Market Update December: Concerns over baubles and bubbles

As the world faces up to a not-so-jolly Christmas season, it may be surprising to learn that sentiment across the global economy was reported to be quite strong this week. Admittedly, this is mostly driven by strong manufacturing data and not the services sector, which relies so much more on social proximity. Nevertheless, the current economic environment combined with the announcement of COVID vaccinations becoming an imminent reality (if only for those vulnerable) had markets starting December on an upbeat note. Following the exceptionally strong investment returns in November, it would unrealistic to expect 2020 to close on a traditional ‘Santa Rally’. However, if the European Union (EU) and Britain are able to sort out their political – but not economically relevant – differences over fish, state aid and the governance of the envisaged Brexit deal, then at least the UK stock market could be in for another pre-Christmas upwards bounce.

At the time of writing, there was plenty of ‘theatrical noise’ emerging from Brexit negotiations, but no sign of the white smoke that businesses on either side of the Channel are so much wanting to see. Persistent rumours reached us that an agreement was imminent, but unlikely before the stock market close, which stores up some volatility for Monday morning.

In the absence of a Brexit breakthrough, the news that Britain had become the first country to officially approve the BioNTech/Pfizer vaccine catapulted the UK into the international headlines. Some bragging comments from government politicians evidenced the distinct lack of diplomatic sensitivity of this crop of political leaders, especially since this specific vaccine was not developed by UK scientists. Different national medical bodies are following their own strategies to ensure the wider public’s trust in the vaccine. It appears unlikely that longer scrutinising of data – which has now been available for weeks – will offer any further insight about potential longer-term side-effects (only time will tell), but more haste and less speed may perhaps persuade some citizens to feel more confident in the national vaccination process.

For the UK, what counted was the start of vaccinations as soon as possible, not surprising given Professor Van-Tam’s statement that the vaccination of just priority groups (see our UK article) would lead to a 99% reduction in fatalities. The sooner the vulnerable and elderly have the COVID jab, the sooner the wider public can return to a much less restricted life.

The strong rebound of UK equities over November had, in our view, not much to do with hopes for a Brexit deal, but much more the prospect that vaccines will lead to a strong cyclical rebound of economic activity. Everybody will be keen to make up for what was missed during the annus horribilis of 2020. This plays to the more cyclical nature of the UK stock markets, heavy with energy, resource and bank stocks, all of whom are highly cyclically sensitive.

This cyclical theme was further enforced during the week. With the US Congress looking increasingly likely to pass an extension of the previously so successful COVID unemployment support programmes – and in anticipation of a broader recovery – oil and commodity prices rose on expectations of higher 2021 demand. This led also to a rise in long maturity bond yields, which was particularly good news for banks. The relative strength of cyclicals, which are more reflective of non-US economies and stock markets, saw capital outflows from the US which increased the downward pressure on the US dollar. Dollar weakness, as we have commented here before, is increasingly linked to accelerating world trade, improving financial conditions worldwide and, as a result, can constitute a formidable growth stimulus around the world.

While this easing of financial conditions tends to encourage central banks to raise interest rates (or at least reduce their current monetary support measures) that particular outcome looks unlikely This means global money supply takes another leg up, just as growth starts to be solid. Should this play out as it usually does, then over the next few months, the term ‘bubble’ may no longer just apply to the people in your house.

While this year’s pre-Christmas season may look distinctly bleak, markets are certainly looking through the extension of partial lockdowns to January (Germany) and the extension of other restrictive measures (UK). But what might go wrong for markets against such a bullish scenario? Well, if central banks decided to step back from their previous promises to kept yields low and buy as many bonds as necessary to make this happen, then a rapid increase in yields could sour market sentiment very quickly as the positive scenario begins to quickly evaporate. Not a very likely scenario, but some tightening may be on the cards should economic and market conditions turn ‘bubbly’ too quickly in 2021.

When investors look back on the COVID-19 crisis in years to come, and recall what a torrid year it was, November will likely stand out as the second turning point. The arrival of not just one but three vaccines with high efficacy to fight the coronavirus, switched markets from their distinct ‘risk-off’ mode of October to an even more marked ‘risk-on’ mood in November, and added fuel to the post- US election rally. Concerns about the near-term economic outlook seemed to all but evaporate. Stock markets spotted the light at the end of the tunnel, with this year’s biggest losers gaining themost in November. The MSCI Europe ex-UK and FTSE All-Share indices returned 13.4% and 12.7%, respectively. Meanwhile, the year’s star performers, Asia ex-Japan and the US, still managed impressive monthly gains of 8.0% and 7.5%. Global value stocks returned 15.1%, outperforming growth, which returned 10.9%. Within fixed income, it was the riskier high yield and emerging markets that outshone the higher quality markets. November was the best month for the global investment community this year.

