Market Update November: Change is in the Air

Investors have enjoyed another very good week. Optimism had already returned the previous week, with the US election eventually delivering a clear verdict. This week then brought the news that literally everybody had been waiting and hoping for, and which we had portrayed as probable in our ‘optimistic case’ forward-look on these pages two weeks ago. The news on Monday that the BioNTech/Pfizer vaccine candidate had not only generated immunity against the virus, but also at an astounding efficacy of over 90% had stock markets switch from optimism to practical euphoria.

Investors have enjoyed another very good week. Optimism had already returned the previous week, with the US election eventually delivering a clear verdict. This week then brought the news that literally everybody had been waiting and hoping for, and which we had portrayed as probable in our ‘optimistic case’ forward-look on these pages two weeks ago. The news on Monday that the BioNTech/Pfizer vaccine candidate had not only generated immunity against the virus, but also at an astounding efficacy of over 90% had stock markets switch from optimism to practical euphoria.

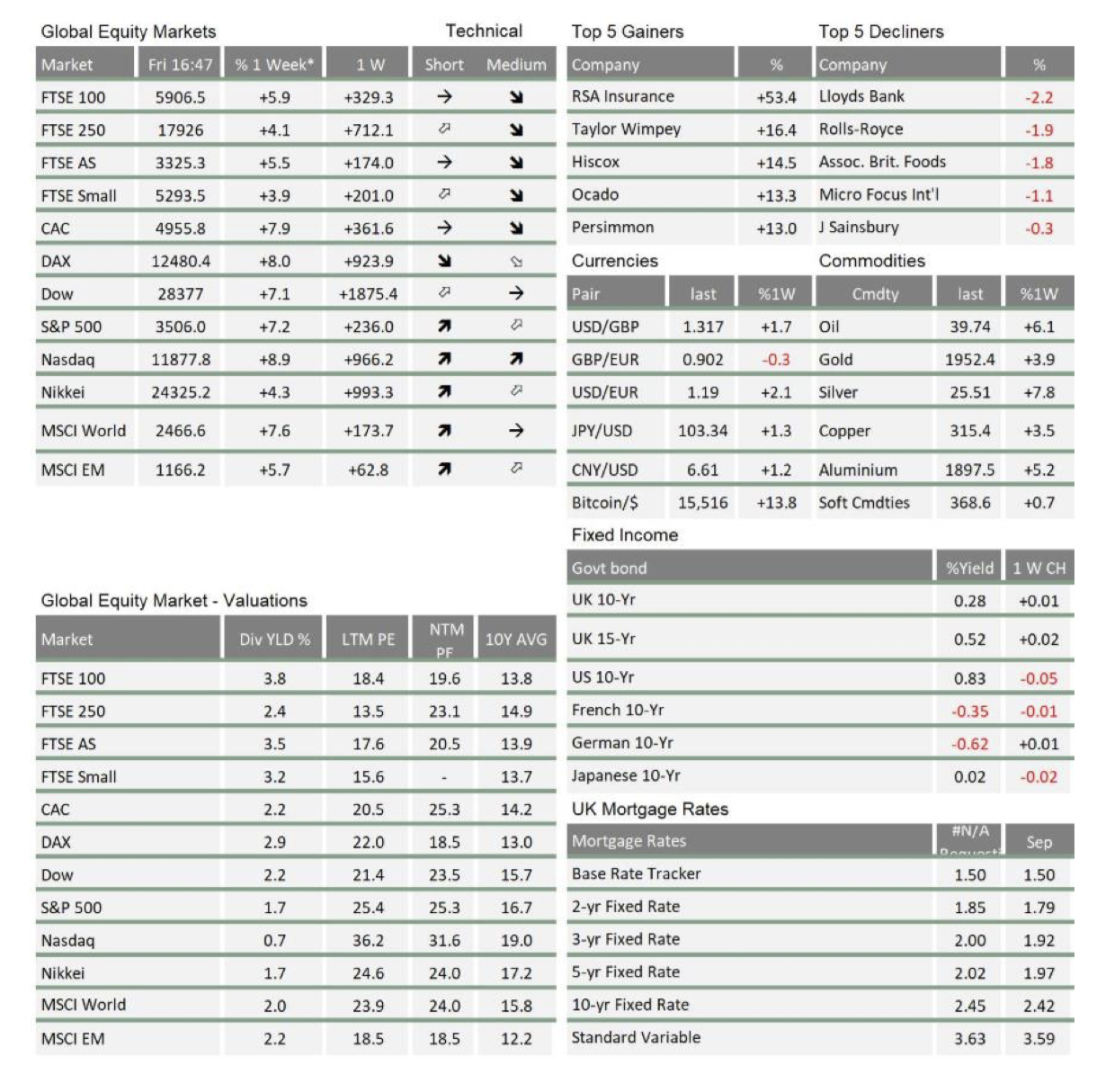

Stock markets around the western world jolted upwards by 5-8% on the day, which saw them not only erasing the declines of late October, but in most cases also returning to previous highs from the summer. Compared to the pattern of the recovery rally from late March, the market action this week was distinctly different. Those sectors and companies that had been hardest hit over 2020 by the risk that vaccines may never offer a remedy to the COVID-19 virus (‘lockdown losers’) rallied most. On the other hand, the ‘virus victors’ of the lockdown economy – especially the US tech giants – lost ground on the news. This also found its reflection in regional return differences with Europe and especially the UK for the first time in a long while leading the weekly investment return tables by a considerable margin.

This specific market reaction informs us that the reversal of regional leadership away from the US was not driven by any political frictions caused by the sitting US President’s personal refusal to concede any form of defeat. This is especially so, given there were similar frictions domestically, as the UK approached and passed another one of its Brexit deadlines. With a trade deal in touching distance, but most certainly requiring some form of compromise, the departure from 10 Downing Street of two of Boris Johnson’s closest and most dogmatic Brexit campaign allies is a notable development and signals that change is in the air. This augurs well for the last phase of (now yet again extended) trade negotiations, and sterling’s strength over the week tells us that markets believe a deal is close.

