Market Update: Another Bump in the Road

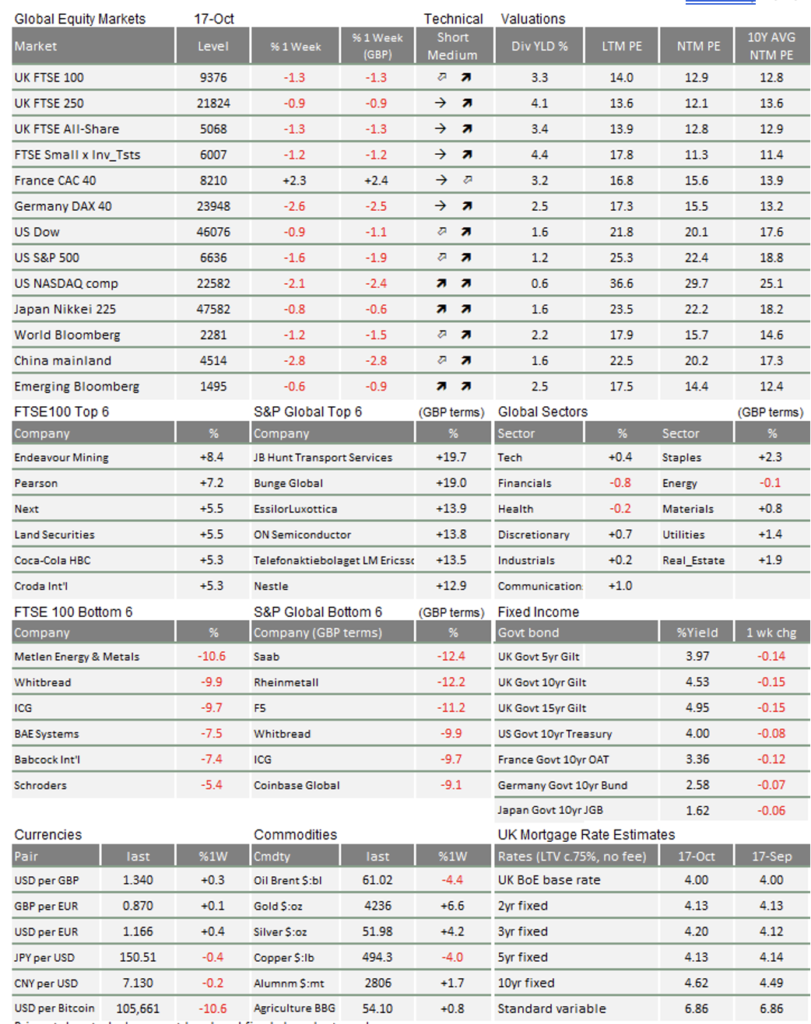

Global risk assets sagged last week. Initially, stocks bounced a little from last Friday’s US sell-off, after Trump appeared to do a customary TACO turn on Sunday. But, investment portfolios are now closer to where we started October than where there got to Thursday two weeks ago. Thankfully, government bonds prices rose, taking yields (their inverse) down. UK yields fell substantially, helping the government’s budget calculations.

An equity pull-back is probably healthy. The rally from April’s ‘Liberation Day’ has been tremendously smooth, but, as recently discussed, there were growing concerns that markets had got a little frothy in some areas. A recalibration puts us in better stead, particularly when coupled with some strong corporate earnings results released last week.

Concerns remain. Tariffs and supply-chain worries catalysed last week’s sell-off, but it has morphed into anxieties about speculative cryptocurrency trading and corporate credit (interestingly not particularly on AI).

Last week’s moves have not been directly focussed on highly-valued tech stocks. Tighter global liquidity makes bouts of volatility more likely, unless strong earnings motivate investors sitting on cash to enter the market. The bullish and bearish arguments are (perhaps surprisingly) balanced for the near-term, so we feel compelled to remind investors that ‘time in the market’ is almost always better than trying to time the market. Even if there are bumps in the road, risk assets look well-supported for the year ahead.

