Market Update: The risks are real – but priced in

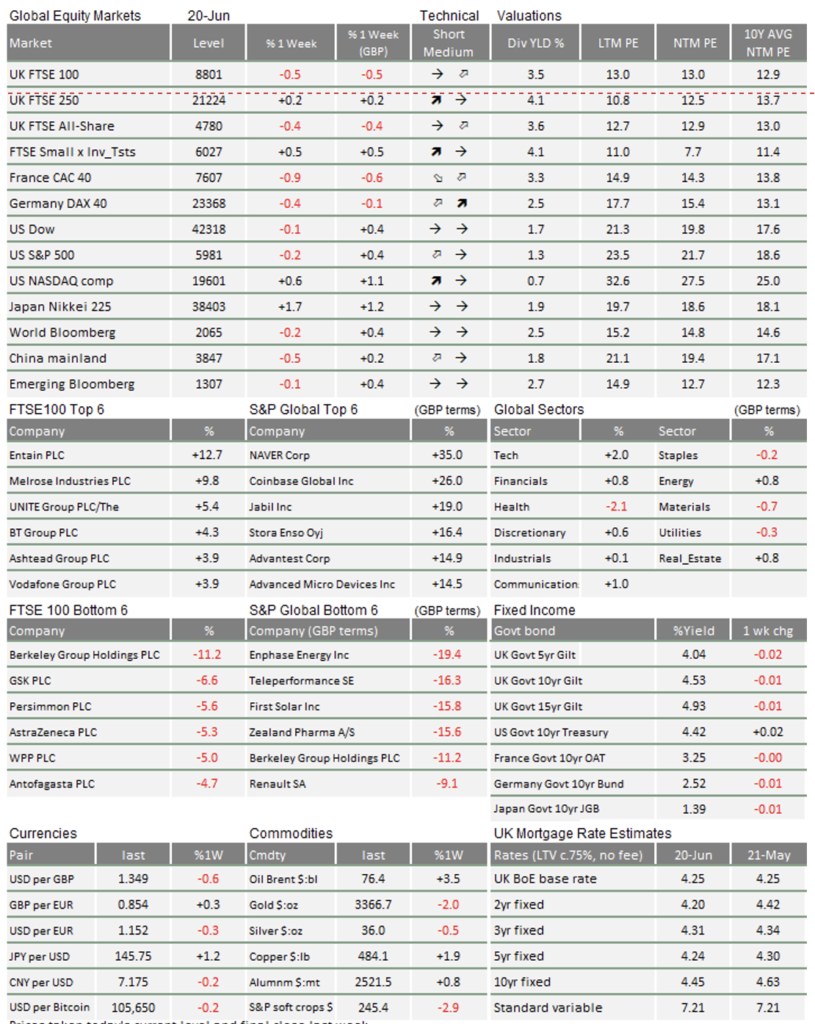

We have, unsurprisingly, had a bit of a down week. The Israel-Iran war has pushed up oil prices about 4%, with a slight knock to equities. The ‘safe haven’ dollar has risen but only slightly, up 0.5% against a stable sterling. None of these moves were too sharp – barring perhaps oil’s gain – and it is fair to say that the market reaction has been more muted than the human one. Experience of the Russia-Ukraine should caution us against thinking this will be over quick or that markets will be insulated, but it does seem like many of the risks are already priced in.

Even if the risks are correctly priced, though, they still exist. Higher energy prices would certainly hamper a global economy which is already slowing – and will likely slow further if and when tariff effects are felt.

Markets see Israel-Iran risks as (relatively) contained.

From the way things are looking, it is likely that the US will join Israel’s attacks on Iran in some way. This is probably what the rise in oil (and the slight rise in the dollar) is telling us. In truth, given the historic proportions of this conflict, we might have expected more than a few dollars higher on the Brent crude oil price. Market’s relative calm might also have something to do with the Juneteenth public holiday in the US.

The fact that markets are currently pricing a probable US action does not mean that further escalation will not disrupt markets. However, it probably means oil prices will remain within “normal market” ranges. Of course, much will depend on the nature of an escalation.

