Market Update: Markets wait for what’s next

Global stock prices have dropped last week, with most regional markets ending down. Some of this is end-of-quarter rebalancing of institutional portfolios. Institutional investors typically adjust their portfolios back to the original risk weights, a process which is equivalent to taking profits on the better performing assets. So, given the very strong equity rally over the last three months, it is predictable that equity markets will struggle as we head into the last week of September.

Nevertheless, we should not be complacent. The equity fall might not be purely mechanical. Market liquidity is drying up somewhat, and investors are starting to reassess how solid some of the old reliable narratives are.

In the UK, this time of year is when the build-up to the autumn budget starts. With talk of potential tax hikes and general economic pessimism, people are understandably nervous.

Markets run out of steam; will AI too?

Things were looking good for small and mid cap stocks last week – particularly in the US – but they ran out of steam last Friday and through this week. The old thinking was that Federal Reserve rate cuts meant easier financial conditions, stronger economic growth and hence better profits. That growth narrative has now come back to bite them. Longer-term bond yields moved up last week, causing financial conditions to tighten once more.

The mega-cap US tech stocks were initially immune to the sell-off, but that changed as the week went on. This culminated in a 2% fall in the tech-heavy Nasdaq index on Thursday. The catalyst for this sell-off was, strangely enough, Nvidia’s announcement that it plans to invest “up to $100 billion” in OpenAI.

Investors’ favourite AI chipmaker injecting its billions into the world’s foremost AI startup feels like the sort of thing that would send markets up, but instead it created anxiety around the sector’s sustainability. The ‘deal’ is more of a vague framework, but it looks like a form of vendor financing – investing into your own customers so that they can buy more of your products.

This kind of circular financing can artificially inflate a business’s value, drawing comparisons to the late 1990s dotcom bubble. That is why we saw some soul searching about the AI investment boom last week. So much money has poured into AI-related companies in the last few years, but it is still hard to see the tangible productivity gains. Nvidia is still an extremely profitable company and will continue to be so, but its struggles this week remind us that tech development and company profits do not always match up neatly.

Liquidity and positioning conditions are slightly challenging

Global stocks – and particularly US mega-tech – have been on a stellar run since April’s “Liberation Day” sell-off, so it is no surprise that many investors would want to crystallise their gains. The end of Q3 is typically a popular time to do so.

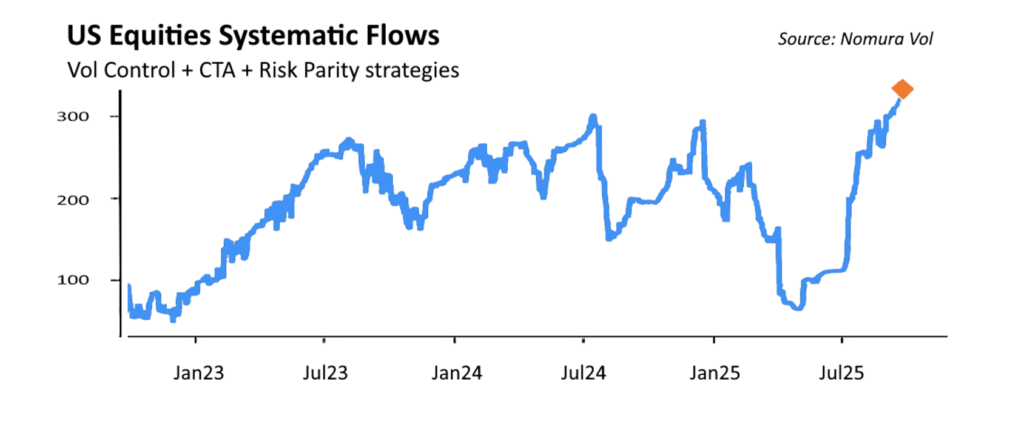

In addition, systematic hedge funds have seen a dramatic change in positioning through this quarter, according to Nomura’s volatility strategist Charlie McElligott. These are known as “volatility control”, “commodity trend advisor” and “risk parity” strategies and all involve algorithmic trading. The nature of these funds is that they respond to trends and shifts in volatility. This quarter has seen stocks trending up and volatility falling, which has pushed many of them into an extended long equity position, as McElligott’s chart below shows. A fall back in markets (which would then inevitably push up volatility) could see them lighten their equity holdings.

Relatedly, financial market liquidity has tailed off in recent weeks. Liquidity was abundant in the summer and everything rallied; now it is scarcer and markets have run out of steam.

That is in the West, at least. Interestingly, global liquidity is still strong on the usual metrics – largely because of substantial money creation in China. In the past, global liquidity would flow around the world with ease. But the world has become more regionalised as the US and China have decoupled, so now that liquidity is largely pooling in Chinese markets. Sure enough, China’s stock market was one of the only ones to keep pushing ahead this week.

In the West, liquidity is now mostly being generated from private sector borrowing, rather than central bank injections. That makes markets more sensitive to short-term risk sentiment. For the last six months investors have had a strong ‘buy the dip’ mentality, but that was not the case last week.

Global growth is still decent

Liquidity tailing off does not necessarily mean markets will be negative; it just means they could be more volatile. It is worth bearing in mind that, despite all the recent talk of weaker US and global growth, we have yet to see any real signs of stress in the economic data. US jobs data from last month was disappointing – prompting the Federal Reserve to signal faster rate cuts – but the latest data looks flat, rather than weak. US businesses are not hiring many employees, but they are not firing them either.

Globally, the latest business sentiment surveys are mixed but not alarming. France disappointed somewhat, but the US was in line and Germany beat expectations. This suggests global growth is still moving along, with little chance of a recession.

That means company earnings should still be well-supported. As we wrote last week, profits are holding up surprisingly well across the world – and that is ultimately what drives equity markets.

At the same time, tighter liquidity conditions and higher global bond yields mean that stock valuations, in price-to-earnings terms, look a little less attractive. Without support for valuations, markets ground to a halt this week. That could also mean volatility in the weeks ahead. But with a decent if unspectacular economic outlook, long-term investors would do well to keep their cool.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.