Market Update: Changing horses in the market race

Equity markets hit all-time highs on Tuesday and Wednesday, including a 1.5% gain for US stocks. But Microsoft’s earnings pushed the US back to where it started last week. The US tech giant’s spending and revenue figures reignited fears about an AI bubble, pulling down tech stocks slightly.

Given that politics has been the main market driver for weeks, there is something oddly comforting about a ‘normal’ sell-off like this. Investors are rightly focussed on earnings growth, which we still think should be strong and broad-based this year. We hope normality lasts.

The dollar has probably found a floor

We wrote in previous weeks that the US dollar was a key signal for markets; cue its sharp decline at the start of last week. The currency dropped to its weakest point in four years after Donald Trump said its recent decline was “great”. Currency markets stabilised once US Treasury Secretary Scott Bessent reassured them that Washington wants a strong dollar after all.

Trump’s recent record of backing down is also calming currency markets. The budgetary deadline that threatened another US government shutdown has been delayed for two weeks, after the President negotiated with Chuck Schumer, the Senate’s minority Democrat leader.

Trump also nominated Kevin Warsh to be the next Federal Reserve chair, when Jerome Powell’s term ends in May. Warsh is a more market-friendly choice than Kevin Hassett – the more pliable former frontrunner. Warsh was the Fed’s liaison with Wall Street during the Financial Crisis, so is seen as committed to the liberal market orthodoxy.

This week, the Federal Open Markets Committee (FOMC) decided, unsurprisingly, to keep interest rates steady. The President, also unsurprisingly, criticised Powell, but the outburst was mild by Trump’s standards. He called Powell a “moron” but did not mention the administration’s criminal investigation against the chairman.

The FOMC said they left rates unchanged because the US labour market is rebounding from its autumn soft patch. Improving weekly employment data backs that up, but does not quite match up with high profile layoffs from the likes of Amazon. Bond markets therefore still think a summer rate cut is likely.

The president will keep pressuring for lower rates and agitating on the global stage, but currency traders sense that the risks putting pressure on the dollar are lessening. All else being equal, the dollar’s current base should hold for the short-term.

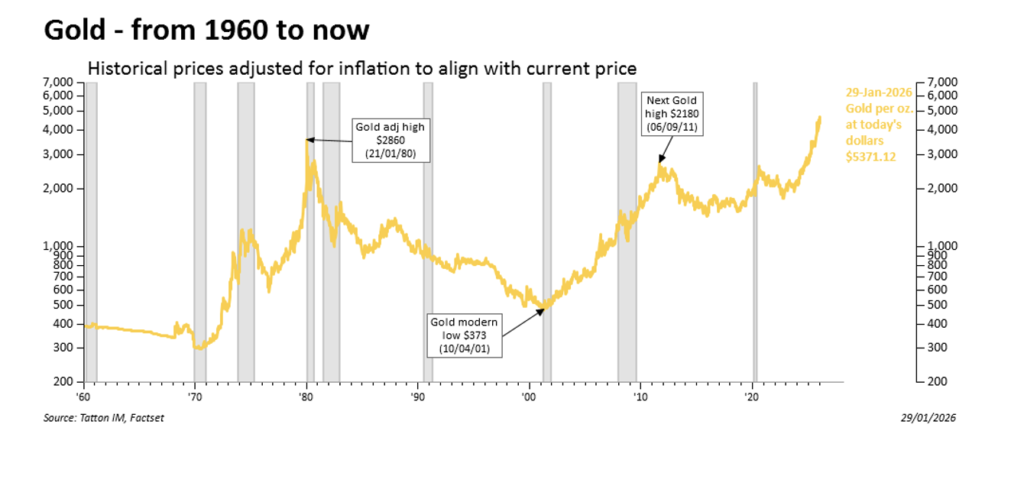

The gold rush isn’t political

Talking of geopolitical risk signals, gold prices rocketed to an astounding $5,600 per ounce, before settling back down to around $5,050 this afternoon. The reasons for gold’s ascent are, by now, well-rehearsed: global de-dollarisation, private Chinese demand, and self-enforcing price momentum, due to speculative investors.

We were surprised to learn that the world’s total stock of gold is probably now worth over $35 trillion despite (still) being able to fit inside a 25 metre cube. Nevertheless, in money terms that is still more than twice the size of the US treasury market. Until 2020, the ratio of the main equity market capitalisation to gold’s market cap was generally over 10:1. Now, we estimate it as less than 4:1.

Investors allocating more of their portfolio to gold has become a hot topic but, as a financial asset, gold has an inherently low return (virtually zero in its own terms). It is a valuable insurance when the world becomes more dangerous – as with the current US administration’s disruptiveness. However, we do not think this latest gold rush reallocation can be sustainable for the long-term. Indeed, some highly leveraged investors have taken out large positions, which suggests a short-term speculative trade.

The daily trading liquidity and depth of gold is much smaller than the daily traded “free float” of bonds and equities – as most of the world’s gold is locked away in vaults or jewellery. It therefore does not take much to move gold prices. Using Bloomberg data, we estimate that gold prices move more than twice as much (in percentage terms) as the S&P 500 index when investing the same amount of money.

Given the size of the (tradeable) gold market relative to other markets, it is hard to put any limit on how high gold prices could go. All we can say is that, historically, sharp spikes in gold have always been followed by long periods of drawdown (see chart below). Long-term investors should therefore be wary. We understand the value as insurance, but the insurance premium is now very high. Historically, as a financial asset, it has not been able to provide long-term return consistency, nor has it been a good hedge against inflation.

Earnings take focus again

Another reason to doubt that the gold rush is about geopolitical panic is that, relatively speaking, there has been less to panic about this week. US threats against Iran pushed up oil prices, but this had very little impact on risk assets. Instead, investors were focussed on corporate earnings.

Microsoft shares dropped 12% on Thursday morning, after its results raised a couple of major concerns: disappointing cloud growth suggests that AI usage might undermine Microsoft’s current business model, and its intertwining with OpenAI revives the talk of ‘circular financing’ among big tech companies. According to the FT, 45% of Microsoft’s cloud contracts come from OpenAI, and Microsoft is also among the companies OpenAI has tapped for $40bn in funding for new infrastructure.

In contrast, Meta’s (aka Facebook) better-than-expected results boosted its share price. Meta also revealed big spending on AI projects, but markets did not seem to mind this as much as Microsoft’s spending. Perhaps this tells us that companies will still be rewarded for investing big – provided they invest in the right areas. That would make sense of the fact that Tesla shares fell only mildly last week, despite an outright decline in revenues. Investors apparently care more about Tesla’s pitch for robotics and self-driving cars than they do its main business.

It’s not as simple as profits per se, but investors are clearly more focussed on market fundamentals – and less focussed on Trump’s Truth Social account. That is good news. We think that the fundamental growth and earnings outlook is strong. It would be nice if politics took a back seat and allowed markets some space.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.