Market Review March 2019: The Return of Optimism?

As Q1 2019 came to a close, we can reflect on a quarter which saw equity markets rebound from the sell-off seen late last year. Most major regions delivered positive returns for the first three months of 2019 with the US in particular recapturing much of the decline experienced in the run-up to Christmas.

In one sense, it may simply be the reversal of some of the things that markets fretted about in the last three months of last year. US interest rates punching higher? Not happening anymore. The Fed pursuing quantitative tightening? Not happening anymore. US – China trade dispute? We’ll see.

UK

Despite the Brexit uncertainty, the UK economy continued to turn in some impressive figures as unemployment fell to its lowest level for 45 years and 32.7m people were in work. Figures from the Office for National Statistics showed that the economy had grown by 0.5% during January – more than double economists’ predictions of 0.2% – with the important services sector up by 0.3%.

Toyota announced that it would build its new hybrid car in Derbyshire – a welcome shot-in-the-arm for the UK car industry which saw manufacturing fall for the 9th month in a row. The BBC also reported that UK manufacturers were cutting jobs at a ‘record pace thanks to Brexit uncertainty’ as companies stockpiled raw materials ‘at a record pace’.

The UK stockmarket rose by 9.4% over the first three months despite the “B” word. The FTSE100’s advance was even more impressive given the headwind that its global earning constituents had to contend with as the pound advanced over the quarter.

Brexit

Yet again, all the really important news regarding Brexit came at the end of the month as Theresa May brought her Withdrawal Agreement back to Parliament for a third time on 29th March – the day on which the UK should have left the EU – only to see it defeated yet again. The margin this time was 58 votes, with the DUP once again refusing to support it.

There were plenty of high-profile Brexit supporters, such as Boris Johnson and Jacob Rees-Mogg, who did support the withdrawal agreement. They feared the only option left was to accept a bad deal or risk losing Brexit altogether – but in truth the Prime Minister never looked likely to do enough to convince either the DUP or 25 die-hard Brexit MPs.

So where does that leave us now? The EU and UK have now agreed to further delay to Brexit until 31stOctober 2019, but with the option of leaving earlier if a deal is ratified. The situation is further complicated by European elections, due to be held in late May: if the UK is still in the EU then it must send MEPs to Brussels.

Europe

March began with the revelation that EU manufacturing was facing its worst downturn for six years. The European Central Bank was once again forced to act, offering banks cheap loans to try and revive the Eurozone economy.

March also saw Italy roll out the red carpet for Chinese President Xi Jinping in an attempt to forge closer ties with China, a move which is sure to worsen the lesss than cordial relationship between the countries populist party and the EU.

Meanwhile in the Netherlands a new populist, anti-immigration party led by Thierry Baudet – inevitably dubbed the ‘Dutch Donald Trump’ – became the largest party in the Dutch Senate. With European elections due in May we can certainly expect to see far more Eurosceptic MEPs arriving for the elections – which perhaps explains why the EU would prefer the UK not to take part in those elections.

On European stock markets the German DAX index had a very quiet month, rising just 10 points to 11,526. The French market did better, rising 2% in March to 5,351 where it is up by an impressive 13% for the year to date. The German index is up by 9% for the first three months of 2019.

US

March got off to a bad start in the US as figures showed that the US had created just 20,000 jobs in February, well below expectations of 180,000 and the lowest figure since September 2017 when employment was impacted by Hurricanes Harvey and Irma. It was therefore little surprise later in the month when the Federal Reserve announced that it does not expect to raise interest rates for the rest of this year, voting unanimously to keep the US interest rate range between 2.25% and 2.5%.

On Wall Street the Dow Jones index had a quiet month: it finished March up just 13 points at 25,929. It is, though, another market which has done really well in the first three months of the year, rising by 11% since 1st January.

Far East

March ended with real optimism about the US/China trade talks, so it was no surprise to see China’s stock market up by 5% in the month.

At the beginning of March there was much less optimism, and some continuing tension as China temporarily stopped customs clearance for Tesla’s new M3 car. The trade dispute had certainly taken its toll as figures revealed that Chinese exports in February suffered their biggest fall for three years – down nearly 21% on the previous year.

