Market Update: Next stop, Santa Rally?

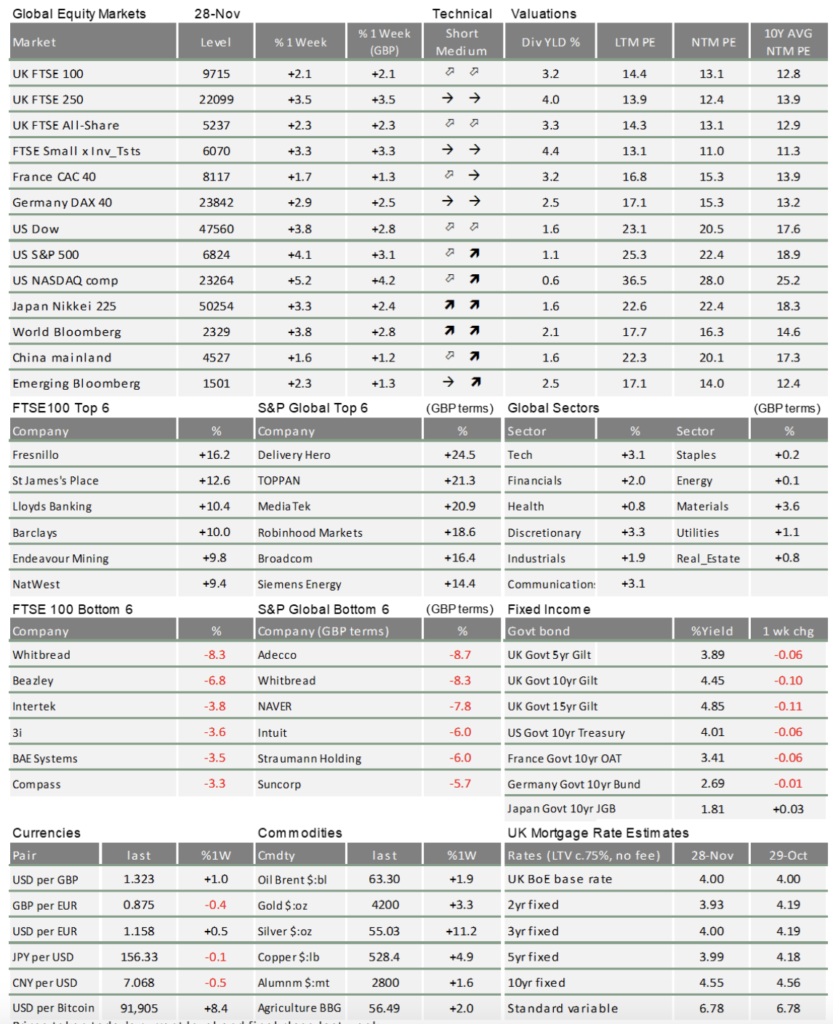

Capital markets had a good week. Stocks and bonds gained virtually everywhere – particularly small and mid-cap companies. The most obvious rationale for this rally is a growing expectation of interest rate cuts, but we suspect this is just part of investors’ better mood.

Headwinds from recent months seem to be abating: the US government operations have re-opened and thus are no longer a cash trap for the economy, and tech company profits prove AI investment has not run out of steam yet. The optimists see conditions for a Santa Rally into the end of the year, and the pessimists only think markets cannot go any higher. Considering the great run we have had in 2025, that is not a bad place to be.

UK markets take budget in their stride

The short version is that markets took the budget pretty well; stocks gained (particularly small caps) and government bond yields fell. Nobody likes paying more in tax, but international bondholders appreciate not being tapped indefinitely to fund government spending.

A significant amount of capital was withdrawn from UK investment portfolios in anticipation of tax-free allowances being cut – which never happened. Now that the budget is over, perhaps that capital will return. If so, UK bonds and equities could get another boost. It might not feel like it at home, but overseas investors see the UK’s fiscal position as relatively more stable than some other nations. Anecdotally, we know of a few US investment professionals that are looking to diversify their holdings away from the US – and the UK could be an ideal destination.

The budget being over also means that the Debt Management Office can plan its new bond issuance. It is notable that this new issuance is skewed towards short-term bonds, which is more in line with the structure of demand in the bond market and takes some additional pressure off longer-term yields.

Also helping UK yields is the fact that the Bank of England now looks highly likely to cut interest rates in December. Sticky inflation looked like it would get in the way, but UK inflation now looks certain to fall, in the short-term at least.

Central banks cut but Asia is an outlier

Bond yields fell across most major markets, largely motivated by dovish signals (preferring lower rates) from the US Federal Reserve. The Federal Open Markets Committee (FOMC) is still split on monetary policy, but the dovish voices got more airtime this week. Judging by the recent signs of consumer weakness, the Fed has room to cut. Bond markets are now pricing in a 90% chance of a December cut (this stood at 30% only two weeks ago), and expect three cuts in total by the end of 2026. The Fed will also end its quantitative tightening (QT) bond sales next month.

The European Central Bank’s (ECB) is also split, judging by the minutes from its November meeting. Previously, ECB officials implied they were near the end of their rate-cutting campaign, but recent economic data has been weak. Industrial confidence is low, wage gains are low, and the ECB’s own chief economist is confident inflation will drop to the 2% target. The recent strength of the euro is helping inflation too (but weighing on exporters), so we suspect the bank will cut some time next year.

The outliers are in Asia. Despite Japanese Prime Minister Takaichi’s desire for lower interest rates and a weaker currency, the Bank of Japan is unhappy with stubborn inflation and yen weakness. Against Takaichi’s wishes, the BoJ is building towards a rate hike.

China’s monetary policy is similarly tight, as shown in the recent rise in its bond yields. The yield hike is odd, considering China’s economy is still weak, but Beijing is intent on pushing its currency stronger. As we have argued before, the strong renminbi policy is more about international status than the economy.

Institutional investors positive; retail less so

In the US, monetary policy is looser and, after the long government shutdown, money is now flowing out of the US Treasury General Account (TGA – the US government’s current account). That has improved liquidity conditions, and it came just in time ahead of the important US holiday season. Easier liquidity helps build risk sentiment; even bitcoin recovered somewhat, after its sharp sell-off.

Notably, the good mood has spread beyond the handful of big tech stocks. Small caps outperformed across developed markets. Rate cut positivity is an important factor, since smaller companies are more sensitive to interest rates and have struggled with high debt costs.

But this is also about who is getting positive. For most of the year, the ‘buy the dip’ factor has come from retail investors, who tend to prefer buying the big names. Institutional investors fretted about the sustainability of stretched price-to-earnings valuations in light of the Trump administration’s policy unpredictability.

Now, we see the opposite. Retail investors are getting nervous, intuitively fearing an end to the three year run of strong returns. Meanwhile, institutional investors see earnings positivity, looser fiscal and monetary policy at the start of 2026, and an additional boost from exceptionally high levels of capital investment into AI supporting infrastructure.

That naturally leads to the lesser loved stocks doing better. Institutional investors are more likely to look at earnings and revenue fundamentals, and are more wary of the momentum factor. That could lead to some interesting market dynamics in the weeks ahead. Without buy-happy retail investors, we will likely get short sharp sell-offs followed by recoveries, as others spot value in the market. As we argued last week, that could lead to a rotation into smaller caps next year. After years of large cap outperformance, such a broadening of the market would not be a bad thing.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.