Market Update: Market momentum reigns

Nothing shuts down the stock markets

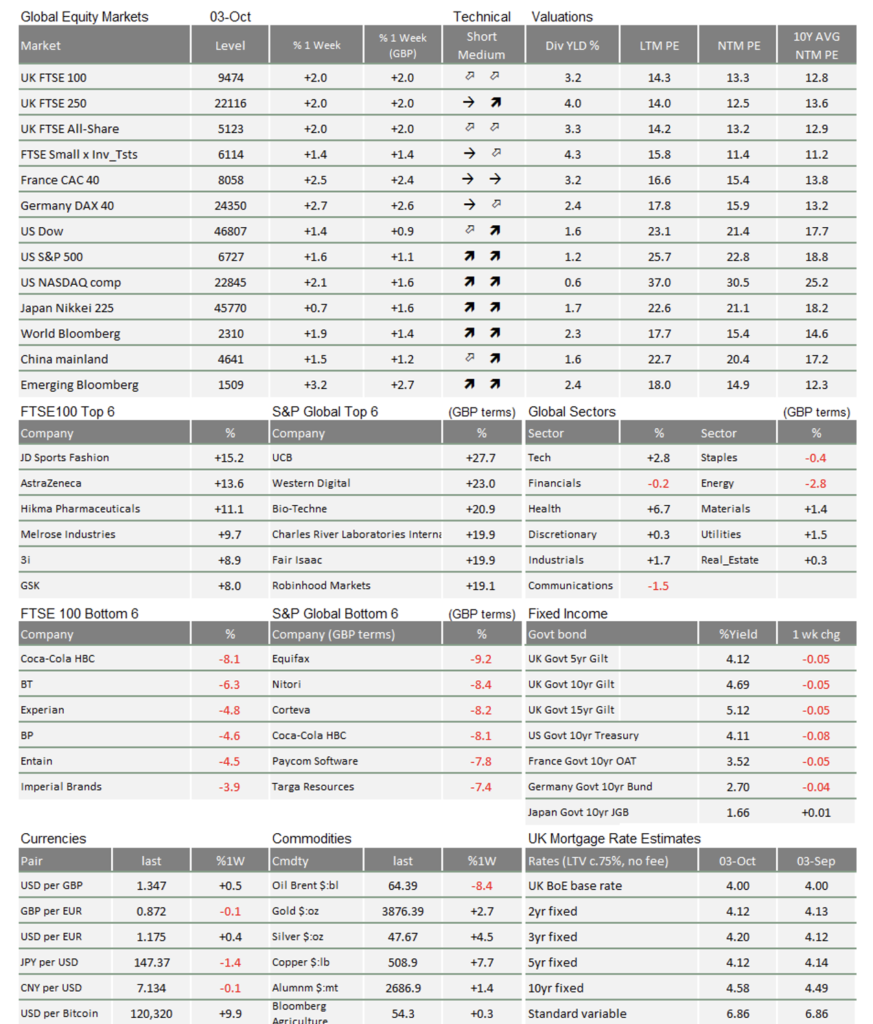

Global stocks bumped up last week, recovering all of the previous week’s losses and then some. That is despite a US government shutdown that shows no sign of being quickly resolved. Previous funding gaps have hurt the world’s largest economy, but markets are choosing to ignore the noise. With politics no longer driving markets, corporate profits will almost certainly take the wheel.

Tax hikes hurt, stamp duty holiday helps

The clamour in Washington in previous weeks contrasted with a relatively quiet Labour party conference in Liverpool. Those expecting infighting amongst the Labour Party ranks were disappointed. More important was what was not said: Chancellor Reeves decided not to reaffirm Labour’s pledge of no tax rises – suggesting a hike is coming in the autumn budget. The signs have pointed that way for a while, the only question being what form they will take. Raising income tax or VAT will be politically unpopular, but would probably cause less economic disruption than another grab at the savings pool or national insurance.

Regarding domestic savings and investments, there was some encouraging news: the Treasury announced a stamp duty holiday for new London stock listings. As we have argued before, the trade tax on UK shares constrains liquidity in our market, which is why so many British companies are choosing to list in New York. Suspending the tax will encourage a return of valuable early-stage companies. Of course, most of us save for the long term, so a short-term period of no stamp duty will be irrelevant.

Considering the FTSE 100 hit another all-time high in previous weeks, we will issue our usual reminder that the UK economic outlook is not nearly as bad as media coverage suggests. Company profitability is a key signal of economic strength, and UK corporate profit margins (indeed margins everywhere) have been expanding for a long time.

US political flashpoints loom

The US government shutdown drama is back on our screens – but markets are not tuning in. Stocks did not even bristle at Trump’s suggestion that the budget deadlock could be used as pretext for firing more federal employees, a kind of DOGE-by-proxy. Perhaps markets just see the government shutdown as mere political theatre that will be resolved (as it always has), or perhaps they think the economic impact will be mild. A quick resolution looks unlikely, but previous federal cuts under DOGE did not hurt US growth too much.