Unsurprisingly, the Chinese government looked to domestic demand to counter this, unveiling a raft of tax cuts. China’s de facto number two, Li Keqiang, warned that the country faced “a tough struggle” as he laid out plans to bolster the economy. Opening the annual session of China’s parliament, he forecast slower growth of 6% to 6.5% this year, down from the 2018 target of 6.5%. He duly unveiled plans to boost spending with tax cuts totally $298bn (£229bn).

Unsurprisingly, the Chinese government looked to domestic demand to counter this, unveiling a raft of tax cuts. China’s de facto number two, Li Keqiang, warned that the country faced “a tough struggle” as he laid out plans to bolster the economy. Opening the annual session of China’s parliament, he forecast slower growth of 6% to 6.5% this year, down from the 2018 target of 6.5%. He duly unveiled plans to boost spending with tax cuts totally $298bn (£229bn).

The Shanghai Composite Index’s 5% rise meant that it closed March at 3,091 where it is up by an impressive 24% for the year to date. The Hong Kong Market was only up 1% in the month to 29,051 but is up by 12% for the first quarter of the year. The Japanese and South Korean markets turned in much more subdued performances, falling by 1% and 2% to end the month at 21,206 and 2,141 respectively. For the first three months of the year Japan is up by 6% and South Korea by 5%.

