Market Update: Bond’s Split Personality

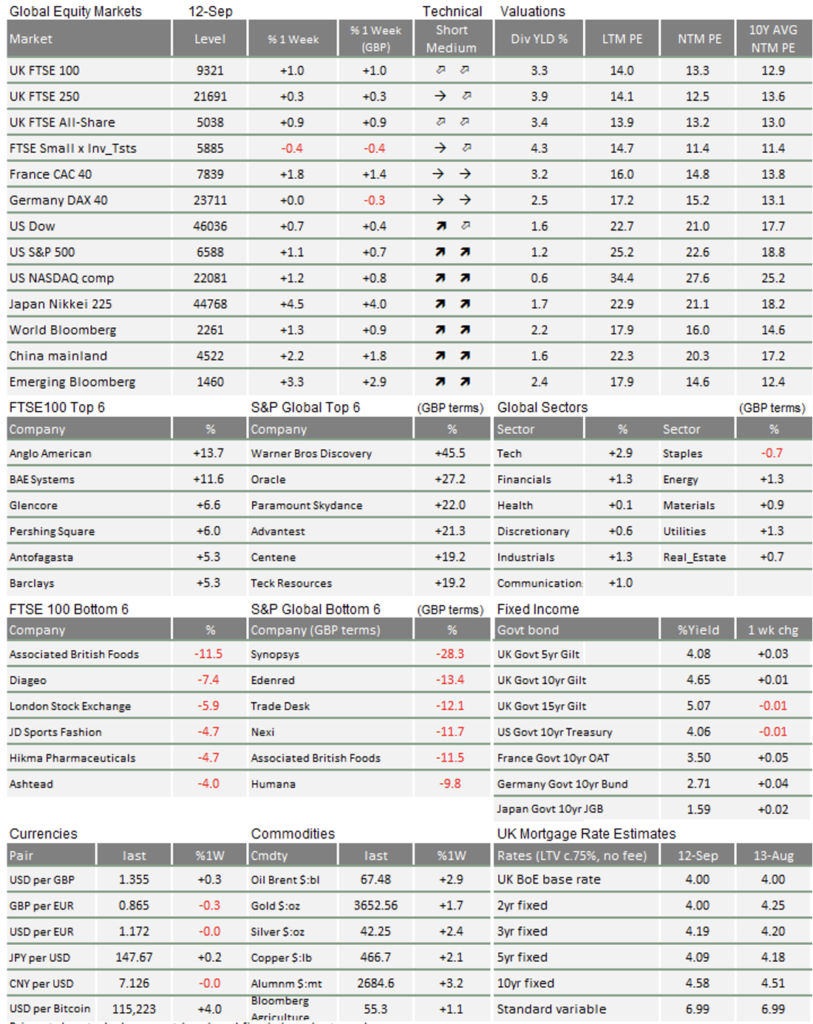

It has been another slightly confusing week for some investors. Markets mulled over last Friday’s weaker than expected US jobs report, but stocks kept climbing higher virtually everywhere. There were two big market action stories: a sizable fall in long-term government bond yields, and the outperformance of small cap stocks. These trends might seem in conflict but we think they are consistent.

Meanwhile, geopolitical tensions flared up again. Markets are not immune to these risks – but they are doing a good job of acting that way.

Stocks and bonds are reading different narratives

Yields on 30-year US government bonds dropped sharply through the week – pulling UK yields down with them. For all recent talk of bond panic, US long yields are now at their lowest point since April. Meanwhile, small cap stocks had a strong week, evidenced by the outperformance of the US small cap versus large cap segment, i.e. the Russell 2000 Index versus the S&P 500 Index.

On the face of it, these moves do not match up. The bond move suggests weaker growth expectations. They fell after the weak US jobs data – which effectively locked in a Federal Reserve interest rate cut when the Federal Open Markets Committee meets next Wednesday, the only question being how big that cut will be. Small companies, on the other hand, are usually more sensitive to the economic cycle. Their rally suggests stronger growth ahead.

Tony Pasquariello of Goldman Sachs called these markets’ “two narratives” – and in a sense both are true. Bond markets see the weaker US employment market as limiting growth, while the Fed’s imminent rate cut means lower short-term yields.

At the same time, there is evidence that Trump’s tariffs are now generating decent tax revenues – making the US treasury a more reliable borrower. We have said for a while that historically high long-term bond yields look like good value, and with rates set to fall, investors have a strong incentive to lock in those higher yields.

