Market Update: Spend, Spend, Cut

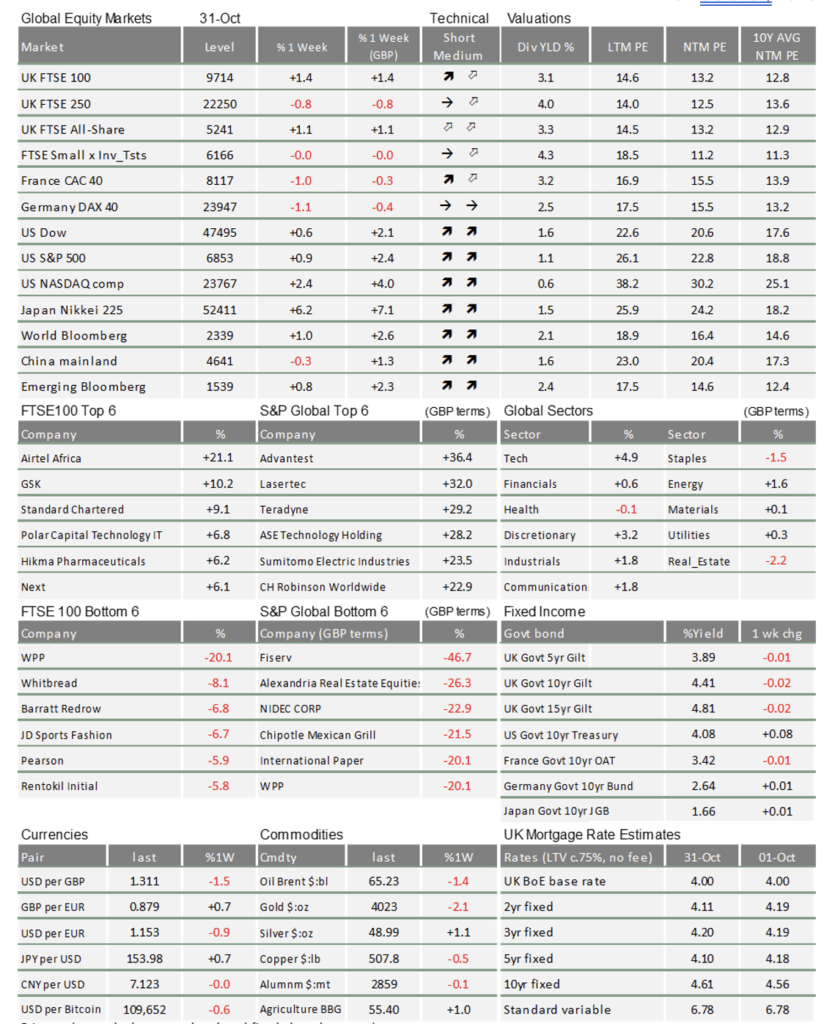

Stock markets mostly continued their upward march last week, but the underlying picture is little changed from last Friday. Global growth and corporate profits look decent, geopolitics is not getting out of hand, but the pace of change and a tightening of liquidity also means a risky environment.

UK markets deserve an honourable mention last week, with strong performances for large and small cap stocks, stronger sterling and the lowest government bond yields since last December. British media gloom will no doubt continue, but it increasingly looks like the economy is climbing out of its trough.

A split Fed is more hawkish than thought

The US Federal Reserve cut interest rates by 0.25 percentage points on Wednesday, as expected, but chairman Powell warned that a further cut in December is not a “foregone conclusion”. Most thought a December cut was pretty certain, so US stocks and bonds initially sold off in response. The Fed’s rate-setting committee seems to be pretty even split between hawks (preferring higher rates) and doves (preferring lower), with few in the middle.

This polarisation is partly linked to Trump’s recent appointees – Stephen Miran being the most entrenched dove – but there are other reasons too. The extended US government shutdown means there is scant economic data being released and, without evidence, policymakers have to rely on their prior beliefs. To make matters more confusing, the available bits of evidence give us mixed signals.

