Market Update: Pluses and Minuses

Pluses and minuses

Asset markets and portfolios reached new all time highs as April’s downdraft appears all but forgotten – so what’s left in the tank?

Inflation targeting: why 2%?

Without any economic reason or theory behind it, every major central bank has a 2% inflation target. Is it time to adjust it to the new realities of de-globalisation and climate change investment pressures?

China building a new world order, but still living in this one

China and Russia present their partnership as a stabilising alternative to the US led market economy, and democratic, international order. Wishful thinking or a genuine new reality?

Pluses and Minuses

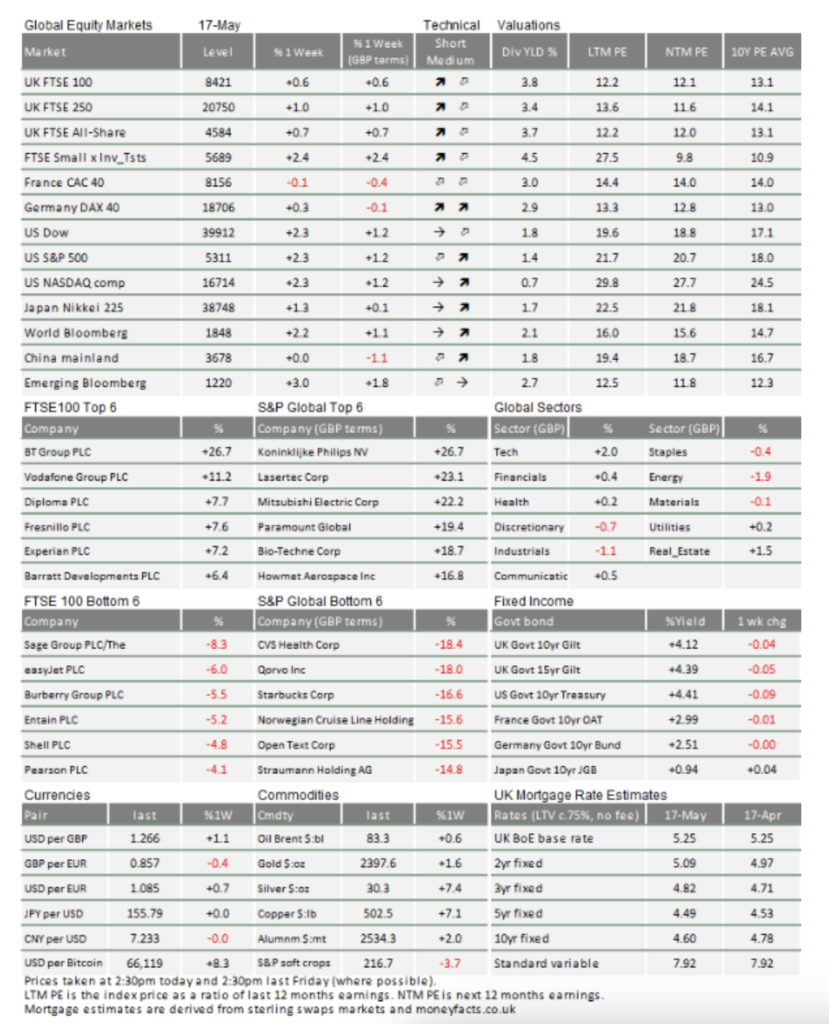

It was a decent week for investors, with global stocks up around 1% from last Friday. British and European equities finished virtually flat, with the US and China slightly up. The gain for US stocks was not outsized, but it was enough to take the S&P 500 to a fresh all-time high on Wednesday. Breaking that record made a fairly average week for markets look like a great one.

US stocks were able to break fresh ground because of encouraging inflation numbers published on Wednesday. April’s Consumer Price Index (CPI) report showed a 3.4% increase on the year before, exactly in line with economists’ expectations. Not particularly outstanding, one might think, compared to the EU and UK, which are fast heading down towards 2%. But it meant slower inflation than the month before for the first time this year, and the first time this year that US inflation did not exceed forecasts. With the inflation outlook finally improving, investors piled into US stocks in the aftermath, sending the S&P 1.2% higher on the day. Markets have become so used to the US economy beating expectations that it feels like an achievement when things are as predicted.

