Market Update May 2020: Lock-Down, Open-Up

In April, the virus ended the lives of over 190,000 people across the world. Of those, 13% were in the United Kingdom, nearly 25,000. The UK has been one of the worst affected countries during this pandemic. The US has suffered a similarly heavy death toll, with nearly 58,000 deaths recorded with the coronavirus as a cause.

In April, the virus ended the lives of over 190,000 people across the world. Of those, 13% were in the United Kingdom, nearly 25,000. The UK has been one of the worst affected countries during this pandemic. The US has suffered a similarly heavy death toll, with nearly 58,000 deaths recorded with the coronavirus as a cause.

It seems remarkable that, as we enter May, an end to ‘lock-down’ is either underway or being considered. Many will think it not just foolhardy but morally wrong. Yet the slowing of the rate of change in underlying cases and fatalities is allowing the discussion to progress.

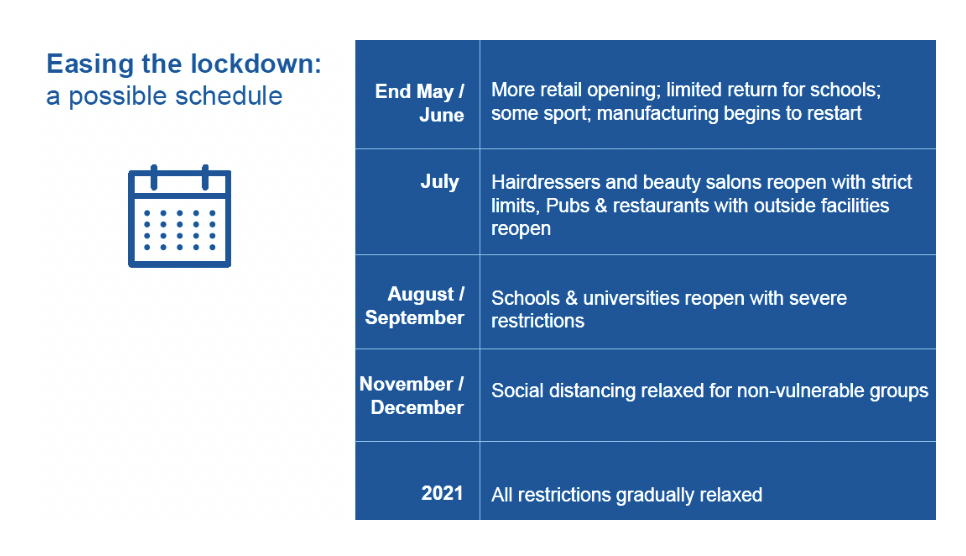

“Open-up” will probably be announced here in the UK to some degree before next Friday’s May Bank Holiday. Nobody thinks enforcement will end completely. Steven Bell, the much-respected Chief Economist at fund managers BMO expects something along these lines for the UK:

Enforcement is different to how individuals and groups will feel and actually behave. Governments have to be guided both by the science and the views of its people. In the US especially, views have become so deeply intertwined with politics that the Michigan State Capitol Building had rifle-toting members of the public attending a vote to end the Democrat governor’s lockdown law.

Thus, the sense of “open-up” in the US is perhaps stronger than elsewhere, which has affected not just their politics but also their markets. That means that should the science start to conflict with the policy, there may be a renewed bout of volatility on the downside.

“Open-up” is strongly helped by early but undeniably positive news regarding treatments. US pharma company Gilead announced that the early trials for Remdesivir (the treatment developed for the Ebola virus) has been (probably) positive in terms of recovery outcomes and thus confirms previous anecdotal evidence.

If nothing else, this reduces fear. It reinforces the belief that medical science can save the day, even if that day is still in the future. Even at nine months, that’s a long time. But people, businesses and markets can see an end, a resumption of “normal”.

In the meantime, governments and central banks (which met this week) have our collective backs. In the US, Federal Reserve Chair Jerome Powell reaffirmed the commitment to do whatever it takes in his post-meeting statement following the 28-29 April meeting:

“In determining the timing and size of future adjustments to the stance of monetary policy, the Committee will assess realised and expected economic conditions relative to its maximum employment objective and its symmetric 2 percent inflation objective. This assessment will take into account a wide range of information, including measures of labour market conditions, indicators of inflation pressures and inflation expectations, and readings on financial and international developments.”

