Market Update: Buy the rumour, sell the fact

After the BBC hurricane comes the heat wave, Matt, 11 October 2024

Buy the rumour, sell the fact

Investors are confused by China’s messaging around its supposed economic policy bazooka, which last week looked more like a paper tiger – meanwhile, investors get even more optimistic about US growth.

What to expect this earnings season

A dive into the mechanics of the circus that is corporate results announcements, and what’s in the pipeline for US third quarter earnings.

A new kind of antitrust

Google has a high stakes problem; the US government wants to break it up and end its monopoly. So, why are markets seemingly not buying it?

Buy the rumour, sell the fact

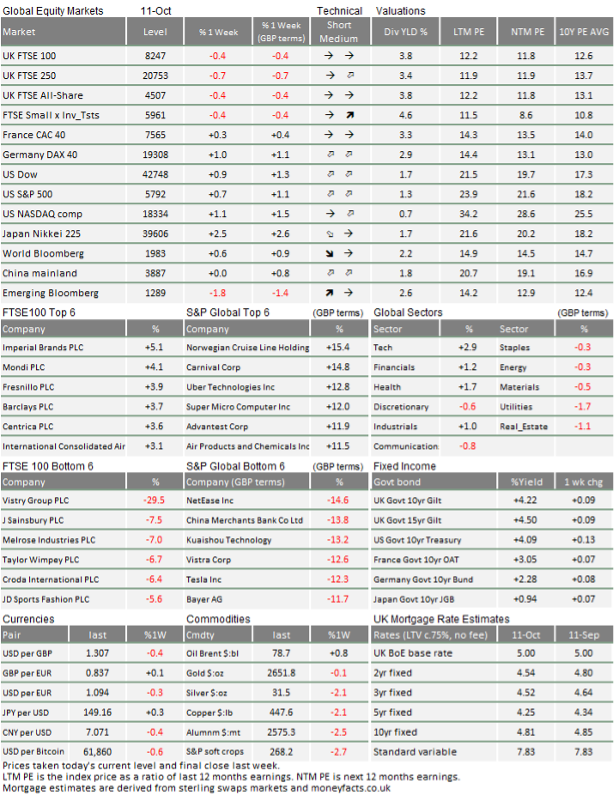

For a week with so many competing market narratives, global stocks were fairly stable. However, the S&P 500 continues to hit new highs and is doing so as we write. Broadly, US equities were stronger despite higher than expected inflation data, while the UK and Europe are lower on the week (at the time of writing) thanks the effect of dividend payments, currency moves and some policy uncertainty.

The exception to this calm was China’s stock market – which managed to compress its boom-bust cycle into the space of a few days. There are lots of uncertainties, from policy to a potential oil shock, but underneath them the global growth picture continues to improve. Despite the noise, we remain confident about the long-term outlook being benign for investors.

Inflation sees Fed move back to neutral.

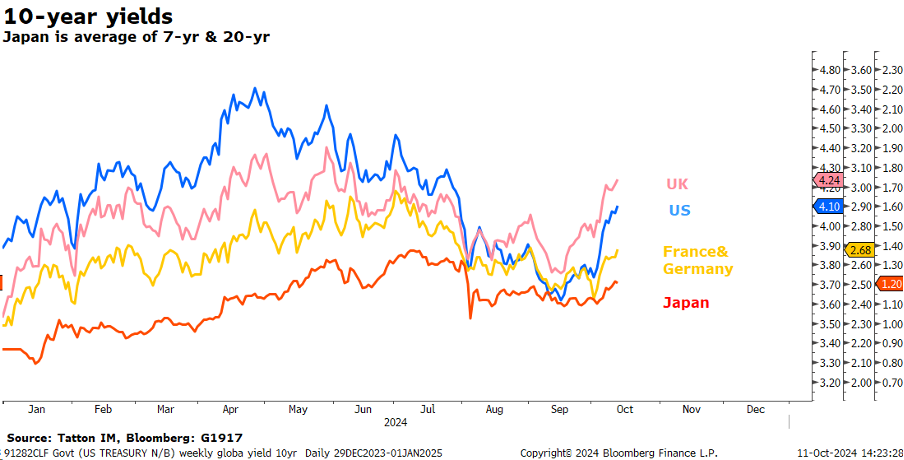

The main market theme was a move up in government bond yields around the world, but centred on the US. This started last Friday, after the surprisingly strong numbers for new jobs created in September, and continued this week as US inflation data surprised to the upside. This makes it difficult for the Federal Reserve to cut interest rates as aggressively as markets hoped it would – which is why markets’ implied path for rate cuts flattened in response. Interest rates are still expected to bottom out in March 2026 but that bottom has risen to 3.4% – half a percentage point higher than what markets expected at the start of October. We said last month that markets were too optimistic about Fed rates and we are not unhappy that the market has come around to our view.