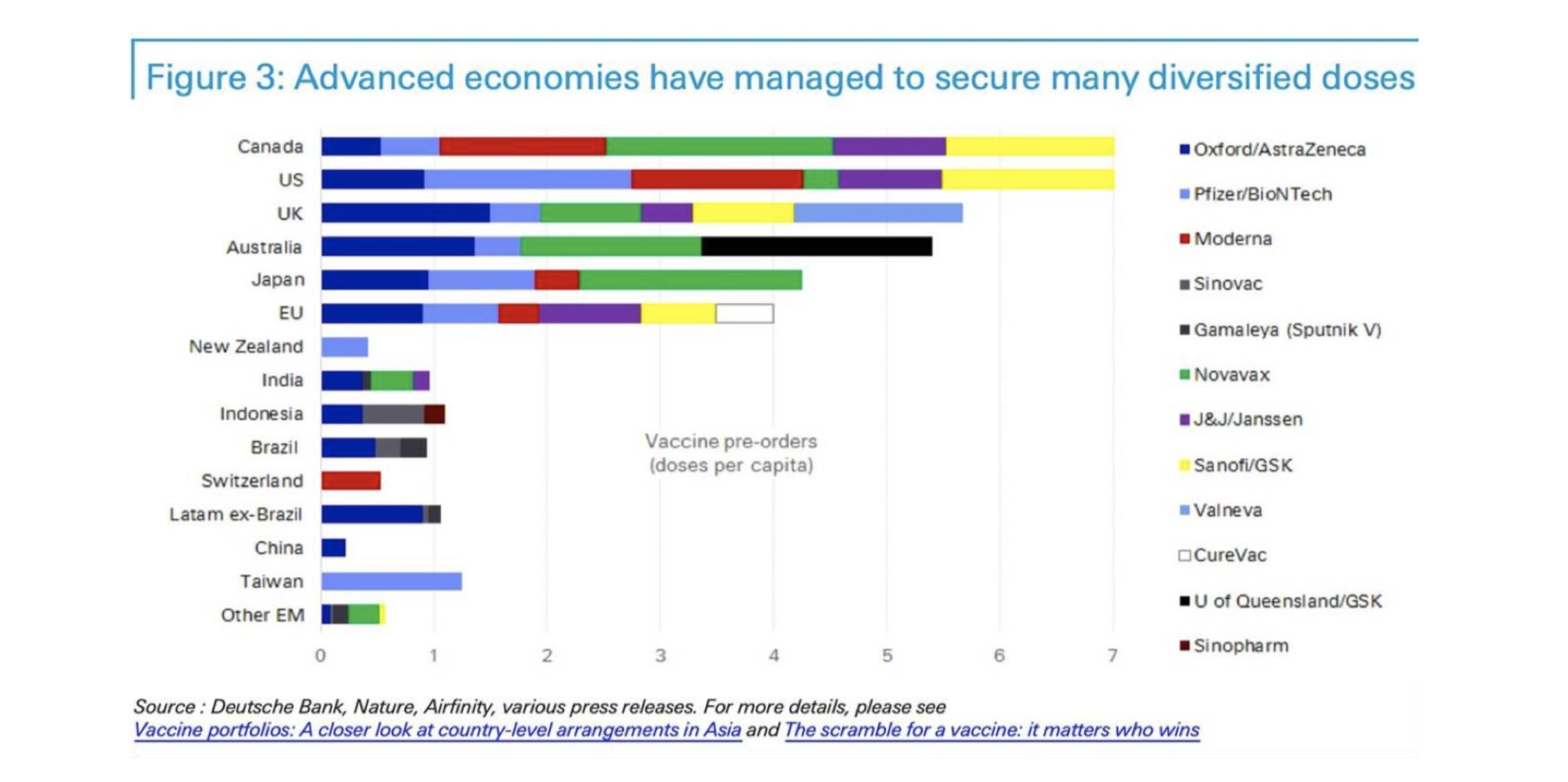

The stock market rotation in favour of the ‘lockdown losers’ seems imminently rational if the arrival of vaccines – of which the western world appears to have secured plenty to go around (see table below from Deutsche Bank researchers) – offers the prospect that we will be able to return to our pre-pandemic lives after all.

