Market Update: Start with a bang

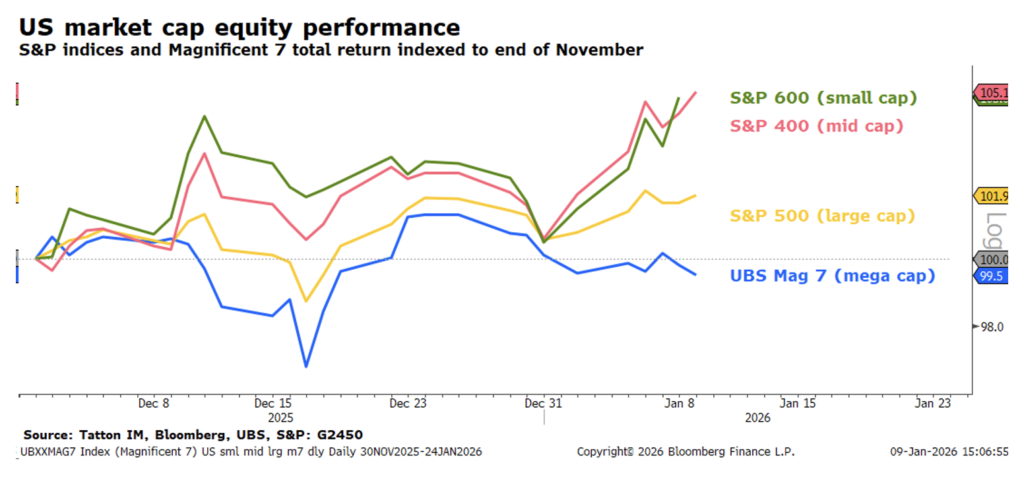

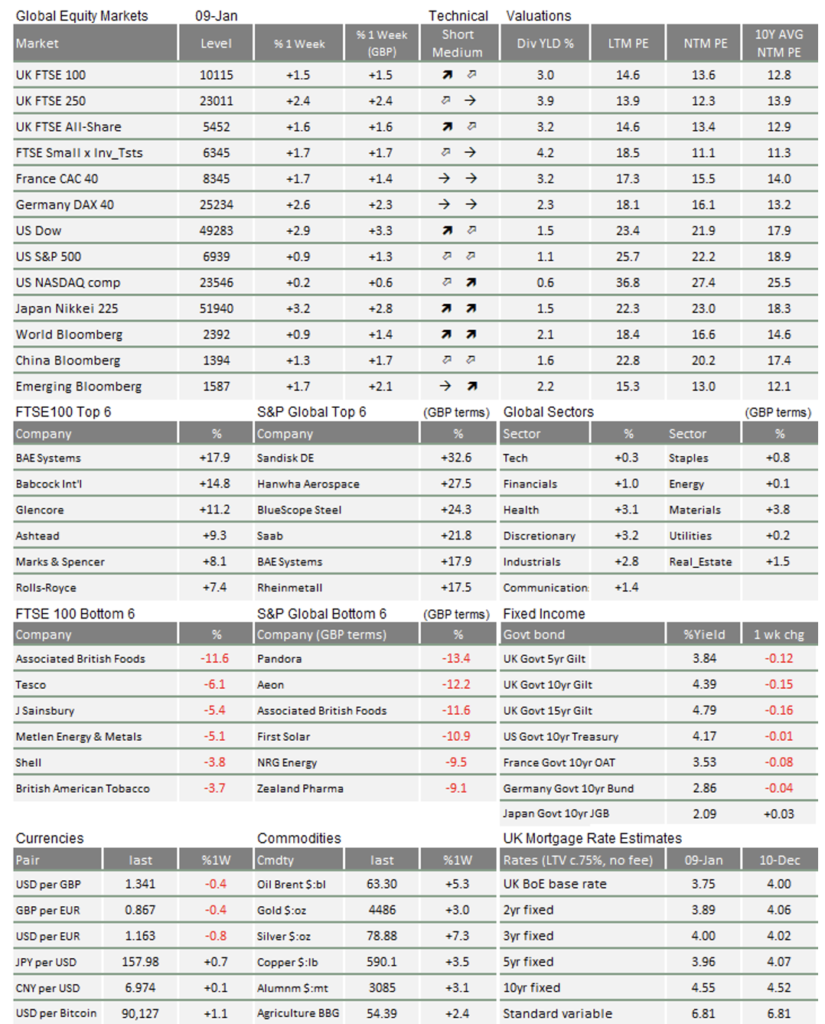

Global stock markets have started the year well, with most gaining during the first two weeks. The FTSE 100 broke through the 10,000 level last Friday for the first time in its history. Encouragingly, small and mid-cap stocks have led the rally, particularly in the US. That shows investors are growing more confident about global growth this year, shrugging off geopolitical worries. In fact, right now, the biggest risk for markets is that global growth might be too strong, prompting inflation in the second half of 2026.

