Market Update April: New Bond News Gives Green Light for Equity Investors

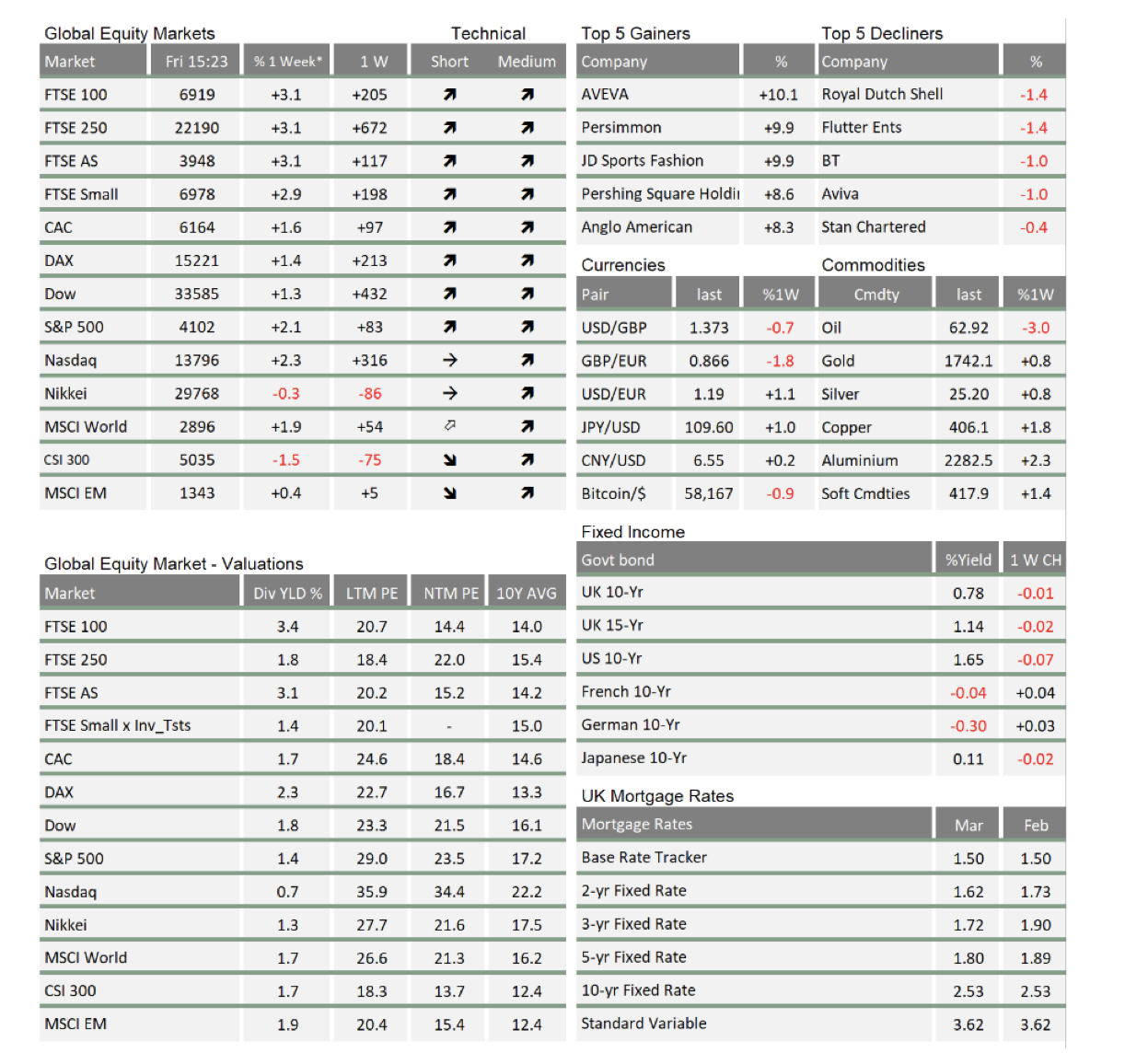

We usually start by summarising equity market action over the course of the week. This week, developments in the bond markets may be of more significance for investors, over the fact that equities continued to do well. On Thursday, yields of long maturity bonds across global developed markets fell quite sharply, at the same time as economic data showed resoundingly strong activity. As readers will know from previous editions, bond yields tend to rise in response to an improving economic outlook – sometimes far enough to even undermine lofty equity valuations, due to added competition they bring to the returns equation for investors.