Tamer inflation numbers increase the likelihood of an interest rate cut from the US Federal Reserve, which would support relative equity valuations and offer relief to borrowers struggling under the weight of the increased interest burden. Markets have been excited about the monetary policy pivot since late last year, but continued strength in the world’s largest economy has repeatedly pushed back the timeline for cuts. Four months of higher than forecast inflation – together with a still-tight labour market – have led some to question whether cuts are coming at all. Disinflation signals are therefore crucial support for market sentiment right now.

Still, when we look at the detail, we cannot get too excited about US inflation. While CPI was in line with expectations, producer prices beat the forecast once again. This shows that companies still have pricing power, and that usually indicates higher consumer prices down the line. This matches up with the other signals too: consumer demand has been handsomely strong even as the labour market loosens, and recent corporate earnings show that companies are still very profitable and expect to improve their earnings further.

These mixed signals present a conundrum. For most of the year, markets were propelled by rate cut expectations – which were themselves predicated on falling inflation – while growth or at least growth expectations maintained a healthy upward pace. Persistent inflation on the back of that growth dashed some of those hopes and led to the first real bout of volatility last month, as growth finally slowed somewhat even though broader growth data showed there is still plenty to get excited about. Moreover, the Fed keeps hinting that cuts will come despite inflation still comfortably above the official 2% target.

There is a growing feeling that the vibrant US economy simply has more inherent inflation pressures than before the pandemic – but without this necessarily affecting economic stability or investment. It currently comes with higher growth and stronger corporate earnings, which could just result in price stability at a higher level, rather than instability. If so, it is debatable whether the central bank’s official 2% inflation target is still appropriate.

By contrast, rate cuts look a sure thing in Europe and the UK. Inflation has come down significantly this side of the Atlantic, and this is ultimately related to weaker growth prospects. The European Central Bank (ECB) and the Bank of England (BoE) both have greater room to cut rates and more of a need to, with support required as economies come out of last year’s technical recession.

While rate cuts seem certain, how deep or fast those cuts will be is still an open question. On Friday, ECB Executive Board member Isabel Schnabel warned that back-to-back cuts are unlikely. Most people think the ECB will slash rates at its meeting next month, but Schnabel thinks “a rate cut in July does not seem warranted”. Policy is likely to loosen, but Europe still has its own inflation pressures and we are not about to enter a full blown easing cycle.

The UK is in a similar situation. Implied market expectations suggest the BoE will deliver a first cut in August, and these expectations are aiding what is currently a strong period for UK equities. This is encouraging, and hopefully it marks an end to years of underperformance for British stocks, even if European and US stock markets still have the upper hand for the period since the year started (appr.8% UK, 10% EU and 12% US). UK based investors should bear in mind that short term movements in the FTSE 100 will not be exactly mirrored in portfolio values, which are based on globally diversified investments. That might seem like a bad thing when the FTSE 100 does well, but the long-term picture clearly favours globally diversified portfolios.

Interestingly, UK stocks used to be considered a pretty adequate proxy for global stock performance – thanks to the FTSE 100 being dominated by large multinationals. In recent years, though, the FTSE 100 has become overwhelmingly focused on a limited number of sectors, like energy, consumer staples and banks. Again, that is good when those sectors do well, but it means the UK stock market is more disconnected now from UK and global growth trends and therefore no longer constitutes an adequate yardstick for equity returns in general.

Speaking of global growth, one of the most prominent stories last week was the US imposition of another bout of tariffs on Chinese electric vehicles (EVs) and solar panels. Compared to the tariffs introduced under the Trump administration, this is likely to have only a small effect on the Chinese and US economies, given the much smaller volume of affected trade, but trade hostilities between the two are likely to continue as we head toward the US election. Trade war between the world’s two biggest economies has already knocked China from top spot on the list of US trading partners (which is now Mexico).

Encouragingly, EU policymakers are trying to stay out of the spat, even though the US move is likely to put even more Chinese downward price pressures on European manufacturers, given the overcapacities in EV’s and solar panels that state subsidies and lack of domestic demand have created in China. This is perhaps why Beijing is promising more support for its ailing domestic economy and consumers. This should be a positive for broader global, rather than just US growth, and given Europe’s larger export orientation, this would benefit Europe more than the US. However, the deterioration of US-China ties makes things difficult to project with confidence. In this environment, it is hard to get even more optimistic about the world economy and corporate earnings growth than what is already reflected in asset prices. Markets’ fairly middling week, with the US markets taking the lead again, probably reflects that. Investors will at least be pleased that, after the April setbacks, portfolio values are touching new all-time highs.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.