Market Update May 2020: Stock markets suffer altitude sickness

Reading the news seems much more complicated these days. Our friend and old colleague, Rob Martorana, has lived and worked in New York all his life. An excellent portfolio manager and great thinker about investments, Rob has written a series of articles for the Chartered Financial Analyst group[1] about how to digest news in a way that takes account of its underlying biases. The easy way to do this is to pick a sample from media sources with known biases to judge the central case and the range of interpretations.

Reading the news seems much more complicated these days. Our friend and old colleague, Rob Martorana, has lived and worked in New York all his life. An excellent portfolio manager and great thinker about investments, Rob has written a series of articles for the Chartered Financial Analyst group[1] about how to digest news in a way that takes account of its underlying biases. The easy way to do this is to pick a sample from media sources with known biases to judge the central case and the range of interpretations.

The difficulty occurs when those media biases change. This has happened in recent years and particularly recent weeks, with opinions generally becoming more pronounced and polarised. But when events are momentous, those biases can fluctuate and be difficult to judge.

The problem for investors is to try to identify both the biases, and their conscious (and unconscious) swings. It seems to us that, during this pandemic, facts have been sparse but opinions (often dressed up as science) have never been so abundant. The strongest opinions are often about the things people fear – in other words the risks – so risks get amplified and become a ‘fact’ rather than a possibility. This can make markets highly volatile, but also increases the potential reward for being on the other side of those risks.

Financial news reporting also has another problem. Humans want to work out why something is happening. We like cause and effect. As individuals, we gravitate towards those that ‘know’, so when market direction changes, financial journalists feel obliged to identify what looks like the most likely cause and are quick with statements like “the market rose because the US non-farm payrolls were much better than expected”, without it being any more than anybody’s best guess. It may carry some truth at the time, but history tells us there have been many, many occasions when markets have fallen, not risen, after upside surprises in jobs data.

Most professional investors therefore digest financial journalism with a healthy pinch of salt. But it can still be revealing when not taken at face value. The main consumers of the news are active retail investors, and there are times when they can be a significant influence on market direction.

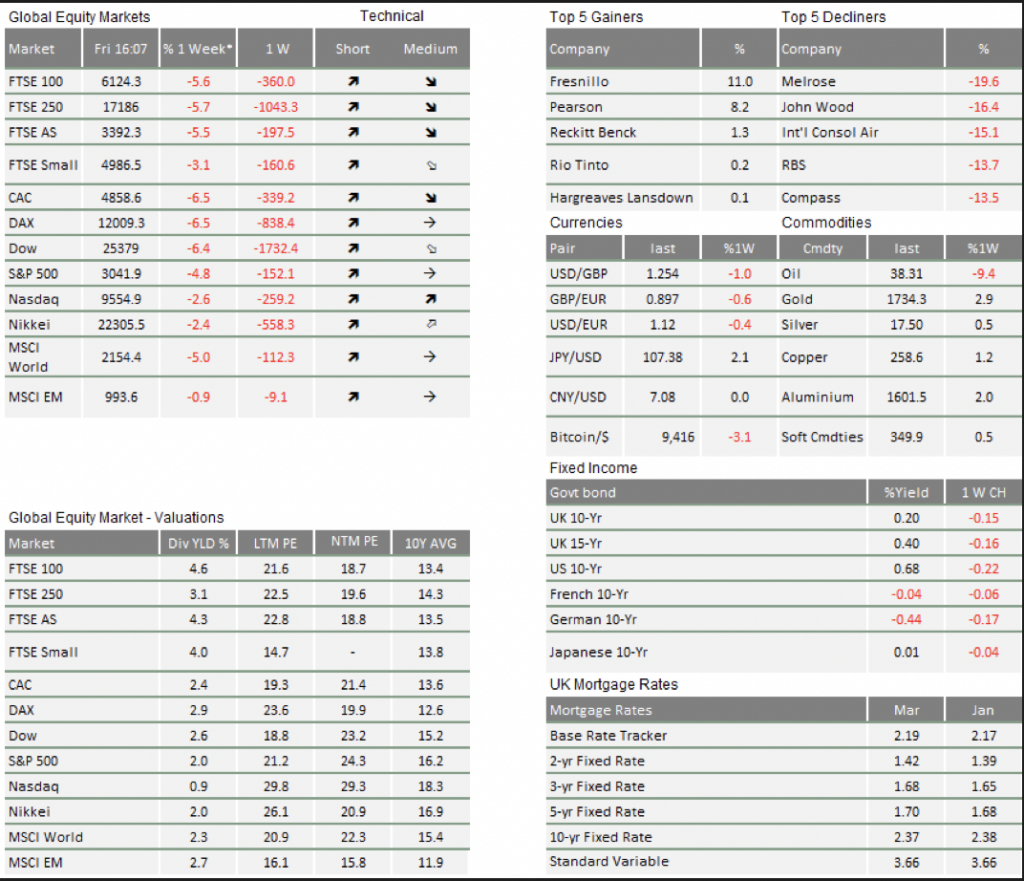

This week has been a case in point, as the rising chorus of financial press commentariat warned how increasingly disconnected lofty stock market valuations appeared against the backdrop of a rather dire medium-term outlook for the economy and relative to historical valuation levels under such circumstances.

