Market Update July: Sunak spends big to kick-start the economy

Rishi Sunak’s short time at the Treasury has been a trial by fire. A year ago, the current Chancellor of the Exchequer was Chief Secretary to the Treasury under former Chancellor Sajid Javid. But after Javid’s controversial sacking in February, Sunak’s foot was barely in the door of Number 11 before the global pandemic shuttered Britain’s economy. Less than five months into his tenure, the second youngest Chancellor over the last century has contended with the deepest recession in Britain’s modern history.

He has, according to his colleagues in Whitehall and wider public opinion (a recent poll puts his net approval at +41), performed admirably. In his latest appearance before Parliament, Sunak drew applause as he unveiled yet another wave of fresh fiscal stimulus: a £30 billion job support package plus an additional £33 billion in previously unaccounted for public spending. It comes after the £130 billion fiscal package announced in March and leaves total pandemic-related spending at £190 billion so far this year. That spending is alone 9% of UK GDP, and puts total government borrowing on course for £350 billion this fiscal year.

The fact that Sunak, a Conservative Chancellor whose party spent the last decade rolling back government spending, has loosened the public purse strings to such an extent speaks volumes about the scale of the current economic crisis. In normal times – even in a normal recession – these spending measures would be baulked at. But this is no ordinary recession. With the whole world forced to reduce its economic output, the government has had to intervene on a level never before seen in peacetime.

With that in mind, we would do best to avoid the usual “how do we pay for this?” rhetoric. Payment for these extraordinary measures – most likely in the form of higher taxes – will eventually come due. But it will not happen in the next couple of years, or before we get back to normality. Thanks to the Bank of England’s enormous bond buying program, interest rates on government debt are pegged at historic lows, giving the Treasury the leeway to spend what funds it deems necessary.

With that in mind, we would do best to avoid the usual “how do we pay for this?” rhetoric. Payment for these extraordinary measures – most likely in the form of higher taxes – will eventually come due. But it will not happen in the next couple of years, or before we get back to normality. Thanks to the Bank of England’s enormous bond buying program, interest rates on government debt are pegged at historic lows, giving the Treasury the leeway to spend what funds it deems necessary.

As such, the question is not what we can afford but what we need. On that front, the Treasury faces two main challenges. The first involves plugging the gap between now and normality, and the second is in laying the foundations for solid and sustainable growth afterwards. Sunak’s initial spending measures in March were almost entirely focused on the first problem, but this new package is aimed squarely at the second. With businesses slowly opening up around the country, the government’s attention is now on getting people back to work and boosting consumption.

On the employment side, the £1,000 promised for each employee returned from furlough is designed to help businesses keep workers on even when short-term emergency measures wind down. In addition, the kickstart scheme for under-25s promises six-month work placements for young people “at risk” of long-term unemployment, as long as those jobs are “additional” (that is, where subsidised young workers are not just cheaper replacements for existing workers).

On the consumption side, there will be a temporary 5% cut in VAT on food, accommodation and entertainment and, in August, customers will get a discount of up to £10 a head on restaurant orders (Monday to Wednesday). Homeowners can also benefit from government support when planning on improving the energy efficiency of their home (with £3 billion earmarked in the spending package).

According to a report from the Institute for Fiscal Studies (IFS), the crucial issue in these plans is timing. Fiscal spending is a powerful tool, but only if it is used at the right time and not cut off too early. For instance, the IFS highlights that much of the money spent on returning workers could end up as dead weight, as firms that already planned on bringing back employees will be eligible for the £1,000 bonus, while others that cannot yet open could miss out. This would undoubtedly be a boost for some businesses, but might well end up disproportionately benefitting those not struggling as much.

Timing is even more important on the consumption side. Strong consumer demand is a vital pillar of the economy, but the country can only consume as much as is supplied. Social distancing has forced pubs and restaurants to operate at reduced capacity. If that capacity is already full, a boost to demand will have little effect. As such, the IFS has warned that the VAT cut could well be absorbed by higher business revenues, rather than passed onto consumers.

The even bigger concern comes at the other end. At the moment, most of these measures are set to run out around the end of the year. But that could be when we need them the most. Even when social distancing measures fade, the scarring effects of the pandemic – either through lingering virus fears or reduced consumer confidence – are likely to remain. If government support wanes while the economy is still struggling to find its feet, we could end up with a longer and more damaging recession.

Fortunately, Sunak also made clear that further spending will come if and when it is needed. He was forthright that the next budget update in the Autumn – when the scale of the economic crisis will be clearer – will be a bigger event than this announcement. If the virus can be contained between now and then – and it is a big if – the gap-plugging exercise will end and the rebuilding exercise will begin. According to Sunak, “Our ‘plan for jobs’ will not be the last action, it is merely the next, in our fight to recover and rebuild after coronavirus”.