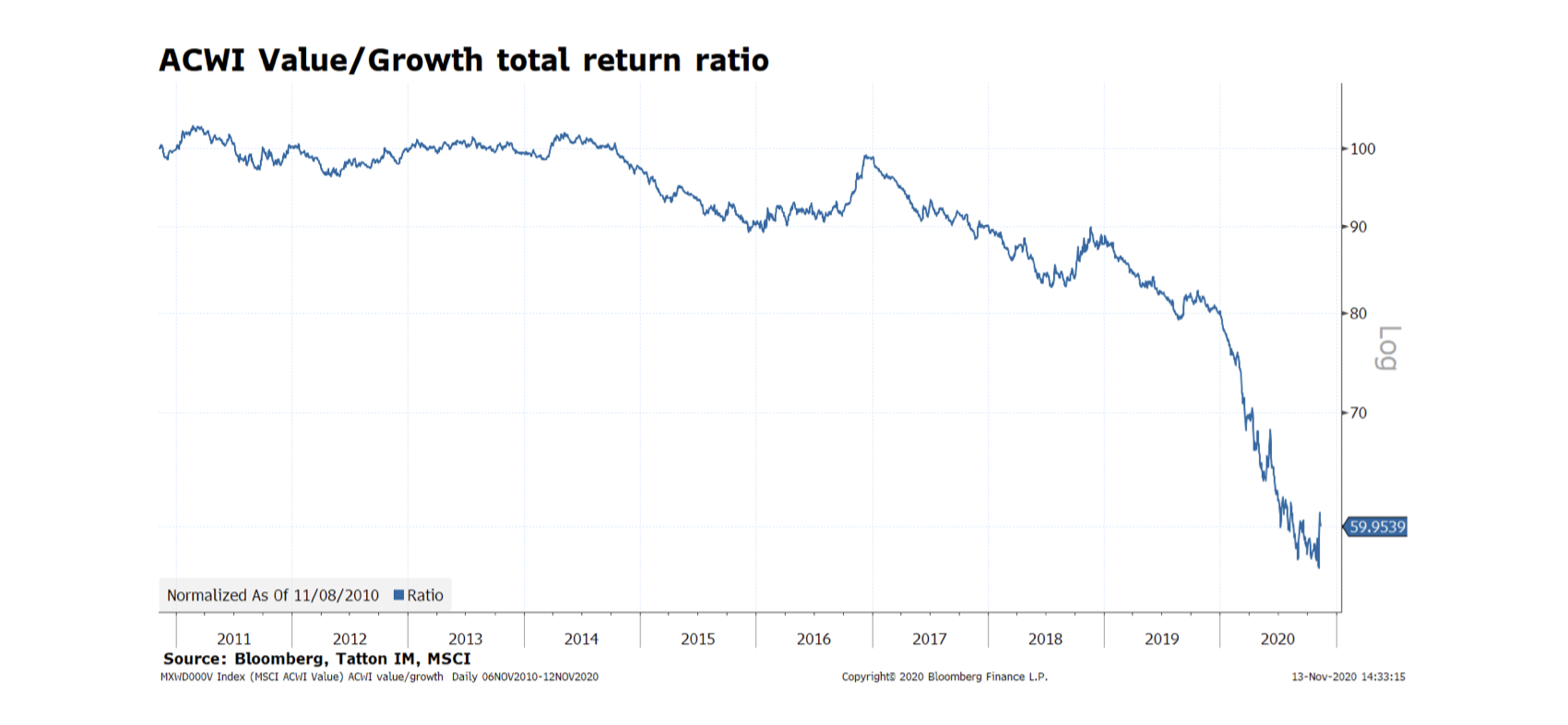

Beyond these more obvious moves, our investment team was particularly interested to observe the rotational forces between growth and value shares around the world. This was best observed through the MSCI All-Country World Index that has sub-indices comprising growth stocks and value stocks. As we know, value stocks have underperformed over an extended period, indeed a phenomenal near 40% over ten years. On Monday, value outperformed growth by some 4.5%, and then another 3.2% on Tuesday (although, of course that undoes only about 4.7% of the underperformance, when measured from the starting point ten years ago).

