Market Update June: Investors try to make sense of the Fed’s ‘dot-plot’

The biggest event of the week took place on Wednesday, as the US Federal Reserve (Fed) concluded its two-day Federal Open Markets Committee (FOMC) meeting, where it discussed economy policy and its latest projections on inflation and interest rates. Leading up to Wednesday, we were asking ourselves the question “what will the Fed change?”. In essence the choices were “nothing”, “a bit”, or “more than a bit”. All of us were somewhere between “nothing” and “a bit”. The Fed delivered “a bit”.

The biggest event of the week took place on Wednesday, as the US Federal Reserve (Fed) concluded its two-day Federal Open Markets Committee (FOMC) meeting, where it discussed economy policy and its latest projections on inflation and interest rates. Leading up to Wednesday, we were asking ourselves the question “what will the Fed change?”. In essence the choices were “nothing”, “a bit”, or “more than a bit”. All of us were somewhere between “nothing” and “a bit”. The Fed delivered “a bit”.

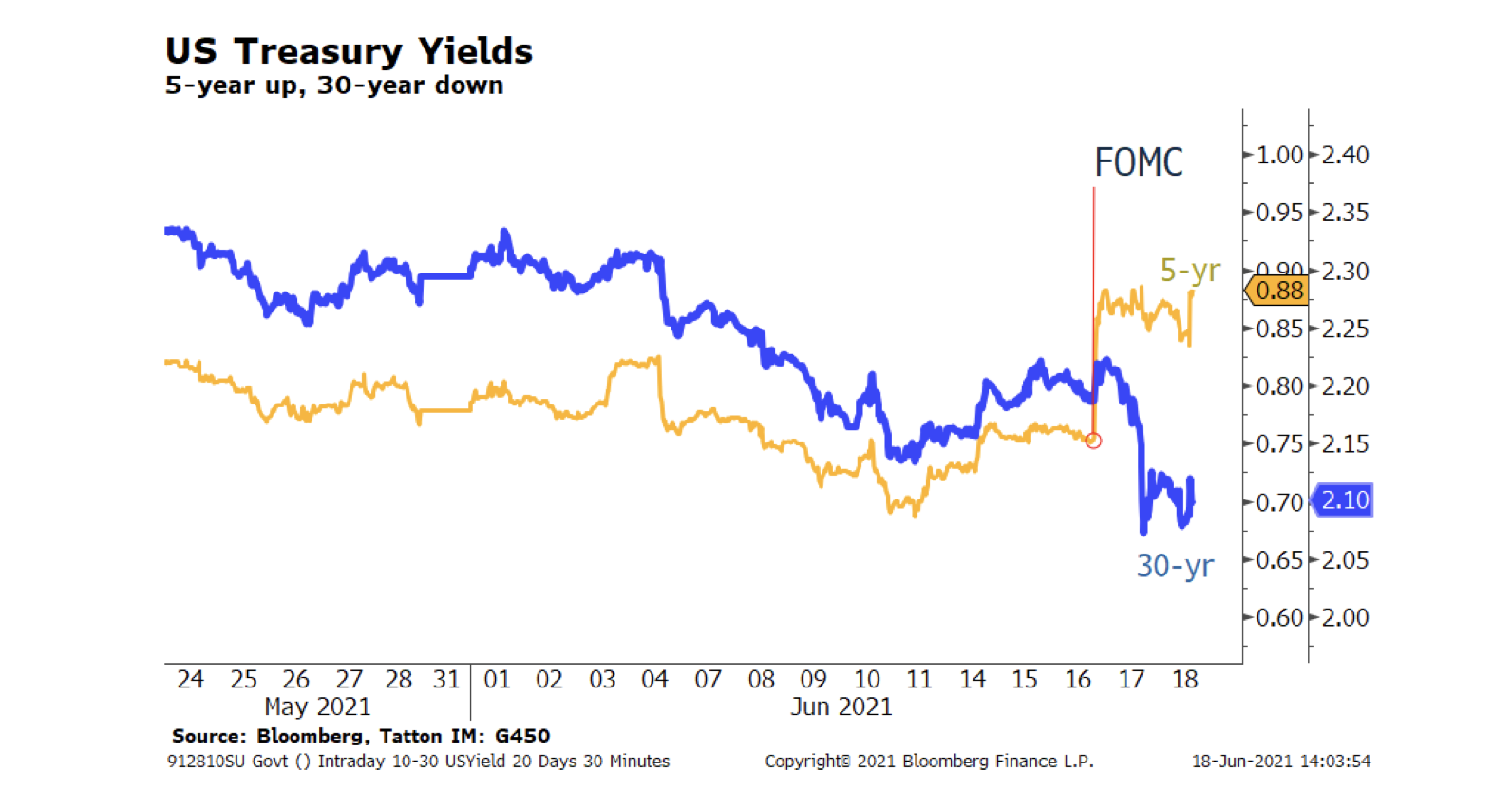

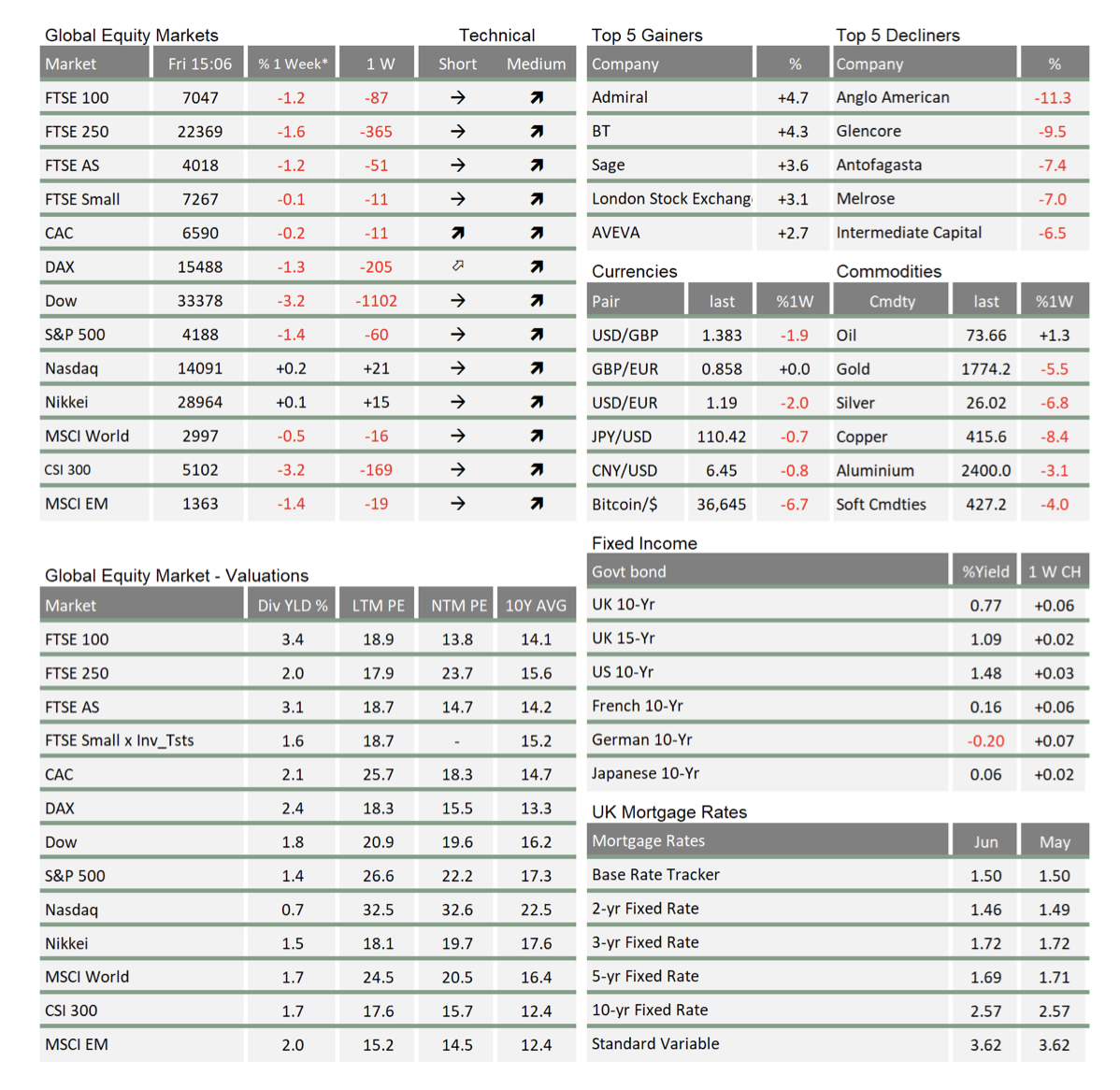

Yet the markets had some quite strong moves. The US Dollar rose sharply, by about 2% against most currencies. In bonds, the five-year yield rose to 0.88% from 0.75% and stayed there. The 30- year maturity bond rose to 2.22% but then reversed down to 2.10%.

Meanwhile, equity prices edged higher with tech shares in the NASDAQ getting the biggest boost and heading up to all-time highs again.

Ahead of the FOMC meeting, US inflation data had been a bit stronger than expected, but still mostly explainable by temporary virus effects, employment data were reasonable but showed a slower pace of improvement. Money markets remained awash with government, company and household cash. With the vaccination programme doing well and risks well contained, things were probably a bit better than expected at the previous meeting.

