Market Update: Uneasily positive

Capital markets started the week calmer than they have been, and are ending with yet more all-time-highs. However, investors remain uneasily positive. The mid-week saw more wobbles, and this patch of increased volatility could continue – thanks to tariffs, credit troubles and tighter liquidity.

Volatility does not mean investment portfolios are in real danger. We have had a long rally in risk assets which can naturally lead to pullbacks. People can sell to realise those gains – especially when there are “known unknowns” on the horizon: the APEC summit, the US Supreme Court ruling on tariffs, the UK budget and so on.

The longer-term outlook it still positive. Indeed, we have noticed a disconnect between people’s economic pessimism and recently strong investment returns. The latter give plenty of reasons for optimism. Global inflation has been surprisingly lower than expected (last week’s UK and US inflation data were cases in point) while business confidence has been stronger than expected (as exemplified by today’s flash Purchasing Manager Index data, again particularly in the UK, US and Germany).

The bond outlook is a welcome reprieve

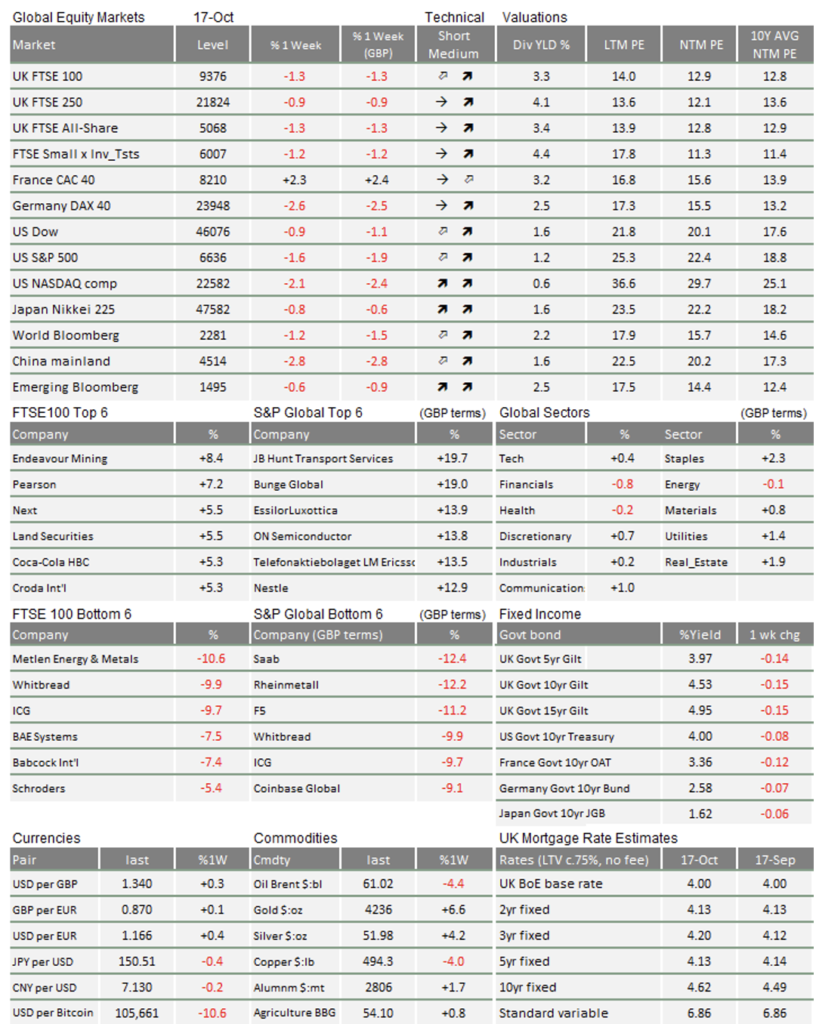

Nowhere is the ‘better-than-it-seems’ narrative truer than in the UK. While global stocks struggled on Wednesday and Thursday, the FTSE 100 pushed ahead. UK government bond yields fell more sharply than any other major market too, after September’s inflation came in lower than expected. Economists are starting to think that UK inflation has peaked, and money markets are now odds-on that the Bank of England will cut interest rates 0.25 percentage points in December. Despite the recent gloom, Rachel Reeves could not have asked for a much better build-up to the autumn budget.

The US Federal reserve, meanwhile, is a racing certainty to cut rates at next week’s meeting. The only question is how big that cut will be – 0.25 percentage points at least, but with a small chance of 0.5. Markets expect a dovish Fed (preferring lower rates) partly because of recent US credit stress.

