Market Review November 2019 – Stock Markets Sparkle as the Economy Lights Up

Stock markets sparkle as the economy lights up

Equities continued to rally in November – a relatively consistent feature of markets in 2019, despite the multitude of geopolitical risks that investors have faced this year.

Whilst 2019 has been a fruitful year for investors, news that the global economy may not be slowing as quickly as previously thought may well add a to the festive cheer over the coming weeks. With the UK, Germany and Japan all showing signs of GDP growth for Q3, it was the US that remained the real bright spot, with official figures showing that the US economy grew at an annualised rate of 2.1% in the three months to the end of September, higher than expected. The world’s largest economy appears to be bursting with festive glee with unemployment remaining at a record low, inflation appearing to be contained and consumer and government spending still buoyant.

UK Election

After a momentous night for the Conservatives, Boris Johnson promised to deliver Brexit and repay the trust of voters after he led the Conservatives to a “historic” general election win, a move which has seen the FTSE 250 rocket to an all-time high in a post-election wave of relief.

Whilst the broader UK market reacted positively to a reduction in political risk, utility stocks led the way as the threat of “Corbyn-Risk” seemed to diminish after he said he would not fight another election campaign as Labour leader.

Whilst this morning’s market reaction may feel exuberant (FTSE100 up 1.85% and FTSE 250 up 4.12% at time of writing), the rally is not without substance. The UK market which has experienced 41 consecutive months of underweight positioning by asset managers, has seen a major cloud lifted clearing the way for overseas investors to see the value of the underappreciated UK market.

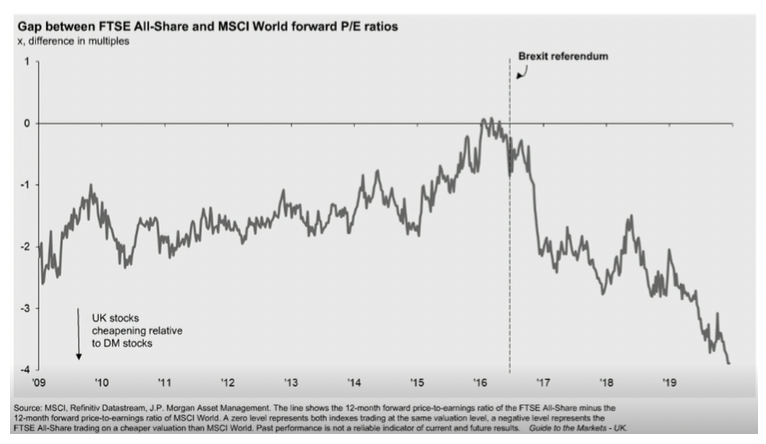

The chart below shows the gap between the price/earnings ratios of the FTSE-All Share compared to the MSCI world. As can be seen, the UK market is significantly undervalued on a P/E basis compared to its pre-brexit level relative to the MSCI World.