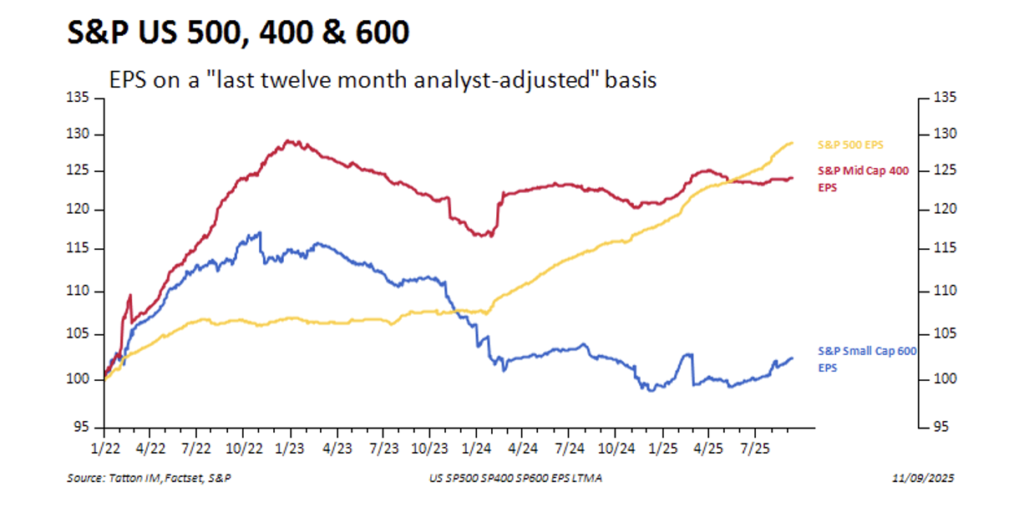

Stock markets, on the other hand, see that corporate profits have held up well at the aggregate (market cap-weighted) level, despite the weak patch for jobs. As the chart below shows, large cap profits (earnings per share; yellow line) have stormed ahead. But profits have been under pressure for smaller companies – and their biggest headwind is prohibitively high borrowing costs (red and blue lines). Fed cuts will ease that pressure and, at the same time, help the economy, all of which boosts the outlook for small cap stocks. Equity investors are effectively looking through the current slowdown to improvement later on.

Rumours of the US economy’s demise are greatly exaggerated

These mixed messages bear on what the Fed should do. While bond traders (and much of the media) are focussed on weaker US growth signals, business sentiment surveys are still fairly strong.

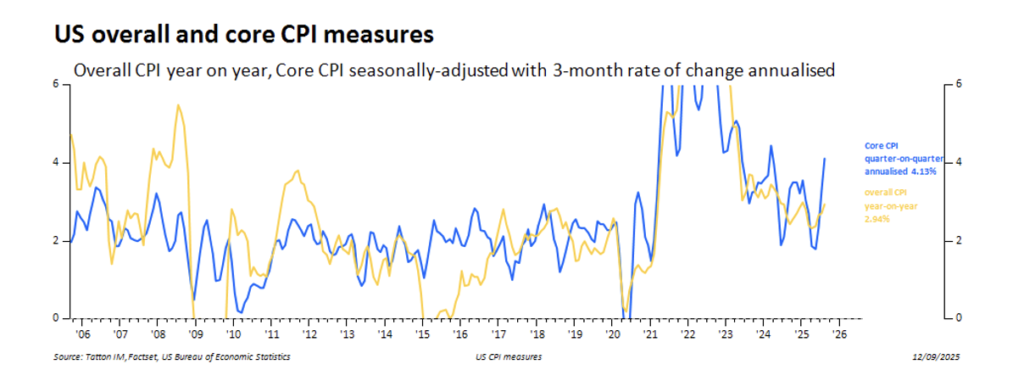

However, US consumer price inflation is picking up again. The August CPI data showed a relatively steady 12 months rate of 2.9% but that is because mid-year economic softness held prices steady before the tariffs started to be felt. We calculate that the 3-month annualised rate moved above 4% (when using our own seasonal adjustment algorithm) as the chart below shows:

This indicates to us that both the overall and core yearly rates will likely keep trending up over the next few months, once tariffs are felt. Businesses are still confident despite this backdrop, so American companies clearly feel demand is strong enough to pass extra costs on to consumers.

On the other hand, central banks do not like cutting rates when prices are going up. So, is there a risk that the Fed moves too soon and stokes further inflation? On balance, we think that is unlikely. At the Jackson Hole conference, chairman Powell announced that the Fed was switching its focus to weaker employment – and they have a point. While the US economy is holding up okay, households and smaller business could do with some relief for their high debt servicing costs. And though tariffs will impose extra costs, markets are convinced that inflation will be ‘transitory’ – a one-off price hike that does not cause lasting inflationary dynamics.

With the weakening labour market, as evidenced by the weak payroll numbers and the pick-up in initial jobless claims, it would be difficult to argue the US is on the verge of any wage-price spiral, but neither is it falling apart. There is no emergency on rates – contrary to Trump’s claims – but they are marginally too high for the US economy, at least compared to more accommodative monetary policy in Europe and Asia.

Markets ignore geopolitics again

The fairly rosy view in equity markets also does not match up with increased geopolitical tensions this week. Russia was bold enough to taunt Poland and NATO with drone flyovers, while Isreal was blatantly defying all international conventions by bombing the Hamas negotiation team on Qatari soil. These risks did nothing to upset risk assets. The only sign of any anxiety was another step up in gold prices, though there are other reasons for gold’s rally, as we have discussed previously.

There are idiosyncratic reasons why investors might ignore these tensions. Moscow is probably right that European nations will not respond with force. The incursion could restore Europe’s fragile defence alliance with the US too, meaning greater stability for the continent. Meanwhile, Arab nations continue to avoid any strong actions against Israel, meaning there will likely be no impact on oil prices.

Geopolitical flareups do raise risks for markets. But, with Fed cuts on the way, these risks are not currently enough to significantly shift investors’ outlooks. For geopolitics to scare markets, we would need to see clear signs of disruption to the global economy. If you held onto your stocks through the tariff panic, Israel’s attack on Doha is unlikely to change your mind.

Still, global instability can make markets uncomfortable. If and when there is a strong catalyst for a downturn, the market reaction could be even more volatile than it should have been. If no catalyst comes, there is nothing to stop equities from grinding higher. Markets now see a tariff-driven recession as highly unlikely in the foreseeable future. In this environment, focus unsurprisingly turns on extrapolating the positives, rather than exaggerating the negative narratives.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.