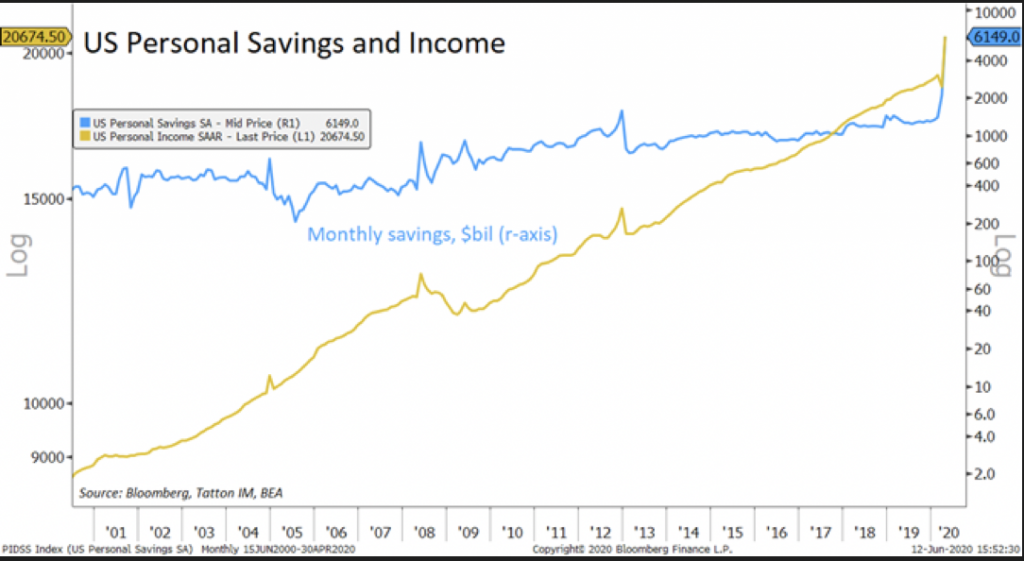

Retail investors have a lot of excess cash for investment just now. In the US, both personal incomes and savings have shot up over recent months, thanks to the various support government measures introduced to bridge the income gap that enforced COVID-19 inactivity has caused (see chart below). This is very different to what usually happens during an economic crisis, but so is the current weekly supplementary payment of $600 for every unemployed adult.

[1] Essentially a global industry body of investment professionals

These support measures, along with the stability of the banking system, have prevented the current crisis from becoming a financial catastrophe. This may change towards the autumn, when government support is phased out, but equally could prove a reason for significant optimism if due to diminishing underlying virus issues. Meanwhile, the opening up of the US economy has produced a mechanical bounce in activity. Even if it’s merely progressing from terrible to awful, it feels like a big improvement. Better jobs numbers were inevitable at some point.

Meanwhile, US retail investors can now invest in single shares ‘commission-free’ via Robinhood, a mobile equity trading app. (Of course, free isn’t free. Small investors get a higher price than institutional investors when they buy, and lower when they sell, much like ‘commission-free’ currency exchange at airports). US finance magazine The Reserve Report explains: “it’s really easy to use… with no sports, Robinhood has been filling America’s gambling void. In Q1, Robinhood added 3 million users.” Goldman Sachs is quoted as saying: “By every metric we track, retail activity is the largest since 1999/2000.”

Through May, the flow of retail money into the market began in earnest, picking up the baton from institutional investors. Financial journalists gave investors the positive economy ammunition, even if institutional investors saw the information as not really ‘news’.

The Fed must be very cautious with its actions and announcements, given how capital markets react to any apparent policy change and how much the real economy is affected by swings in capital market sentiment. Their announcements this week were extremely good news, because they signalled a continuation and duration of liquidity support, which will be much needed to reaccelerate the US economy. Just like the Fed, we do not, and have not for a while, thought that progress towards economic normality would be quick.

Even so, there are many reasons to think a return to economic normality might not be as slow as some suggest. Either way, no expert worthy of the title will have the confidence to predict how long it will take for economic normality to return. Even very downbeat projections from the Organisation for Economic Co-operation and Development (OECD) – particularly for the UK – published on Tuesday should be consumed with healthy scepticism about their underlying assumptions. It places emphasis on a ‘second wave’ virus outbreak and assumes lockdown policy responses would be a repeat of the first round. The former may happen, the latter is highly unlikely.

Given what we know about the speculative tendencies of US retail investors, the swift market rebound on Friday leaves us siding with those who suggested that all the above could not be deemed ‘surprises’ to markets. As a consequence, the week’s sell-off was an all-too-natural episode of ‘profit taking’ from some market players, as they experience a significant dose of valuation altitude sickness. At the same time, markets also displayed signs of schizophrenia, given how quickly FOMO returned as Friday’s driver of market sentiment. This ‘fear of missing out’ was prevalent as unusually high valuation levels in markets continue to be reinforced by the distinct lack of alternatives as to where to put one’s surplus cash. As central banks around the world continue to signal that they will keep interest rates and even medium-term bond yields near or below zero, this equates to near certainty of losses of capital or, at the very least, purchasing power for any cash left on deposit or other ‘safe’ assets like government bonds.

The past week has confirmed our expectation that stock and other risk asset markets are likely to see a return of elevated levels of volatility. But over the coming months, markets remain well supported by central bank pledges for open-ended liquidity support. Economic reality will only prevail over monetary liquidity as the dominant market driver once we get a better sense of how long the downturn will last – or (less likely) if governments and central banks withdraw support despite an absence of an end perspective.

In the meantime, our investment portfolio activities will focus on fine-tuning allocations between regions in anticipation of central bank actions, as well as monitoring the progress and sustainability in opening-up economies from East to West. The risk of a second wave of infections continues to linger until such time as more effective treatments – and eventually a reliable vaccine – become available.

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.