Over three successive weeks, investors were greeted by announcements that the Pfizer/BioNTech, Moderna and AstraZeneca/Oxford vaccines had proven their effectiveness. With the first hurdles of efficacy and safety passed by all three, the next question is how quickly the vaccines can be approved, manufacturing further cranked up and then intelligent vaccination programmes implemented to achieve the biggest positive impact in the shortest period of time. Here it is worth noting the logistical challenges of the 90% effective Pfizer/BioNTech and 95% effective Moderna vaccines, which both require cold storage (at -70OC in the case of the former) and are relatively expensive. The potentially less effective (70%) AstraZeneca/Oxford vaccine can be stored at regular fridge temperatures, and comes at a fraction of the price. With developing world nations having made their largest pre-orders for the AstraZeneca/Oxford vaccine, they stand to benefit from its approval the most.

An end to the virus crisis is now in sight, but the path to recovery may still be marked by volatile markets over the coming quarters, as governments struggle to control the virus at the same time as vaccinating their populations. In Europe, significant restrictions to curb the virus spread look to have been effective, with new infections now falling sharply from their latest peak. In the US, the situation has continued to worsen – just as with the first wave – with new cases continuing to rise and fatalities following. High-frequency activity data shows the stark effect that restrictions in Europe have had in slowing the economy. The question now is whether Europe will once again show the path the US will follow, and whether renewed restrictions, and therefore a decline in services activity, will be needed to contain the virus there as well.

In any case, markets are likely to digest near-term economic developments in the context of better times on the horizon, just as they did this month.

The US election, which had been so nervously anticipated, passed without overly upsetting markets. Unprecedented numbers of mail-in votes were cast as a result of the pandemic, meaning that results remained much less clear for a good while longer than usual, and markets had longer to wait to find out whether Joe Biden would be declared the next president. Despite Donald Trump’s ill thought through legal challenges, the transition process from a Trump to a Biden administration is now underway.

Joe Biden’s presidency should lead to two major policy changes. First, the incoming president will likely take a more diplomatic – and less isolating – approach to foreign policy, choosing to assert influence in a multilateral way, and avoiding the greater economic costs that tariff measures come with. Second, with the President-elect intending re-joining the Paris Climate Agreement on day one of his administration, the US should reunite with its global peers in the effort to combat climate change. We expect this to help drive the ‘green agenda’ and shape the policies for global economic recovery in 2021.

The US economic recovery has been strong in recent months, but now there are some signs that it is slowing. Business sentiment surveys (PMIs) for November showed both manufacturing and services activity was improving. Jobs data for October also continued to improve, with the unemployment rate falling one percentage point to 6.9%, albeit at a slower pace than expected. However, the consumer is feeling conspicuously more wary of late, with various confidence measures for November declining.

Meanwhile in the Eurozone, virus restrictions have once again led to a meaningful gap between the paces of recovery in the manufacturing and services sectors of the economy. While businesses are feeling gloomier about the present, their expectations of future activity have increased significantly.

Just as in the US, Eurozone consumer confidence also declined in November. It is now highly likely that the Eurozone economy will suffer a contraction in the fourth quarter. In politics, Poland and Hungary effectively vetoed the EU’s recovery fund and seven-year budget, because funding is conditional on upholding the rule of law. Negotiations are ongoing, but the intervention raises the risk of reduced effectiveness of what constitutes far-reaching fiscal support packages.

The UK government once again followed the European lead, – albeit somewhat behind the curve – and reintroduced restrictions to contain the latest virus outbreak. As a result, the much-feared phasing out of fiscal support was reversed and the furlough scheme extended, as it was recognised that compliance of lockdown rules would be undermined without support measures in place. The Office for Budget Responsibility forecasts government borrowing will hit GBP 384 billion this year, or 19.4% of GDP – a figure not seen since World War II.

Thanks to the efforts of the Bank of England (BoE) to keep gilt yields near zero, the government has been able to continue to finance its much-needed support measures without causing stress to financial markets. With the near-term economic outlook darkened by the latest restrictions, and more government spending needed, the BoE announced it would expand its asset purchase facility by a further £150 billion, £50 billion more than had been expected.