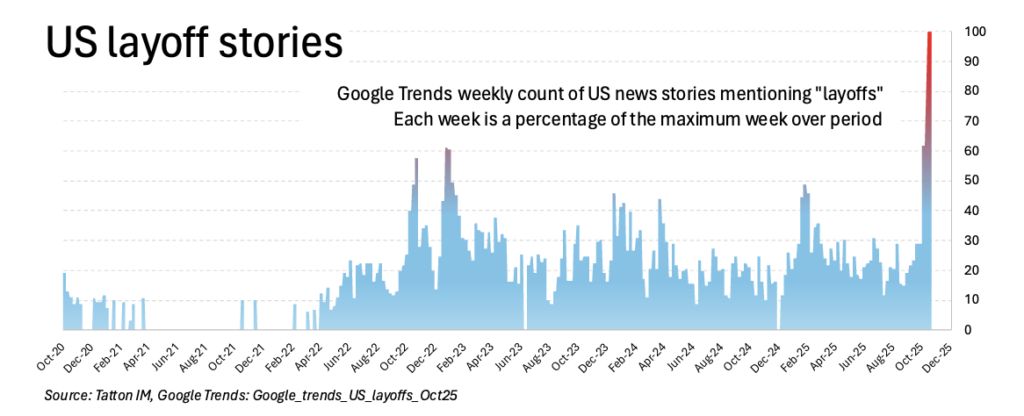

US new job postings are falling somewhat, according to Indeed.com. American companies have not been hiring much for a while, but that has been counteracted by the fact they were not firing either. Unfortunately, layoffs are now increasing. Last week, the major tech companies reported strong profits and huge capital expenditure but also significant layoffs – mostly because of AI-related efficiency gains. Meanwhile, the government shutdown is disrupting activity and now clearly hurting the economy.

There is not much new reliable information, but the headlines influence consumer and business confidence, suggesting a weaker US labour market ahead of the most important retailing period of the year. The Fed’s apparent hawkish turn is therefore a little strange. Notably, while the biggest US stocks had a good week overall, small caps were poor.

Fed disappoints, ECB teases

While US Bond yields rose, UK yields remained stable. The ECB kept rates unchanged on Thursday, and said it expects inflation to dip below 2% next year, returning to the 2% target in 2027. Lagarde reiterated that “from a monetary-policy point of view, we are in a good place.” December 18th will be the next meeting, with fresh forecasts to 2028. That promises to be a more interesting meeting.

The Bank of England’s Monetary Policy Committee meets this week. Markets are pricing a 30% chance of a 0.25 percentage point rate cut, but doing so before the November 21st budget could be difficult. Markets see a December cut as more likely, at 70%.

Tariffs fade and profits come back in focus

President Trump and President Xi’s mini-deal, suspending some tariffs and export restrictions for a year, is a boon for markets. It pauses, rather than ends, the trade war, but the fact Trump and Xi’s big meeting went smoothly is helpful nonetheless.

It was interesting to see China’s presentation of the agreement as an accord between two powers on equal footing. We talk about Beijing’s powerplay, in the context of China’s currency, in a separate article.

Tariff de-escalation brings back the TACO factor (‘Trump Always Chickens Out’) for stock markets. That allowed investors to focus on improved corporate earnings. US tech firms like Alphabet and Microsoft got the headlines, but we also saw strong performances for European banks. Deutsche Bank has salvaged its reputation among investors, which bodes well for Europe’s markets.

The so-called AI ‘hyperscalers’ showed strong earnings, but this was not enough to boost their share prices. Investors are increasingly worried about how much these companies are spending on building AI infrastructure. Not that long ago, tech firms were rewarded for this investment, but now the likes of Mark Zuckerberg has to defend decisions like Meta’s $70bn AI spending spree to shareholders.

Capex good for growth, bad for volatility

The reason investors are not fully on board with AI investment any more is that capital spent building data centres is capital not returned to shareholders. We dedicate a separate article to tech firms’ debt-fuelled spending, but we note here that AI-related companies seem to be locked in a capital expenditure (capex) race. That investment might well benefit them later on but, with uncertainty around AI’s prospects, it adds an extra layer of risk to their share prices.

Even if this might not help tech stocks, we should be in no doubt that a capex race is good for the world economy. It means more jobs and activity right now, and hopefully greater productivity in the future. It is not the only spending race we are seeing right now either – with an EU defence drive and a Chinese infrastructure push ongoing too. Even disregarding the potential long-term gains, spending sprees will boost the world economy in the medium-term.

That is what markets are telling us; the world is experiencing a rapid change. The largest companies are investing very heavily and, at the same time, shifting resources. In a sense, they are taking over the burden from governments. Overall, while there will be risks of mistakes and some in the economies will be losers, this is a very positive story for economic growth and profits.

However, more money being spent productively in the real economy means proportionally less money available for risk assets. That adds to the tightness of global liquidity that we have been talking about for a while, which itself can make markets more volatile. We have seen that volatility in recent weeks, but volatility does not always mean markets go down. Things are not bad overall, but the risks could well feel riskier in the coming weeks.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.