There is no direct mention of financial markets, despite markets having improved substantially since the 19-20 March meeting, which is a good thing for investors. Economic indicators will be slow in showing a resurgence as and when it happens. The central banks, particularly the Fed, will wait to see it in the data, and that data emerges one or two months after it happens. Earnings expectations will increase before that, and markets will go up before analysts publish those expectations. That means the Fed won’t start taking back the liquidity just because the markets have gone up.

Equally if the economy has reason to head back down, perhaps because of a new spike in virus cases, we can expect yet more central bank liquidity and government fiscal support.

The European Central Bank (ECB) also held its meeting this week, which contained another slice of good news. They appear to have devised a way to buy government bonds by proxy – funding regional banks at levels below market interest rates while removing the constraint that the funds must go to private sector borrowers. In other words, banks have been given the green light to buy their national governments’ bonds and make money. This will effectively overcome the bank profitability challenge we discussed in last week’s edition that comes as a side effect of a low interest rates and could have held back a swift recovery. Governments can then provide the profit for banks and spend the proceeds on public investment.

It’s not absolutely clear that this is what is intended or, if it is intended, whether it will be effective. Goldman Sachs pointed out the subsidy would currently benefit only the Italians, and that both the time and size limits of PELTRO (Pandemic Emergency Long Term Financing Operation) mean banks could really only buy short-term maturities, not long-dated bonds. Still, share prices for European banks bounced strongly.

There were other welcome signals; the US dollar’s recent bout of strength may have come to a close, both against developed and emerging market currencies. Sterling hit $1.26 before falling back (after Shell’s disappointing dividend cut). Commodities strengthened mildly, as did oil, provided you squint at the prices for delivery later in the year.

This has added up to a better week for cyclical shares. And while we never want investments to perform poorly, it is a healthy signal when tech is not the only winner. The big tech names reported this week, and Apple announced much better sales than expected. Amazon did well on sales, but its margins were surprisingly much weaker than expected.

Before anybody gets too excited about the latter, we would note that now is not a great time to appear to be a winner. We have entered into a period where there will be many who have not done so well, and with a very important US presidential election now only six months away. Physical retailers are disappearing fast and, with them, lots of jobs. Jeff Bezos is already the world’s richest man, and he can sustain a bit of underperformance of his stock-holding.

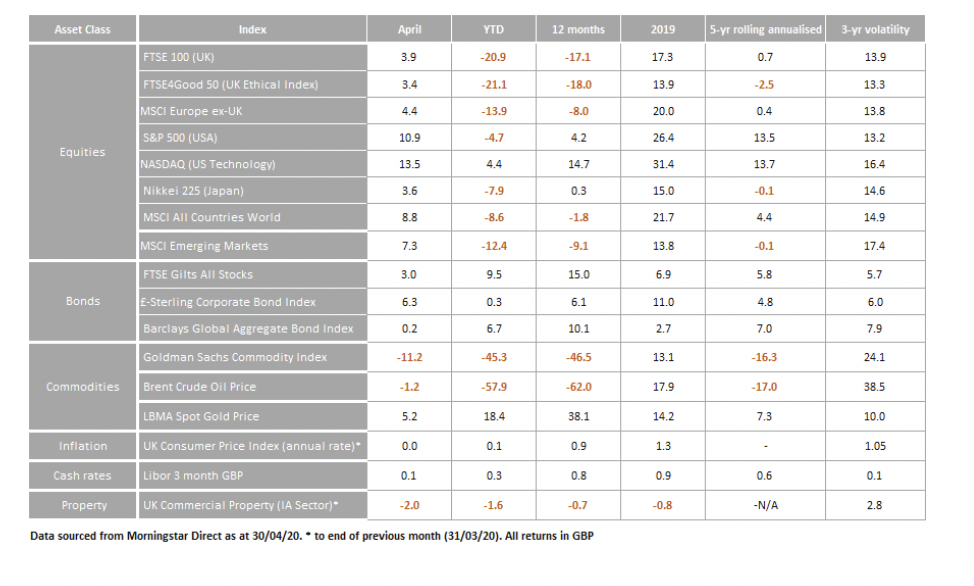

For the time being, May brings opening up optimism to capital markets, which has extended the good news of the fiscal and monetary support of April. Together, this has meant investors worldwide have continued their streak of good fortune from the post-global financial crisis period, and experienced a far less painful hit to their personal fortunes than they could have reasonably expected given the depth of recession we find ourselves in. Our monthly asset class returns table below shows the broad base of the rebound during April and, at the same time, contains some of the highest single-month returns since the autumn of 1987. If it later turns out to have been no more than a bear market rally, it will have been one of ‘unprecedented’ size and rigour.

Lothar Mentel

CEO Tatton Investment Management Limited

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.