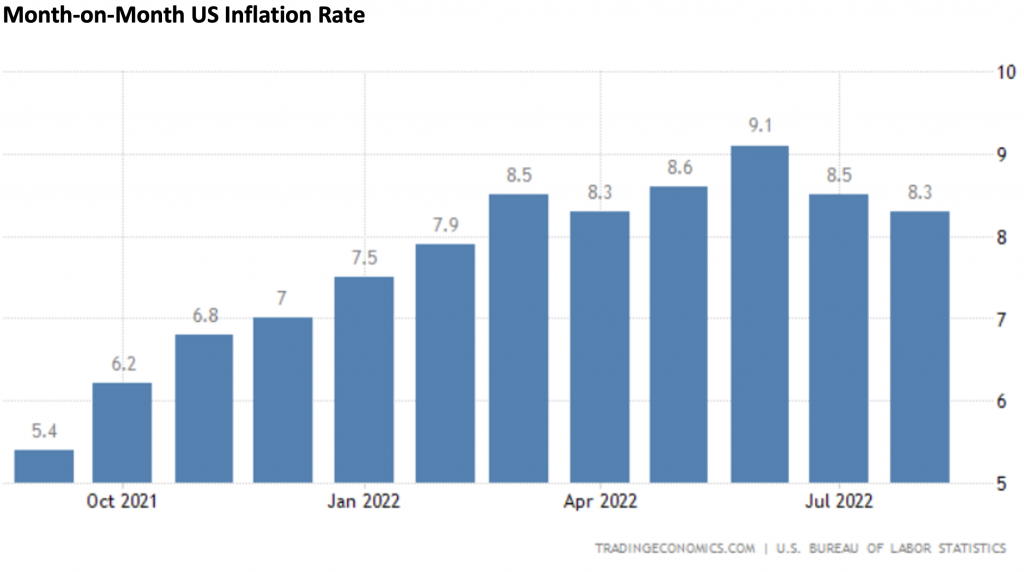

Q3 of 2022 has proved much more positive than the first half of the year despite the backdrop of recessionary warnings across the globe. Whilst Central Banks have continued to push interest rates higher at each opportunity, global inflationary figures have started to look as though they are starting to peak, with the US proving the key indicator for global inflation. However, there remain concerns for economic growth forecasts across developed economies being dampened by inflationary pressure and subsequent interest rate rises.

The Vizion Wealth portfolios, in line with previous decision-making from the Investment Committee, have been successful in their outperformance against their respective benchmarks for Q3 so far due to an increased Defensive positioning of all portfolios. This, alongside the balance of Growth and Value for equities, has aided the portfolios on the downside whilst still retaining a good level of upside. Our non-equity decision-making has also proved positive with a higher allocation to alternatives such as absolute return, global property and infrastructure seeing greater success compared to traditional fixed interest. This is due to increasing interest rates pushing up yields and decreasing capital values of most fixed interest instruments. We expect this to remain a common trend throughout the rest of 2022 and into early 2023.

Looking forward, the UK and Europe in particular may struggle to keep growth forecasts for 2022 and 2023 as positive as other developed economies due to rising energy costs despite expected governmental support. We do feel that we are well positioned in these areas with a bias towards Value and Defensive funds to reduce the expected downside loss as we approach the winter. We will also monitor how new prime minister Liz Truss makes changes to UK government and policy which may impact on consumer spending and business performance. We are expecting to see a pro-business deregulation approach with the attempt to make the UK an attractive investment environment but will reserve judgement on its success until the full details of the policies are revealed.

We see the US as an area most likely to recover from the threat of recession compared to other developed economies as there are more signs that the region’s inflation is starting to fall. This is partly due to the lack of reliance on Russian oil as it is imported from Mexico and Canada. The most recent round of inflationary figures for August were not quite as low as the market had expected. We feel that there may be a risk of the market being optimistic but remain confident in The Federal Reserve’s ability to bring inflation down. Therefore, we remain somewhat positive towards North America but do retain a smaller defensive allocation.

China has also continued to struggle with its economy as its zero-COVID policy has dampened economic activity in the region. The country is under criticism as the reduced health threats posed by the Omicron variant (and sub-variants) make it increasingly difficult to justify the locking down of the region, bringing economic, social and health costs. The economic costs include increasing youth unemployment, lower net exports and reductions in growth targets for 2022 from the IMF. This may lead to a possible shockwave of economic pain across the globe. Should this attitude continue, foreign companies may look to shift production and supply chain links to other Asian countries such as India, Vietnam, Thailand and Mexico as reliance on China is becoming riskier. We will continue to monitor this higher risk region.

As with the global market sentiment, we remain cautiously positive on the outlook for the remainder of 2022 and continue to encourage patience. History tells us that market drops tend to be followed by subsequent significant recovery periods which offer an opportunity not only to recover short-term losses, but also to take advantage of new opportunities to help protect and grow your wealth.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.

DPMS Portfolio Commentary September

Q3 of 2022 has proved much more positive than the first half of the year despite the backdrop of recessionary warnings across the globe. Whilst Central Banks have continued to push interest rates higher at each opportunity, global inflationary figures have started to look as though they are starting to peak, with the US proving the key indicator for global inflation. However, there remain concerns for economic growth forecasts across developed economies being dampened by inflationary pressure and subsequent interest rate rises.