With the vaccine roll-out signalling that 2021 will not mean a repeat of 2020, uncertainty (at least around COVID-19) is beginning to fade. This in turn is brightening the outlook for risk assets, despite the difficult winter ahead for the economy. Across stock markets, November’s strong showing from the year’s overall ‘losers’ makes sense, with a gradual return to normality on the horizon rendering them undervalued. As the economic recovery plays out, earnings expectations should continue to recover providing continued support for equities.

Whether the coming months can provide further upside for investors in the UK will much depend on whether a sensible Brexit deal can be agreed. For the global economy, upside potential rests on whether the recovery will extend to more than just a bounce-back to where 2020 started. We will discuss both in much more detail in our 2021 market outlook, which we will publish next week.

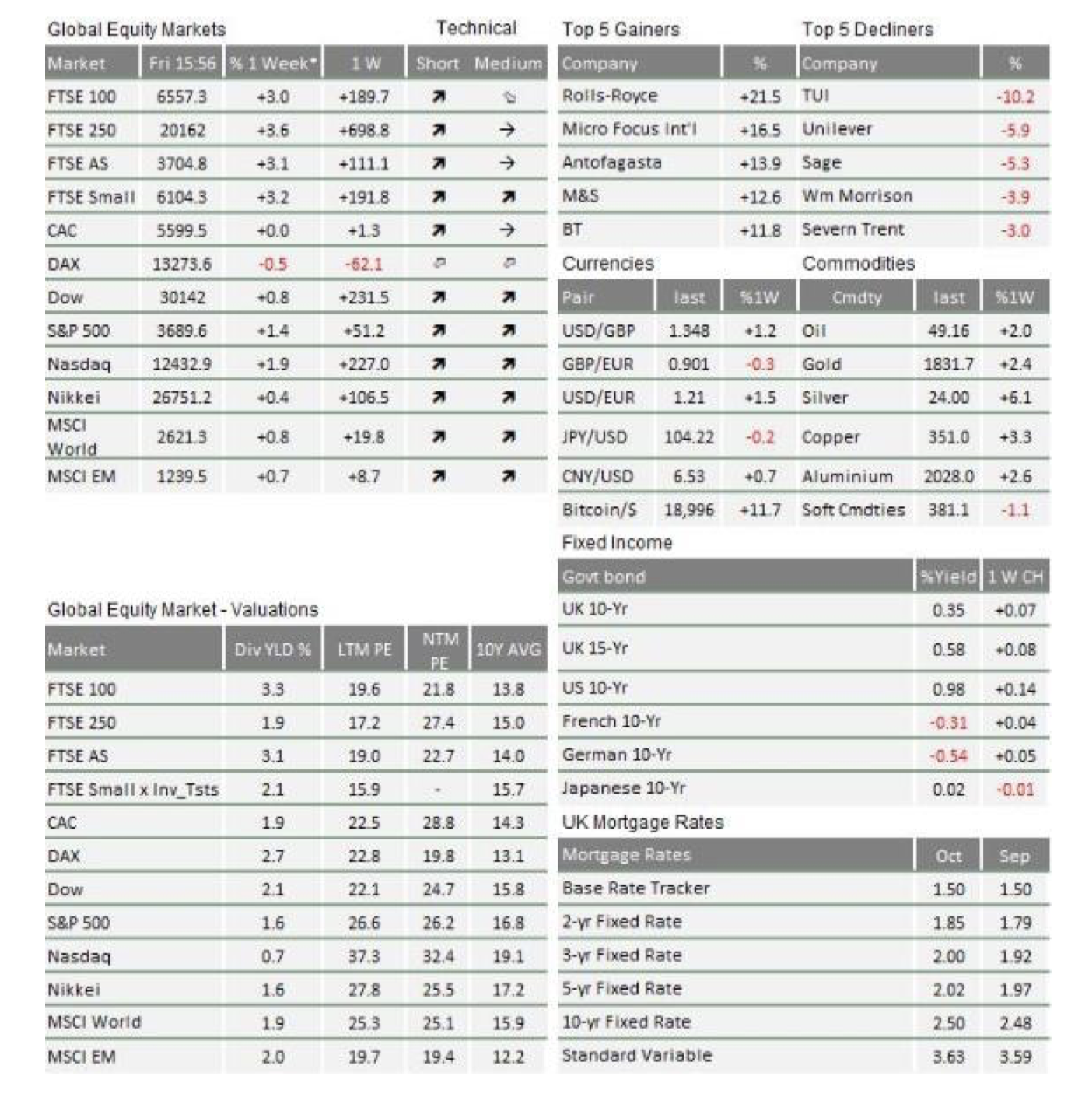

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.