That is an encouraging sign from the fresh-faced Chancellor. Some of the austere minded in his own party have asked for the government’s plans on how to rein in public finances over the long term, but he has done well to ignore them. And the GBP and gilt market seems to support the Chancellor’s approach, for now. How effective these measures will be for struggling businesses and consumers remains to be seen. But the fact that the focus is only on what is needed for recovery, and not what can be ‘afforded’ over the long term, is a positive.

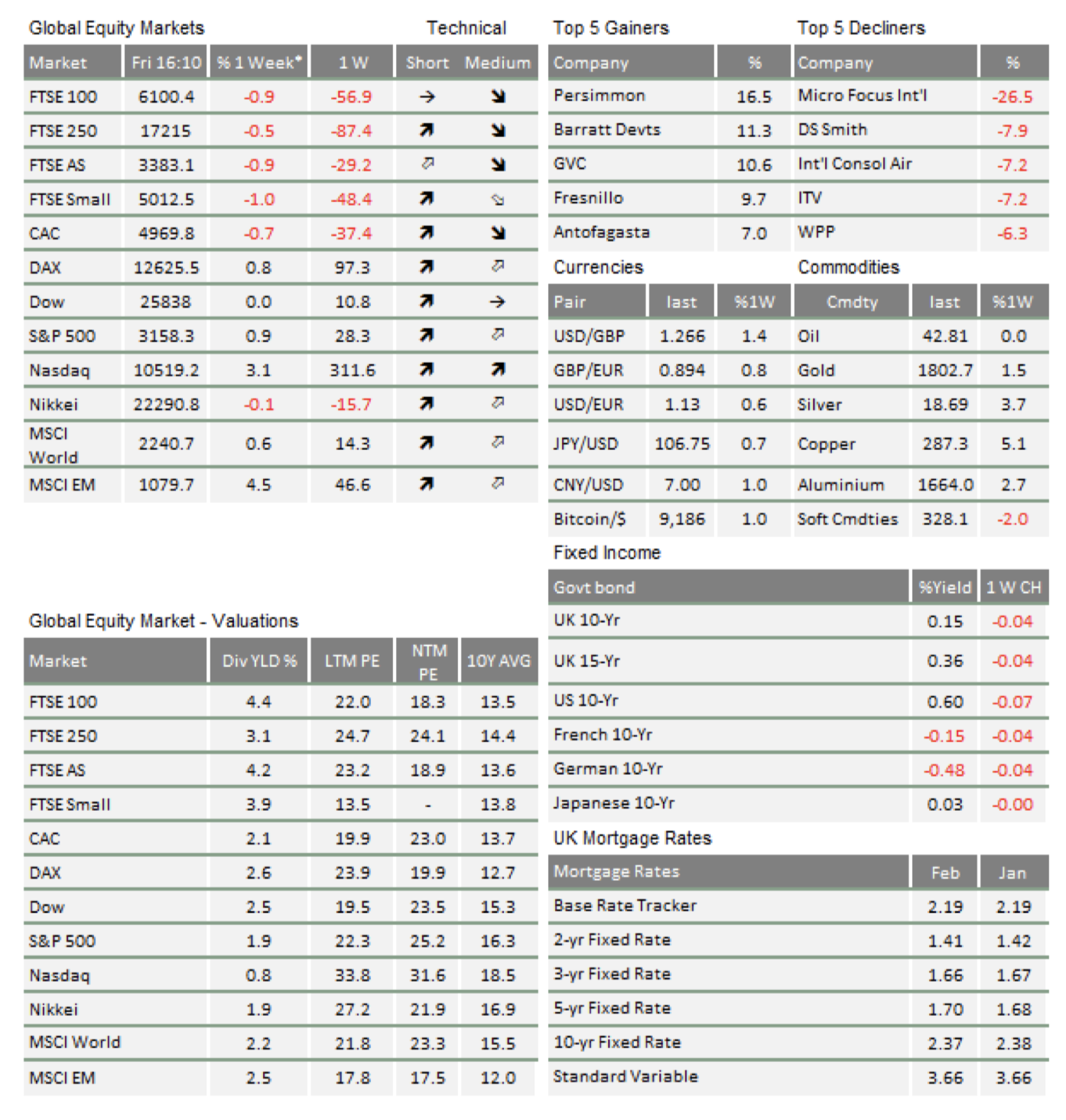

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.