Markets don’t care about geopolitics – yet

Donald Trump’s action in Venezuela and military threats against Greenland dominate the news cycle, but markets are (almost) unfazed. Oil prices barely reacted – most likely in recognition that, even if the overthrow results in increased Venezuelan supply of crude, that will not impact global oil markets in the short-term, because it will take time and substantial investment to restore the country’s oil output.

Investors are focussed on reasonable current growth data and its potential to improve. For example, JP Morgan’s Nowcasts (an estimate of growth right now) suggest that the US economy is currently growing at an annualised pace of 1.6%.

Meanwhile, JPM estimates the UK growing at an annualised 1.5%. The prevailing narrative is that the UK is weak but, once again, the aggregated data do not back that view. Indeed, some of our problems stemmed from UK growth running above the ‘potential’ rate (where growth is non-inflationary) for most of 2025, which is probably what was keeping inflation high.

However, as the year drew to a close, growth in both the US and UK softened enough to cool domestic inflation. That should mean more interest rate cuts, which would help businesses and equity valuations.

The softer US economy has prompted Trump to promise more spending, despite an AI-related spending spree forthcoming. The administration has ordered government-sponsored housing institutions to use their balance sheets to buy $200bn of existing mortgage bonds. This should force down mortgage rates, similar to the Fed’s quantitative easing. The prospect of stronger growth is helping markets, despite concerns over Trump’s disruptive policies and market interference.

Markets’ current nonchalance does not mean Washington’s agenda will work in the long-run. Former IMF economist Gita Gopinath wrote in the Financial Times this week that the impacts of US trade disruptions have so far been obscured by European and Chinese fiscal stimulus, and the AI boom. Just like after the Brexit referendum, short-term profits have not taken a hit, but over the long-term, the detrimental impacts on growth are clear.

The big AI spend is coming

Many worry that AI is papering over the cracks in the US economy: big tech is seeing corporate earnings growth while the rest struggle. That might be a fair description of US growth last year, but not of the current capital investment drive – in which billions are being spent to build and service vast new datacentres. Firms raised huge amounts of capital last year, and are now spending it quickly on the more traditional parts of the US economy. The current AI capex surge is not so much papering over the cracks as filling them with cash, and fast.

The idea is that the capital stored up in big tech (on their balance sheets or in their share prices) might be used to build things, which means better profits for the previously unloved parts of the economy. Investors could therefore rotate out of the big winners into the previous losers. At the end of November, JP Morgan Research gave the following view:

“The AI sector’s momentum is spreading geographically and across a diverse list of industries, from Technology and Utilities to Banks, Health Care, and Logistics, and in the process creating winners and losers. AI contributed roughly one-third of global growth in the 1H25 and our global equity strategists see earnings accelerating above trend to 13-15% over the next two years, driven by AI secular tailwinds. This compares to the long-term average EPS growth of 8-9%”

We have seen exactly that in recent weeks. In the US, previously ignored companies have been winners: value is easily outstripping growth; small cap, mid cap and value stocks have pushed ahead. We have had false dawns before and it is far too early to call this a trend, but it is certainly something to keep an eye on.

Even if rotation becomes a trend, it does not mean US tech will do badly. Most of the companies are far too profitable to have any serious problems. A better way to put it is that, in the medium-term, actual earnings growth will support tech shares but it is hard to see future growth expectations pushing up share price valuation multiples (relative to earnings) much further. In other words, gains for the megacaps will likely have to come from maintained outperformance in profit growth.

Will growth be too much of a good thing?

The decent outlook for global growth should support markets, but it might not mean another massive equity rally. Money being spent to build infrastructure is money not stored in asset markets. Stock markets already seem to have priced in strong global growth for 2026, so we might just see the economy catching up to where asset prices already are. Markets rarely fall when growth is strong but they might not be pumped up to the same extent they have been.

If economic growth is to translate into equity market performance, it is important that global inflation remains benign. With increased capital spending, a boost from lower rates and disruptive trade policy, the danger is that inflation could reaccelerate.

Inflation will likely remain subdued as long as employment markets remain relatively weak – as they have been across the developed world. We have noted for a while US companies have not been hiring (though they are not firing either) for example, which seems to be AI-related. At some point, though, the massive infrastructure buildout will surely mean more employment. At that point, inflation could return, central banks could tighten up and investors would reassess the outlook. That is a risk for the second half of 2026 that we will have to watch.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.