Market Update: Earnings trump Trump

The good times keep coming for global stocks. This week, markets’ optimism was backed up by a fundamentally bullish outlook – the continued improvement of corporate earnings expectations in almost all major markets. And, with US interest rate cuts even more likely, small and mid-cap stocks joined in the fun.

This comes against the backdrop of improving global growth, after a recent weak patch. The old known risks have not gone away completely, and the reshaped narrative brings new ones, but they are mostly tomorrow’s risks. In the meantime, markets are enjoying today.

The next big event – the Trump-Putin meeting – happens tonight. In the two weeks since its announcement, markets have shown optimism about the prospects for peace. The result will probably be heralded as positive by both sides, although investors will fear a “Liberation Day” scenario where a Trump big win is deemed to be a loss for everyone else. In the trading hours after we publish, dealers are likely to reduce their risks somewhat.

Earnings are on the up – and consumers might be too

Equities have rallied hard in August. We wrote previously that this had much to do with abundant global liquidity. Earlier in the summer, the economic data were weak – particularly employment numbers. Many thought that tariff pressures would keep it that way. The difficulties faced by smaller-cap US companies backed up this view. So, many commentators doubted how sustainable the stock market rally was.

That view is changing. The latest corporate earnings reports are solid, not just in the US but (almost) everywhere. The UK, affected more by soft energy and metals markets, has been a laggard, but even British companies are now getting more positive about future profits. This positivity is backed up by stronger than expected GDP growth in the second quarter. The 0.3% expansion is hardly much to write home about, but it is better than the stagnation forecasted.

In the US, employment data and GDP statistics have not been strong but these are ‘lagging’ indicators of how an economy is doing. Businesses generally hire when they are already doing well, so an upswing in employment follows other growth measures. Meanwhile, GDP data takes some time to aggregate because of its breadth.

We know that businesses and consumers went through a rough patch after April – but the more recent indicators show a rebound. US company survey data is generally improving, as tariff nerves ease. In particular, the National Federation of Independent Business sentiment index improved again in August.

Consumer confidence is less buoyant, with today’s release of the August Michigan consumer data showing renewed inflation worries, but retail sales remain positive. A Financial Times report on Jungle Jim’s, a mainly import-based retailer in Cincinnati, demonstrates this resilience nicely. Despite putting up prices, consumer demand is resilient.

US rates are set to fall – but should they?

Markets are also positive about interest rate cuts from the Federal Reserve. Bond prices suggest a rate cut in September is all but certain – the question is just how big it will be. Lower rates will help smaller US companies, who have struggled with high debt repayments. Indeed, that is the main argument for cutting rates, as we discuss in a separate article.

Wednesday’s consumer price inflation data for July rose +2.7% year-on-year, as expected. Considering tariffs were in place, that figure was considered quite small. But, there is still a danger that prices start spiralling. The fact businesses and consumers are so resilient undermines the case for a Fed cut. The general consensus is that tariffs will be a one-off cost shock for US consumers, but tariffs might not be the only source of price pressures.

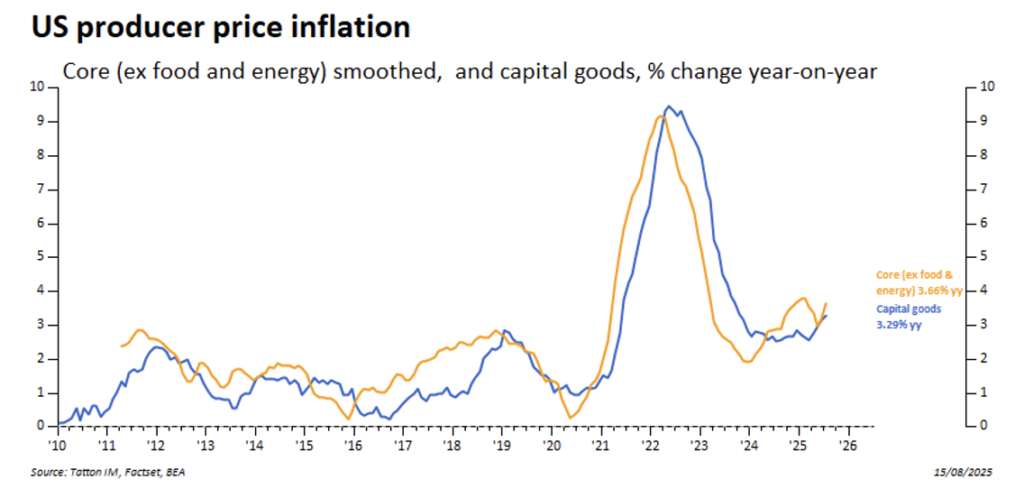

Thursday’s producer price inflation report demonstrates the risk. As the graph below shows, core finished goods prices have started to rise more steeply again. July’s rate was +3.7% year-on-year, with capital goods +3.2% year-on-year. There appears to be a surge in business spending as a consequence of immediate full capital depreciation, as well as the incentive for foreign companies to relocate production to the US.

Bond markets (slightly) lowered their bets on a September cut, but less than might have been the case a few weeks ago. This could be because the White House is doing all it can to force the Fed’s hand. Donald Trump has already appointed his loyal economist Stephen Miran to the Fed’s voting committee, and is now openly mulling about chairman Jerome Powell’s replacement. The long-list of candidates for the top Fed job includes everybody on the current committee and then some fairly outlandish names. Even treasury secretary Scott Bessent – usually the saner voice of MAGA-nomics – has now come out saying that US rates should be 1.5 percentage points lower.

Long-term risks, short-term gains

If growth stays strong, the likelihood of long-term inflation goes up. You would expect government bond yields to go up in tandem – yields showed little sign of stress this week. In fact, the only release for pent up political or institutional anxiety about the US is the dollar. The world’s reserve currency weakened yet again – and is significantly down in 2025.

The lack of a wider market reaction means there is a danger that long-term bonds are overpriced – meaning yields (the inverse of bond prices) could go up and the economy could overheat. But that is a problem for a couple years’ time. It will do little to disturb market momentum in the short-term, particularly as global liquidity remains strong.

Right now, markets are focussed on improving global growth. Most of the laggards are catching up to the previously dominant US, or have already done so. The only exception is China but, judging by the recent rally in Chinese stocks, investors think that will change soon.

That expectation would be boosted if Beijing gets a decent trade deal with the US, which looks increasingly likely. In that sense, US-China negotiations could be even more confirmation for the bulls. That is not to say that markets could not wobble again. But for the moment, things are going smoothly.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.