More encouraging was the news that the US Supreme Court temporarily blocked Trump’s attempt to remove Federal Reserve governor Lisa Cook. Cook could still be removed if the court finds her guilty of tax fraud next year, but at least Trump cannot easily wrest control of the Fed. The next legal flashpoint will be the Supreme Court’s decision on whether the president has the power to impose his tariffs. Judging by comments from US trade representative Jamieson Greer, the White House is already preparing for defeat in the November case.

The conventional wisdom is that tariffs being struck down will be good for markets. But, strong tariff revenues are one of the reasons that our measure of US government bonds’ debt risk has declined recently. The US budget deficit has become stretched and disconnected from the economic cycle in recent years, so it is no surprise that bondholders want to see money coming in. A ruling that tariffs are illegal could therefore raise US bond yields – and, by extension, hurt risk assets.

It’s the earnings season, stupid

If politics will not move markets, corporate earnings reports probably will. We will soon get US company results from the third quarter and, judging by the most recent growth signals, they should be pretty good. As we start the season, S&P 500 2025 Q3 earnings are expected to rise 8.2% (compared to 2024 Q3, using Factset data).

We are in a slightly odd situation heading into this earnings season, though. Companies usually temper profit expectations as they get closer to reporting, so that they can ‘beat’ them and bump up their share price. That “beat” has pushed up the earnings expectations by an average of 4% in the past two years. Analysts aggressively marked down Q3 and Q4 2025 earnings due to tariff uncertainty at the start of the second quarter. However, the uncertainty also caused many companies to refrain from their usual earnings guidance. Lacking guidance, analyst forecasts remained fairly static through this quarter. Meanwhile AI-related company profit expectations have been buoyant. In sum, we think this means corporate earnings are less likely to ‘surprise’ by a strong margin, and hence less likely to boost stocks across the board.

Elsewhere in the corporate space, there was lots of talk last week about the Saudi-backed leveraged buyout of gaming company EA. There was some suggestion that it could herald the return of leveraged private equity buyouts. Compared to historical examples, though, (like the infamous buyout of RJ Reynolds in the 1980s) the actual amount of debt leverage was small, compared to the deal’s price.

Where does this all leave us?

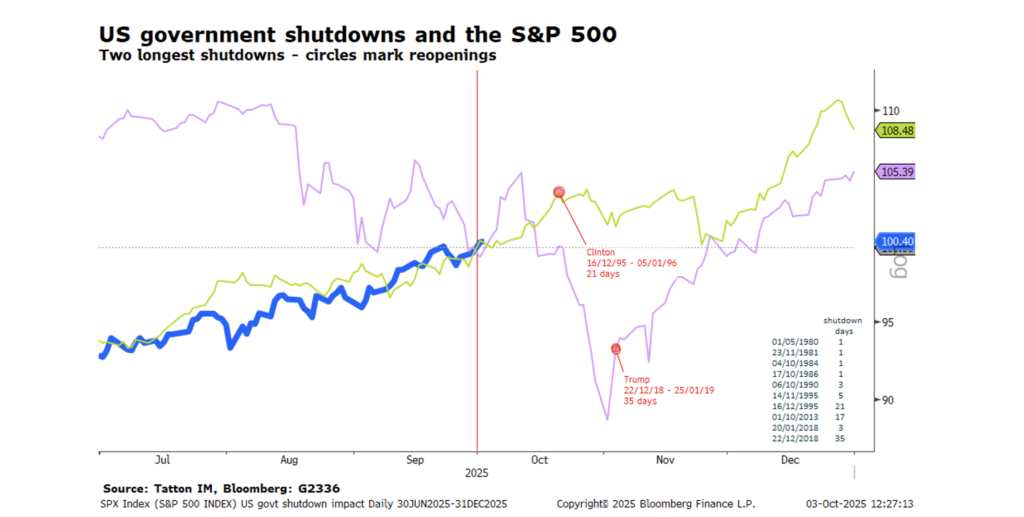

Previous US government shutdowns that lasted more than a week had little impact on the markets in the first few days. This is probably because short shutdowns have not significantly damaged the economy. The chart below shows the current situation compared to the two longest shutdowns:

The last and longest shutdown occurred in Trump’s first term, from December 2018 to January 2019. The S&P 500 gained in the first two weeks after the shutdown, although that might have been a rebound from November’s 10% fall. After the re-opening in the new year, the S&P 500 fell another 10% as concerns about the economic impact grew.

However, investors and markets are not showing the same concerns as in 2018. Perhaps investors think it will be shorter, like the 1995 shutdown (to which current markets look similar, as above).

More likely, investors are now ignoring politics while awaiting concrete earnings data. As a consequence, we are in-between space. The fact that stocks are powering ahead anyway suggests markets are becoming a little self-referential or speculative. Rising Bitcoin prices and a resurgent Tesla back that up.

We should not be surprised if stocks pull back in the coming weeks, but not (directly) because of the shutdown. Rather, as we have discussed in previous weeks, it could be because the Fed removing the currently favourable liquidity conditions.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.