We usually start by summarising equity market action over the course of the week. This week, developments in the bond markets may be of more significance for investors, over the fact that equities continued to do well. On Thursday, yields of long maturity bonds across global developed markets fell quite sharply, at the same time as economic data showed resoundingly strong activity. As readers will know from previous editions, bond yields tend to rise in response to an improving economic outlook – sometimes far enough to even undermine lofty equity valuations, due to added competition they bring to the returns equation for investors.

So, Thursday’s somewhat counterintuitive market action was a very good signal for equity markets, which duly went to new highs in the US. The FTSE100 still lags but broke through 7,000 this morning – continuing on its path to recovery.

Some might consider this as a sort of victory for the central banks. Perhaps they have at last succeeded in convincing investors that policy will remain reactive, but without tightening too soon after growth rebounds. Central banks have, after all, been telling us they only intend to withdraw support once the automatic recovery boom has run its course and a sustained growth paths is materialising – which may take us well into 2022.

Although the UK took a sizeable step towards normality this week, it is also clear that most people have been discouraged by snow-bound pub gardens to enjoy spending too long socialising outdoors. The weather does not help us believe greatly in staycation holidays either. However, market dynamics tell us that the economic climate in the UK is more amenable than the weather.

In the US, the historically strong growth indicators still cannot yet tell us whether the current pace can be sustained or even will accelerate further. What we can tell is that equity analysts have recently upped 2021 full year corporate earnings estimates sharply but have been more cautious for 2022. Those are barely changed since the start of the current quarter.

What analysts around the world have been doing is increasing their longer-term (generally three- four years’ hence) estimates. Indeed, research provider Factset’s aggregates of longer-term growth projections are uniformly at the strongest levels since the start of the data in 2001. Where longer-term forecasts are concerned, analysts tend to follow markets rather than lead. In other words, one can see the high corporate growth levels as needed to justify current market levels. There is another way to read it: analysts tend to underestimate earnings rebounds, especially during strong economic growth periods, and these longer-term projections are perhaps signalling only that analysts expect to upgrade nearer-term earnings.

For us though, we continue to be marginally more focused on geopolitical rumblings. US president Biden’s ramping up of sanctions on Russia this week, which were expected by political insiders, were imposed after the hacking of the US cyber security and software company SolarWinds last year. The sanctions themselves are more damaging for Russia than the Skripal poisoning sanctions imposed by Trump in 2019, but are small in comparison to the benefit that Biden’s fiscal boost brings for oil prices, and hence Russian oil revenues.

Nevertheless, it signals that Biden understands his international adversaries are trying to test his mettle, and whether he is as much of a foreign policy dove as he apparently was while part of the Obama administration. This week’s demonstration of a clear willingness to impose consequences on harmful actions might give those adversaries their answer. With China literally and figuratively pushing its boundaries, and Russia following suit with its military build-up at Ukraine’s borders, Biden’s sanctions are perhaps a warning shot in that direction as well.

We are not expecting a repeat of events like the Crimea annexation, but beyond the testing of Biden’s foreign policy stance, some see Russia’s actions as pointing to a weakening in Putin’s popularity, with elections of sorts not too far away. The Putin of 15 years ago may have calculated that Russia’s best interests involved a quiet tactical retreat. Older leaders tend to prioritise more personal incentives towards their legacies, which can lead to more erratic outcomes. This might particularly be the case here, if last year’s speculation about Putin’s health has some basis.

We still do not think this will end badly, or that markets will react negatively if tensions between the US and Russia worsen. It is in neither side’s interests to push their actions to the point of no return. Putin will probably continue with all multilateral engagements – such as the online Earth Day Summit that Biden is convening next week (which, it seems, Xi Jinping of China will also be taking part in). His contribution will be closely watched. The Russians have said they will delay a bilateral summit with Biden and have threatened to pull out, but political analyst Christopher Granville of our research partners TS Lombard thinks Putin will probably engage.

The lesson of 2020 is that one should guard against complacency. So, as always, we can build a wall of worry. Valuations are still high, and require uninterrupted good growth for a reasonably long time. Geopolitics may cloud things over sooner or later. Still, particularly if the weather warms up, vaccinations continue to reduce the public health impact of the virus, and the economy continues to re-accelerate, there are several good reasons to be cheerful.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.