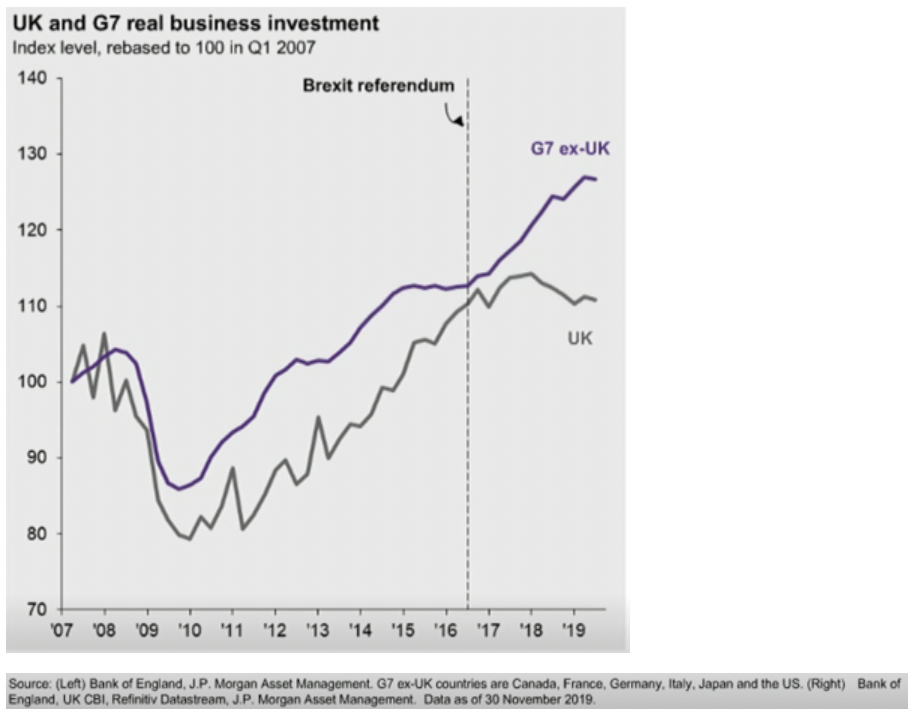

It is hoped that the election result may also encourage domestic business to increase their business investment, with domestic spending being cut dramatically relative to other G7 countries since the Brexit referendum.

All in all, the election result appears to make the UK a far more investable market place but this should not come without a word of warning; the conservatives may have a majority but there appears to still be some way to go with regards to finalising a deal with the EU.

UK

Away from politics for a moment, the UK economy grew by 0.3% in the 3rd quarter of the year, according to figures released by the Office for National Statistics. The ONS highlighted construction and services as sectors which had contributed significantly to the growth.

Positive news continued to flow with news that UK unemployment fell to 1.31m in the three months to September and inflation was down to 1.5%. To temper the mood slightly, it was reported that UK wage growth has slowed, down to 3.6% compared to 3.8% in the previous month.

British home owners will have been further buoyed by news that house prices rose in November at the fastest annual rate in seven months. House prices increased 2.1% year-on-year after a 0.9% rise in October. In November alone, prices rose by 1.0% after a 0.1% drop.

Europe

November saw the European Central Bank (ECB) welcome its new president, Christine Lagarde. So far, Lagarde has avoided any firm statements on monetary policy, and instead has centred her comments on big-picture challenges to the global economy and what governments can do to boost the effectiveness of monetary policy.

November saw activity in Europe pick up compared to previous months, with the perceived easing in trade tensions perhaps playing a role. The latest eurozone consumer confidence data was also encouraging, while the November flash PMI business surveys rebounded. In particular, there was better news across the manufacturing sector, as all of the major components of the eurozone manufacturing PMI rose compared to the previous month’s level. The improvement in the German manufacturing PMI from a low level is encouraging, while the third-quarter GDP reading confirming that Germany avoided a technical recession. Overall, markets focused on the improvement in the manufacturing data throughout the month and Europe ex-UK equities gained a healthy 2.5% over the month.

US

In the US, there have been tentative signs of improvement in business sentiment. The November US purchasing managers’ index (PMI) pointed to a pickup in activity across both manufacturing and services. In particular, an increase in the employment components of both surveys offered some encouragement that companies might not cut jobs despite the pressure on profits. Optimism around a trade deal, combined with improving activity, filtered through to positive equity market returns in the US. The S&P 500 rose by 3.6% in total return terms, pushing its year-to-date return to over 25% and putting it on course for its best calendar year performance since 2013.

Earnings season came to a close, with S&P 500 companies reporting broadly flat earnings relative to the third quarter of last year. Overall, around 80% of companies beat earnings estimates for the quarter – albeit estimates that had been lowered throughout the year.

The latest estimate of third-quarter US GDP rose, so the pace of growth actually picked up slightly, despite expectations for a continued slowdown. The resiliency in growth might be attributed to easing from the Federal Reserve (Fed). Despite the Fed’s interest rate cuts, consumer confidence was weaker than expected. In comments to Congress, Fed chair Jerome Powell said that “the current stance of monetary policy is likely to remain appropriate”. Consequently, the market now expects only one more interest rate cut from the Fed in 2020.

Far East

One sour note for a month that was mostly positive came from China, as authorities expressed concerns as industrial production and retail sales both disappointed relative to expectations. Industrial production grew by 4.7% year on year compared to the previous month’s reading of 5.8%, while retail sales grew 7.2% year on year, compared with a pace closer to 8.5% in the first half of 2019. The ongoing protests in Hong Kong are likely to continue to hinder the region’s economy, along with the slowdown in Chinese growth and the ongoing trade uncertainty.

For now, we will observe and enjoy the sense of positivity in the markets as we look to close 2019 full of Christmas cheer.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.