This is not about the Fed turning hawkish. Markets judge that policy will remain ‘accommodative’ but the economy probably needs less monetary policy than previously thought.

We can see this in inflation-linked bond markets. The rise in fixed coupon treasury yields has been greater than for real (inflation-adjusted) bond yields. This difference is equivalent to a rise in inflation expectations as US nominal growth is expected to remain strong. Over the summer, we thought that US growth outperformance might be ending, but it now looks like that was just a short soft patch. Still only a few see Fed policy turning restrictive in the near or medium-term, so risk markets are still broadly happy.

Hurricanes across the southern US are devastating, and we can already see some impact on the economic data: new jobless claims are up, probably from displaced workers. But oddly enough, the end result will probably boost growth as we head into 2025 because of construction spending for the rebuild effort – paid for by both insurance companies, and state and federal government. Relatedly, US energy prices have gone up, which is probably part of the inflation expectations story.

UK hurt by mixed messages.

Higher US yields and expected growth pushed up the value of the dollar. That is an unfortunate recipe for UK government bonds, as the chart below indicates. 10-year gilt yields are above 4.2% at the time of writing, having been below 3.7% a month ago, and only a tad below this year’s high of 4.4%. That has hurt UK stocks somewhat. Previous sterling strength eased inflation pressures, pushed down yields and interest rate expectations – but that support has fallen away this month.

Higher bond yields are also a big problem for the treasury, reducing its borrowing capacity heading into a tough autumn budget.

Dissatisfaction with the fledgling government has grown, and clearly the ‘quiet competence’ approach Kier Starmer talked up when entering Downing Street has not played out. In particular, there have been too many mixed messages about what will actually be in the budget; one day we hear extensive tax rises and tightening our belts, the next we hear about easing off and borrowing to invest. This back and forth is damaging for market sentiment, particularly smaller companies.

Foreign investor flows have helped UK assets this year, but it now looks like they have dried up. The biggest help for this would be getting over and done with the budget – whatever the outcome is. That will happen soon, at least.

Is Chinese stimulus a paper bazooka?

The title of biggest flip-flopper, however, is still safely in the hands of the Chinese government. Investors were excited about another potential ‘bazooka’ stimulus from Beijing, but announcements from the National Development and Reform Commission seriously disappointed on Tuesday. The commission announced just Rmb200bn ($28bn) for spending on investment – but markets had been looking for a figure in the trillions, as officials had previously floated.

Disappointment quickly turned to fear, that Beijing’s stimulus program might just be a paper bazooka. Chinese equities sold off sharply; at the time of writing, the CSI 300 has lost nearly 13% since Tuesday trading opened. But in a testament to how wild China’s swings have been recently, the index is still up 1% over the last week – and 22% over the last month! There is yet more anticipation for another supposedly big policy announcement this weekend, but this volatility should make long-term investors wary. We note, too, that gold prices have gone up, despite the dollar strengthening (which usually pushes gold down, as it is priced in dollars). Recently, those moves have been a sign of Chinese citizens buying gold, which usually reflects a lack of confidence.

An oil shock is still unlikely.

You could also argue that gold is gaining because of fears of war in the Middle East – which remains the biggest shock risk for the world. But despite horrific escalation in the region, there were signs this week that a significant Israel-Iran conflict might be avoided. Iran’s leadership looks severely weakened, with the Ayatollah notably quiet, and Hezbollah’s remaining leadership in Lebanon reportedly angling for a ceasefire. Moreover, Israel has not immediately responded to Iran’s missile barrage, and gulf states are reportedly urging the US to prevent an Israeli attack on Iranian oil sites.

Oil prices actually fell in the early part of this week, reaching a low of under $77 per barrel on Wednesday. They subsequently climbed back up, but this was probably more down to US dynamics and prices are still below where they started on Monday. The threat of an oil shock is still there, but it remains unlikely. Indeed, the underlying global growth picture remains strong – despite this week’s disturbances.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.