Market Update: Slowdown? What slowdown?

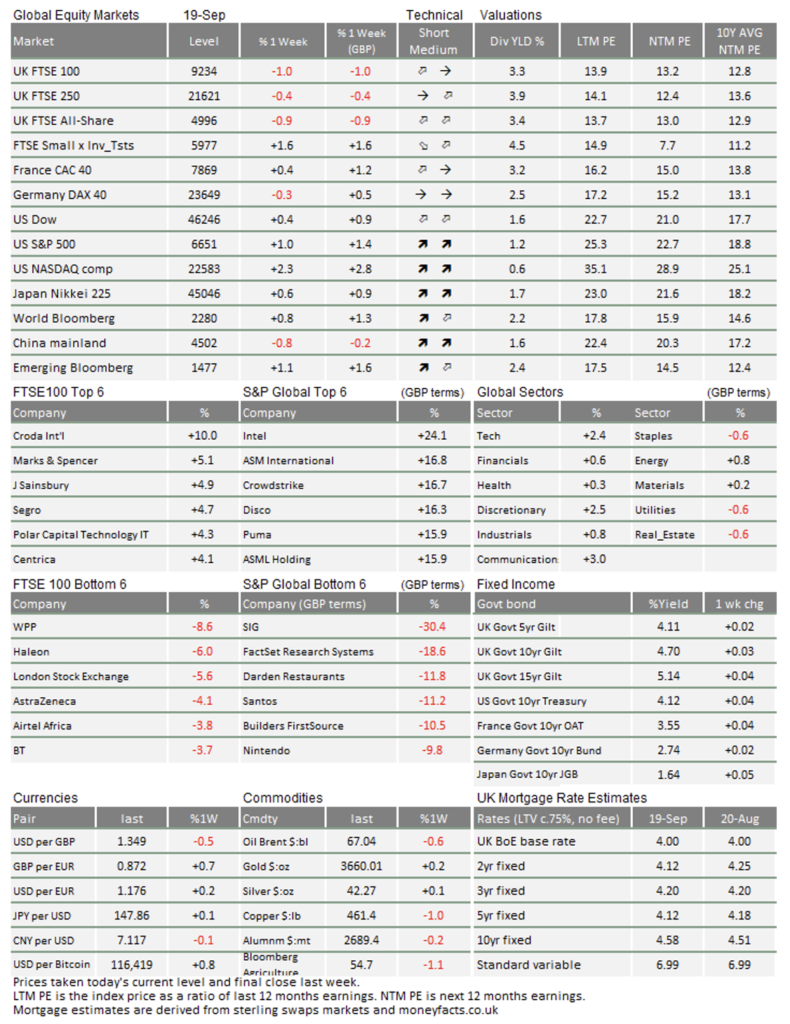

Rate cuts and record highs for markets this week. As wholly expected, the US Federal Reserve voted to decrease interest rates by 0.25 percentage points to 4% (the effective rate is about 4.1%), and signalled further cuts before the year end. The Fed gave investors what they wanted, leading to gains for small cap stocks in particular. The Bank of England was less forthcoming on Thursday – holding interest rates steady – but it announced some welcome adjustments to its bond selling program.

All in all, this environment is very supportive for global stocks.

Fed cuts are here for a good time, not a long time

The Bank of England (BoE) holding interest rates steady at 4% was fully expected, especially after inflation came in at 3.8% year-on-year in August. The central bank did slow its quantitative tightening (QT) program of UK government bond (gilt) sales, though. We note that this is a welcome change. QT has put significant pressure on gilt yields – and, by extension, government finances – since the pandemic. Nevertheless, gilt yields rose again on Thursday, due to a rise in US yields.