In his post-meeting press conference, Fed Chair Jerome Powell acknowledged that its so-called ‘dot-plot’ showed that there could be two rate hikes in 2023, with only a small likelihood of any rate rise next year. He sought to downplay its significance. He said the Fed expected solid employment improvement in the second half of 2021, and that inflation projections showed inflation back down to 2% by 2023. He also gave the gentlest of indications that bond purchases will slow at some indefinite point. (It also moved two minor interest rates up, but neither of them will tighten monetary policy).

The Fed’s credibility is always a contentious topic, and this has been especially so after such a huge episode of money printing. Surely, the more they print, the less we should trust them? Isn’t this the reason for Bitcoin? So, the sharp flattening is interesting, and continues the move lower in the “term premium” we mentioned last week. Real yields, as priced by inflation-linked bonds have stayed stable, which has resulted in market estimates of inflation going down a bit.

When you add in the rise in risk-asset prices, it all says that the Fed’s credibility remains huge. The market is pricing the outcome that the Fed wants: higher inflation followed by stable inflation around the target; profitable companies; trust in the government’s creditworthiness; an ability to keep the dollar’s value not too weak, not too strong. Its moderate path is on track.

Of course, the Fed might make a policy mistake, but it may be more the markets’ problem if inflation data is challenging. It’s all very well saying price rises are transitory when consumer price inflation is at 3.5% but if inflation is at 5% year-on-year, consumer inflation expectations may be less anchored. Half the market may think tightening is in order, the other half may think that would be a mistake. Whatever the Fed did, the market reaction could be substantial, if this week’s moves are anything to go by.