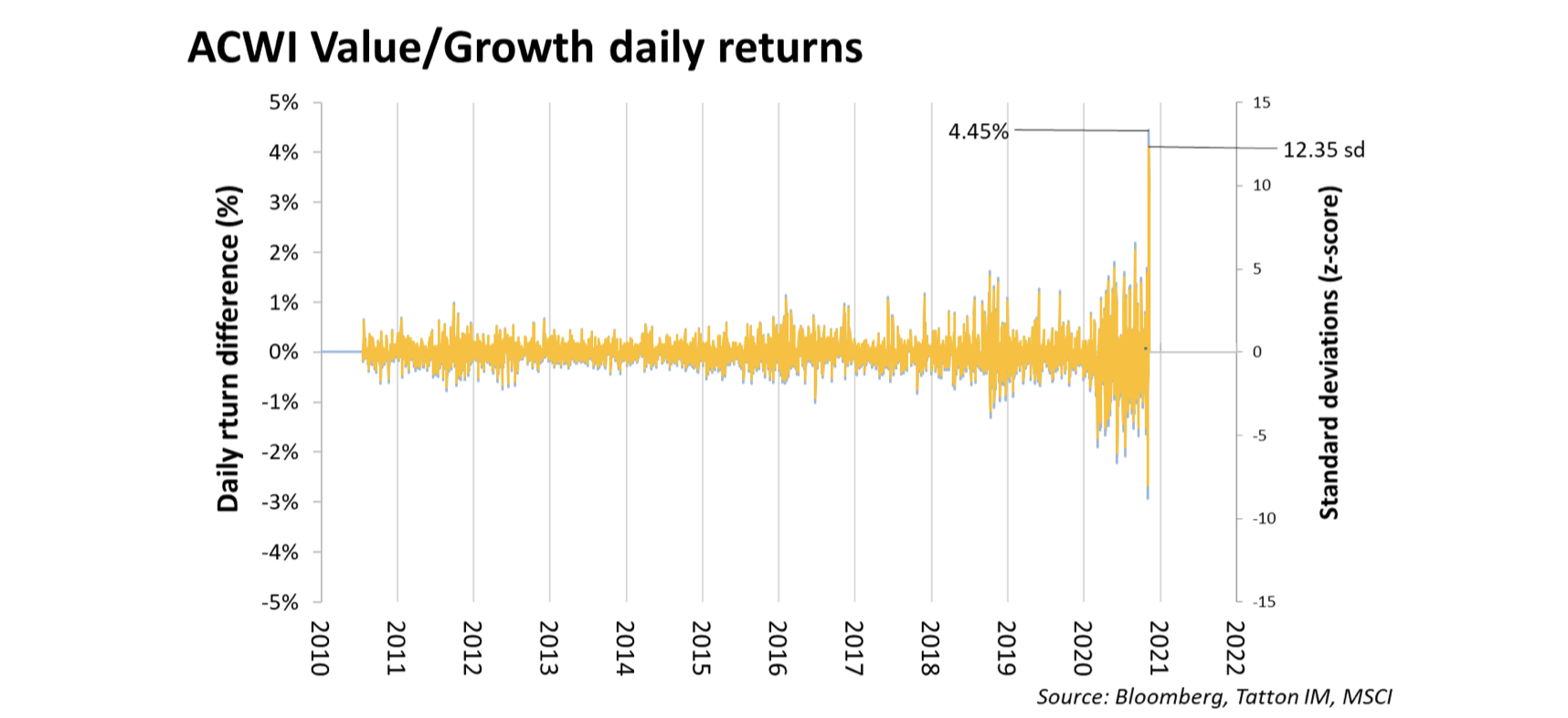

It may seem a tiny retracement overall, but the bounce is significant. The chart below shows the daily difference in performance between the two sub-indices, with the right axis showing it in terms of ‘standard deviation’.

Monday’s move was one of more than 12 standard deviations(!), when taking the data for ten years. Perhaps the other important takeaway from this week was that if the above was a noise chart, then the noise that was rising over 2020 has now reached cacophony level. A conclusion that arises from that is that the growth index’s advancement had become very narrow, or in layman’s terms, increasingly relying on a few of the mega-cap tech names. If ‘change is in the air’ aptly described UK’s Brexit politics, it is an even more appropriate analogy for the prevailing dynamics in the stock markets – and when things get as volatile as observed, diversification is the watchword.