Recent Fed dovishness has helped bond yields come down all over the world. Some felt the bond market had become over-reliant on Fed commentary, given the lack of hard US economic data since the government shutdown in September. It is now clear that the extended shutdown is dragging down US economic activity. Today’s release of the US September CPI data has continued the narrative of lower-than-expected price pressures: both core and overall CPI were at 3% year-on-year, with core actually falling from August’s 3.1%. Treasury 10-year yields remain below 4%.

That has helped investment portfolios. Stocks have wobbled in recent weeks, but bond prices (the inverse of yields) have rallied – providing the balance they are supposed to. With signs that inflation is slowing globally, that should continue. Lower yields – and hence, easier borrowing conditions – are why markets are not overly concerned about a credit crunch.

Does gold’s pullback point to trouble in China?

Equity investors are not the only ones occasionally realising profits. Gold prices end the week nearly 6% down from Monday’s all-time high of $4381.52 per troy ounce. On Tuesday, it briefly reached $4004. After the blistering rally over the last few months, technical signals suggest overexcitement in gold markets. Some pullback is to be expected.

The interesting thing for us is that gold’s sell-off coincided with a drop in Chinese tech stocks, after a strong run. The connection is a speculative, but we know that Chinese investors are heavily invested in gold – so a sell-off in the tech stocks could have prompted some profit-taking in gold markets.

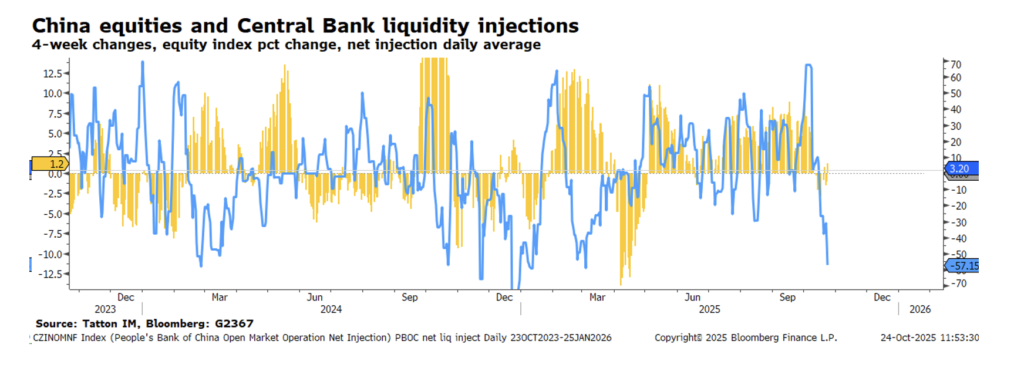

This is related to Chinese liquidity conditions. We China’s plentiful liquidity before (while western markets have been showing signs of tightening), which supported its strong equity run. Now, it has tightened sharply. Perhaps the government wants to support its currency value and avoid its stock market running hot.

China has been spending to support its ailing economy for over a year and, while measures have been small, they add up. One of these has been a significant injection of liquidity. While growth languished, liquidity boosted its stock market. Now, the cheapening of the cost of capital appears to be helping the economy. At 1.1%, the Q3 GDP annualised growth data was stronger than expected and Beijing is now almost certain to exceed its 5% growth target for 2025. With the third Plenum now finished, the government may reduce some stimuli. Market-based measures are the most likely candidates.

Better the tariffs you know

After next week’s Fed meeting, market’s next flashpoint will be the US Supreme Court’s ruling on whether Donald Trump’s tariffs are legal, set to begin on 5 November. Trump’s camp is publicly bullish, but the White House seems to be quietly preparing for defeat. They have pointed to potential workarounds, like sector-specific tariffs under Section 232 of the existing Trade Expansion Act.

If tariffs are bad for markets, conventional wisdom says tariffs being struck down should be good. Things are, unfortunately, not so simple. The revenues collected from Trump’s existing tariffs have gone some way to plugging the US budget deficit. Without them, US bond yields would almost certainly rise – removing a key support. Then there is the unpredictability of Trump’s response. There is every chance that Section 232 sectoral tariffs would disrupt global supply chains worse than the current regime.

It is not clear how stock markets would respond. On the one hand, not having to pay import taxes will help businesses. On the other, potentially higher long-term rates and supply chain uncertainty are a dangerous combination.

Uncertainty is more important now than it was over the summer. Liquidity is tighter, meaning losses in one area may cause profit-taking in other areas. The recent bout of volatility may not be over just yet, and things will be continue to be uneasy. At the same time, though, the global economy is experiencing a welcome capital expenditure boost, partly in response to higher tariffs. As such, we are positive about the long-term outlook for stocks.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.