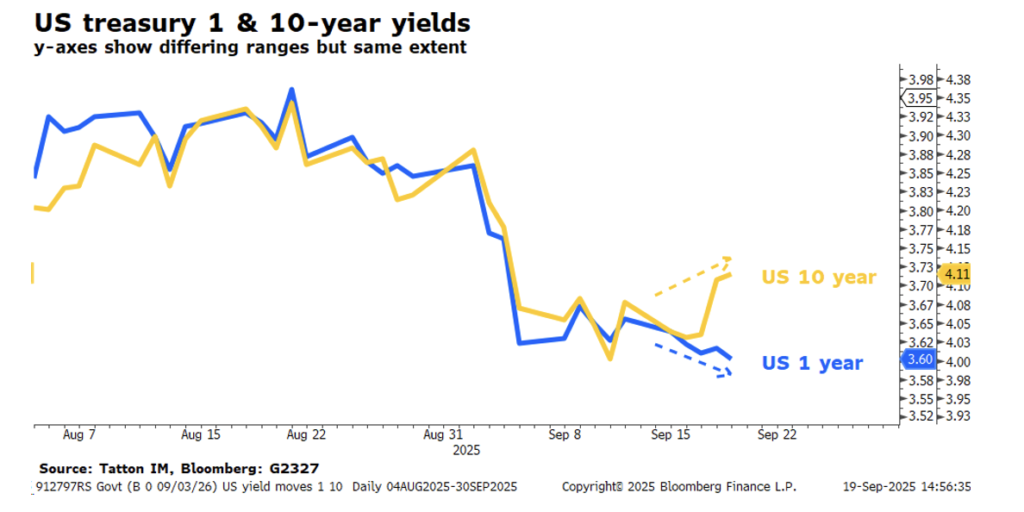

The US Fed’s rate cut was much more important for global markets – and perhaps even gilts themselves.

The fact long-term US yields rose after the Fed cut interest rates is a little counterintuitive – as lower rates should mean easier borrowing conditions. But markets interpreted the Fed’s move as boosting growth, which pushes up yields over the long-term. Given Fed chair Powell’s recent comments about shifting focus to supporting employment, rather than containing inflation, that interpretation is reasonable.

Most of Thursday’s bond yield spike came from the real (inflation-adjusted) yield component, though there was a slight increase in markets’ implied inflation expectations too. That tells us investors are confident about the world’s largest economy. As such, expectations of longer-term US interest rates actually moved up.

The Fed is lowering rates now, in the belief that current rates are restrictive, but its concern that employment is weak could be misjudged. If current rates are “neutral” for the economy, and the Fed cuts further, this will further accelerate US economic growth and mean higher rates in the future.

There is no rate cut emergency

The Fed shifted its focus to employment after weak jobs data in the last few weeks. That data also led to discussions about the US’ ‘weak’ economy. But as we said last week, rumours of the US economy’s demise were greatly exaggerated. Smaller companies are struggling somewhat with historically high refinancing rates (and smaller businesses are significant employers) but there was never any suggestion of widespread credit stress. Meanwhile, you could argue that households are actually beneficiaries of high interest rates – thanks to significant savings built up during the pandemic, and the decent returns on those savings since.

There has been so much talk of a potential tariff-induced recession this year, but the hallmark of recession is sharp earnings declines and businesses going bust en-masse. On the contrary, US businesses are growing their profits – fuelled by a healthy expansion of profit margins. That is remarkable when you consider all the warnings about tariff costs. Indeed, US inflation is currently running well above the Fed’s 2% target, precisely because companies feel confident enough to pass on costs to consumers.

Clearly, the US economy was not in dire need of lower rates – whatever Donald Trump says. The most you could argue is that historically high rates are no longer needed, and on balance should be a little lower. The Fed seems convinced that tariff inflation will be ‘transitory’ (a one-off cost shock that does not beget inflation later on) and they are probably right. The Fed’s cut is therefore not unreasonable, but central banks usually need a stronger motive for slashing rates. Neither the US nor global economy is crying out for support.

Equities are well supported

Notwithstanding Thursday’s spike, long-term government bond yields have moved down in the last few weeks. So too have corporate credit spreads (the difference between government and corporate bonds), the end result being that companies’ cost of finance has fallen significantly. That combination helps boost stock valuations, in terms of price-to-earnings ratios.

At the same time, the underlying earnings are improving too. This is not just a US phenomenon; profit margins have expanded across the world and look set to grow further. Future profits are going up, and the valuation multipliers are going up too. That is potent fuel for a stock market rally.

It is a little perplexing why profit margins are growing so well, considering US tariffs, global economic uncertainty and pervasive weakness in national employment markets. Like many, we thought that corporate investment would be stifled this year – due to uncertainty around tariffs. But in actual fact, business investment seems to be growing well.

The most plausible conclusion we can draw from this is that productivity is improving. Perhaps the AI revolution is finally having a tangible economic impact – which might hurt jobs (hence weak employment numbers) but should support corporate earnings. Over the long-term, productivity growth is the only sustainable source of real economic growth.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.