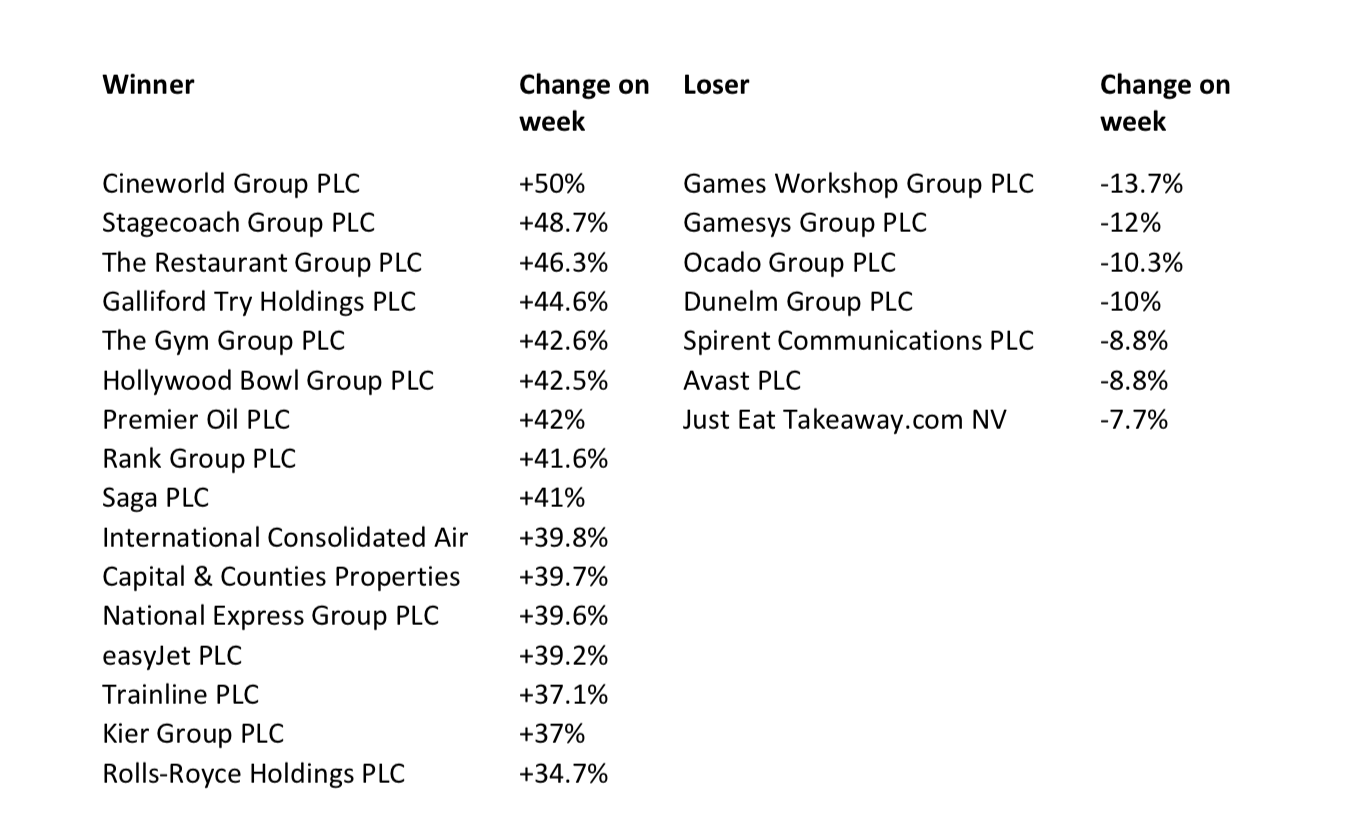

At the risk of overwhelming readers with market detail this week, we thought it may be appropriate to provide some factual evidence of just how extreme the week has been in the UK market. Below is a list of some the biggest gainers and fallers. The overall market return really does not do justice to what just happened in the UK stock market:

Clearly, western societies are not out of the pandemic woods yet, and record infection and fatality numbers provide a dire warning that things still might get worse before getting better. Nevertheless, we always observe that capital markets turn or experience paradigm shifts well before the economy does. Indeed, what capital markets require is a reasonable perspective that the worst-case scenario has been averted and that light at the end of the tunnel has become a distinct possibility. A year from now, this second week of November may well be recognised as the fundamental turning point, when capital markets were no longer driven by the relief provided by emergency policy measures, but instead by the real prospect of a sustained economic recovery.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.