Having sent some signals at this point, the Fed will probably not do anything further as we head through the summer. Investors, both retail and institutional, will probably be desperate to take the holiday denied to us all last year. Markets may get very quiet. However, headline inflation will almost certainly look like it is rising, while an improving global economy may involve money being taken out of savings. By the time we get to the end of August’s big central bank get-together at Jackson Hole, there could be a lot of tension building up.

Of course, long-term investors shouldn’t worry too much. The Fed indicated that things are going pretty well, and we think the Fed is credible. Of course, we reserve the right to change our minds in the future.

We write about China and Japan in articles below. In a discussion about the aftermath of the Toshiba news, we mention how Japan is often thought to be a large exporter but, in fact, is much less so than either the UK or Germany.

There’s a fly in the ointment for the UK. The chart in the Japan article shows how exports have plummeted since the start of 2020, from around 32% to 25% relative to GDP. Of course, GDP is not up over the period, which tells us exports have been horrendous. At its heart is the fall-off in exports of services to Europe. There may well be impacts from COVID, but the Brexit process has left the UK in a weaker position, especially around the world of finance. The financial services balance had not worsened greatly as of the end of 2020, but we would usually see a big benefit from the improvement in financial activity in Europe. Instead, new capital raising is happening almost as much in Frankfurt as it is in London. The recent strength of sterling will be very difficult to sustain if our current account balance does not improve in the next twelve months.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.