China is improving, but still has a strong incentive to settle the trade war

Previous week’s sell-off came after Trump’s extra 100% tariff on China, itself a response to Beijing’s export controls on rare earth minerals. Markets have ignored politics in recent weeks, but jumped for a profit-taking rationale this time.

The three-day APEC summit in South Korea starts on October 31st and, despite last week’s kerfuffle, Trump and President Xi are set to meet face-to-face. This will be crucial for markets and the global economy. It looks like Washington and Beijing are getting their barbs in ahead of negotiations. If so, the meeting itself will hopefully be more constructive than current relations suggest. But, undeniably, extreme trade threats between the world’s two largest economies are a risk.

Interestingly, China will go into the APEC summit in improved shape. European luxury goods company LVMH reported strong quarterly profits this week, largely thanks to resurgent Chinese demand. China’s imports are up across the board, suggesting that consumer demand is finally improving.

The Chinese economy is still struggling. Exports are flat and private sector loan growth is weak. So, despite recent bullishness on China, Beijing still has much to lose in a trade war with the US. Hopefully, that gives everyone an incentive to keep things stable and civil.

Private credit drama may mean tighter credit conditions

Government bond yields moved down – pushing bond prices up – last week, particularly in the UK. UK bonds had their best performance in a long while and the premium over US yields has come down. We have long argued that Britain’s economy is not as bad as media coverage suggests, and the FTSE 100 recovered well from last Friday’s sell-off. It is a little odd that others are coming round to the “not-as-bad-as-it-seems” narrative just as tax rises are set to come in, though.

While government bond yields have fallen, corporate bonds look less healthy. In the US, credit spreads (the premium of corporate over government bond yields) widened. This comes amid a public spat between JPMorgan CEO Jamie Dimon and the heads of private credit firms over who is more responsible for creeping sloppiness in lending standards – banks or private credit.

When lenders come under the spotlight, they tend to do their due diligence more judiciously. In practical terms, that means companies find it harder to get credit, and other problem credits are likely to emerge. In their results on Thursday, US regional banks Zions Bancorp and Western Alliance mentioned write-offs regarding Cantor funds, which invested in distressed commercial mortgages. Their share prices were hit hard, Zions falling 13% and Western alliance down 11% on the day.

We suspect this caused credit spreads to widen, and triggered nerves in the distressed debt sector. Their long period of strength could now turn around. Credit spreads will struggle to return to the recent lows in this environment.

Good earnings are timely reminders of underlying fundamentals

Credit nerves may not spill over significantly into equity markets. This is partly because the Federal Reserve looks nailed on to cut interest rates again, judging by Chairman Powell’s comments. The Fed is able to do so in part because smaller US companies are struggling with debt refinancing, a ‘bad news is good news’ story. Smaller US companies, who are more interest rate sensitive, were some of the better performing stocks last week.

Last week’s other saving grace was a strong round of quarterly earnings from the major banks, reflecting a healthy underlying economy. While bank stock prices were not immune to a sell-off over specific credit worries, strength from the largest banks should signal strength in other sectors, as they report in the coming weeks. Moreover, the credit worries were not evident when looking at loan loss provisions; all of the major banks (other than JP Morgan) reduced provisions. Despite the risks this year, company earnings remain resilient across the developed world.

Decent earnings reports are timely. There are signs that investor risk appetite is waning in the short-term, from talk of an AI bubble to a flash crash in cryptocurrencies. Without the earnings bump, it could have been an even choppier week.

Unfortunately, a stabilisation from previous week does not mean that it will yet be a return to smooth sailing. Overall liquidity is tightening at the margin, and the riskier parts of the market could bleed into a broader downturn. As we said previously, we should not be surprised if there is more volatility ahead. But, given the positivity in underlying earnings – which fuel stocks over the long-term – investors would do well to stay calm through any turbulence.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.