It was surprising to see reports that China might be sending secret weapons shipments to Iran, but we suspect that any Chinese support (if true) will be purely for the purposes of ensuring continued oil flow, rather than supporting Iran’s efforts more broadly. One could interpret the China rumour as relatively supportive for global oil supply.

It has been interesting to see how the Israel-Iran conflict has created internal tension among Trump’s supporters. The MAGA isolationists want the president to stick to his ‘no more war’ promise, while old-school Republican war hawks have long advocated attacking Iran. But the MAGA wing did seem to acquiesce to a certain extent, as seen in Steve Bannon saying he will support Trump in whatever he decides.

This could be the start of more substantial internal strife within the Trump administration, whose factions sometimes fit awkwardly together. In crises, factional tensions usually get worse. If this stifles some of the White House’s more destructive policies, that will not be such a bad thing for markets.

The Fed is in purgatory.

One of the destructive policies that markets have fretted about is Trump’s threats against Federal Reserve independence. On the White House lawn last week, the president called Fed chair Jerome Powell “stupid” for not cutting interest rates at the central bank’s meeting this week, suggesting they should be two percentage points (!) lower.

Trump is not wrong that the US economy could do with some rate cuts – even if his 2% figure is pie in the sky stuff. Growth is weakening and companies are struggling to pass on costs. But the Fed is unable to cut rates now, because Trump’s tariffs and deportations of foreign born workers are a dangerous recipe for inflation. They might be outweighed by weaker growth, but the pandemic taught the Fed not to underestimate the long-term impacts of these kind of shocks.

The medium-term trend is towards lower US rates – as the Fed’s “dots plot” projection shows – but Trump has put them in purgatory. It is heartening, at least, that monetary policymakers are staying level-headed through the threats. We should also bear in mind that the Fed is much more than just Powell, and his colleagues on the committee are hardly more slash-happy than the chairman.

The Bank of England also held rates steady this week, but is in a slightly different situation – facing stabler government policies, though perhaps tilted more towards growth. Policymakers signalled a cut as early as August, and inflation will be helped down by sterling’s recent strength. Notably, the countries that did cut rates this week – Sweden, Switzerland and Norway – have all benefitted from stronger currencies.

Currencies are driving returns – to Europe’s benefit.

Conversely, dollar weakness this year is a problem for the Fed. The balance of US risks is to the downside (supply threats from tariffs without the positive supply-side reforms promised) which is weighing on the world’s reserve currency. There was a very slight uptick this week, but the dollar is well below January’s level and has yet to recover to anything like the same extent as US stocks.

Dollar weakness also makes middling US company earnings look less attractive for global investors. US equity profits from an index perspective have been okay in dollar terms but, even then, the positivity is basically all from the ‘Magnificent Seven’ tech companies. That cohort is increasingly seeming more global than American (several are starting to issue euro-denominated bonds) while other US companies struggle. When you look at this broader market and take the dollar risk into account, the US looks no better, and perhaps worse, than the UK and Europe.

The dollar actually slightly strengthened last week on safe-haven flows, with both investors and the Trump administration being distracted from tariffs by the middle-east. Indeed, Trump hinted he may suspend tariffs beyond the 90 day deadline. Nevertheless, the previous dollar-softness trend has indicated a growing belief in stronger growth elsewhere, and is probably one of the reasons the FTSE 100 hit a new all-time high last week.

It also explains why European Central Bank president Christine Lagarde chose last week to write a Financial Times op-ed encouraging a “global euro” moment. Lagarde recognises the benefits that euro prominence would offer the continent’s capital markets and broader economy. Being more a politician than your typical central banker, she also recognises the work leaders need to put in to realise those benefits.

As it stands, it seems that it is not just the US Fed in a state of purgatory, but US capital markets at large. Over the coming week, all eyes will be on the Israel-Iran war and whether US forces get involved, but also on any news from trade negotiations, as the 9 July as the tariff suspension deadline draws nearer.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.