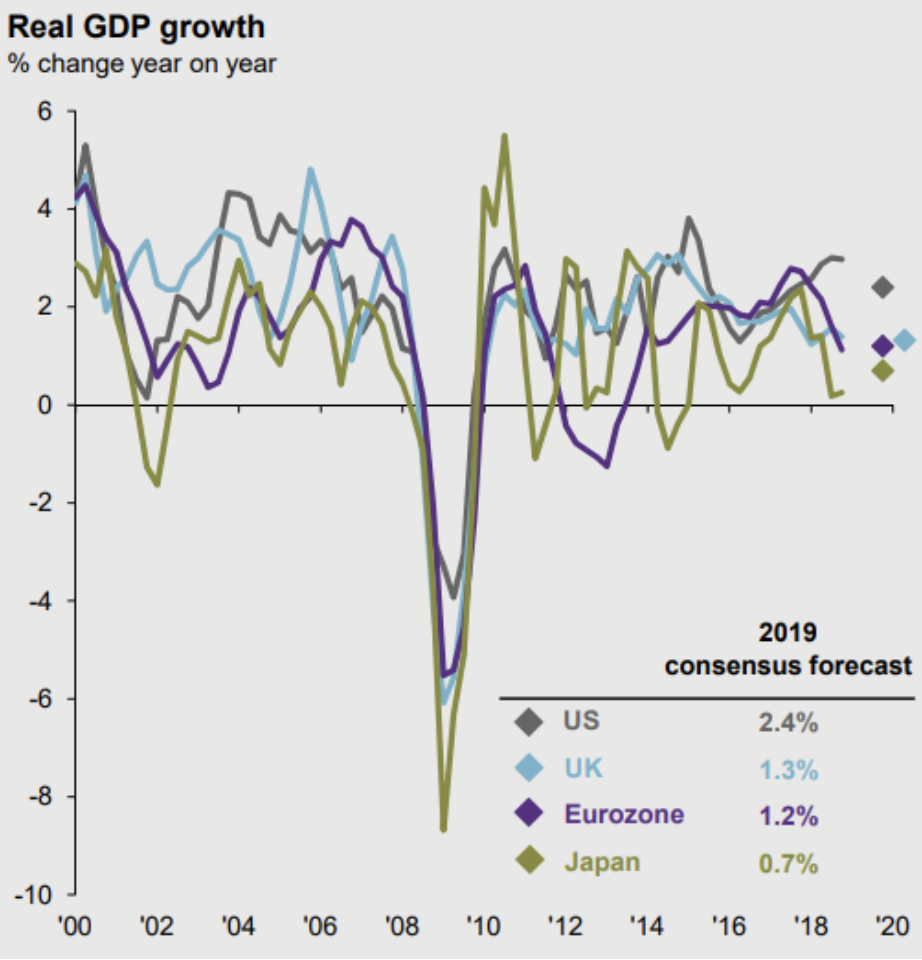

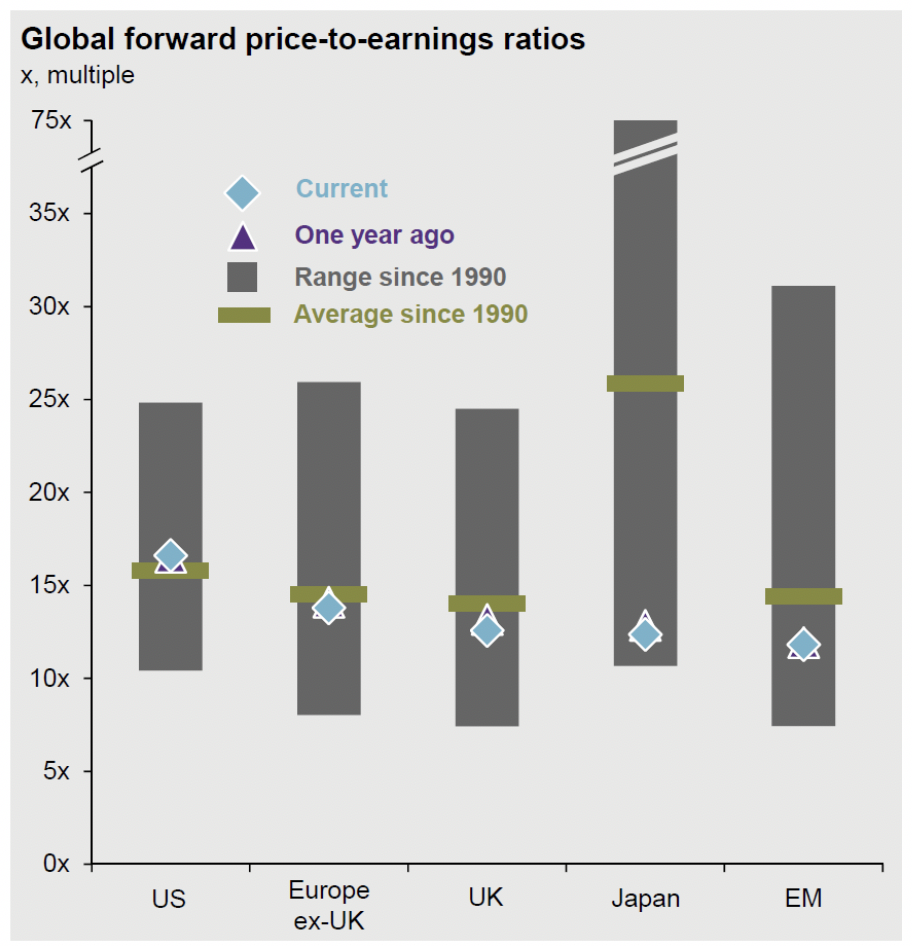

In summary the global economy continues to grow with recent OECD forecasts for 2019 and 2020 remaining at robust 3.5% pa. Many markets face headwinds as they always do and global forward price to earnings rations are similar to what they were a year again. Most markets now sit below their long run global forward PE ratio as shown below. This is not an immediate signal that equity prices will increase further, although what history does tell us is buying equities now at current forward PE rations over the long term (10 years +), nearly always this results in far superior returns to cash although this cannot be guaranteed.

In other news

A New York City woman has taken out a lawsuit against TGI Fridays after claiming that the company was deliberately misleading consumers by selling “Potato Skins” that contain no potato skin!

The lawsuit has been backed by the Idaho Potato Commission and others inside and outside the industry has said that TGI Fridays’ defrauded consumers into purchasing an “inferior product”.

“The presence of potato skins imparts a further value in the eyes of reasonable consumers,” according to the complaint filed in Manhattan federal court, which seeks unspecified damages.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.