Market Update: Healthy market rumours

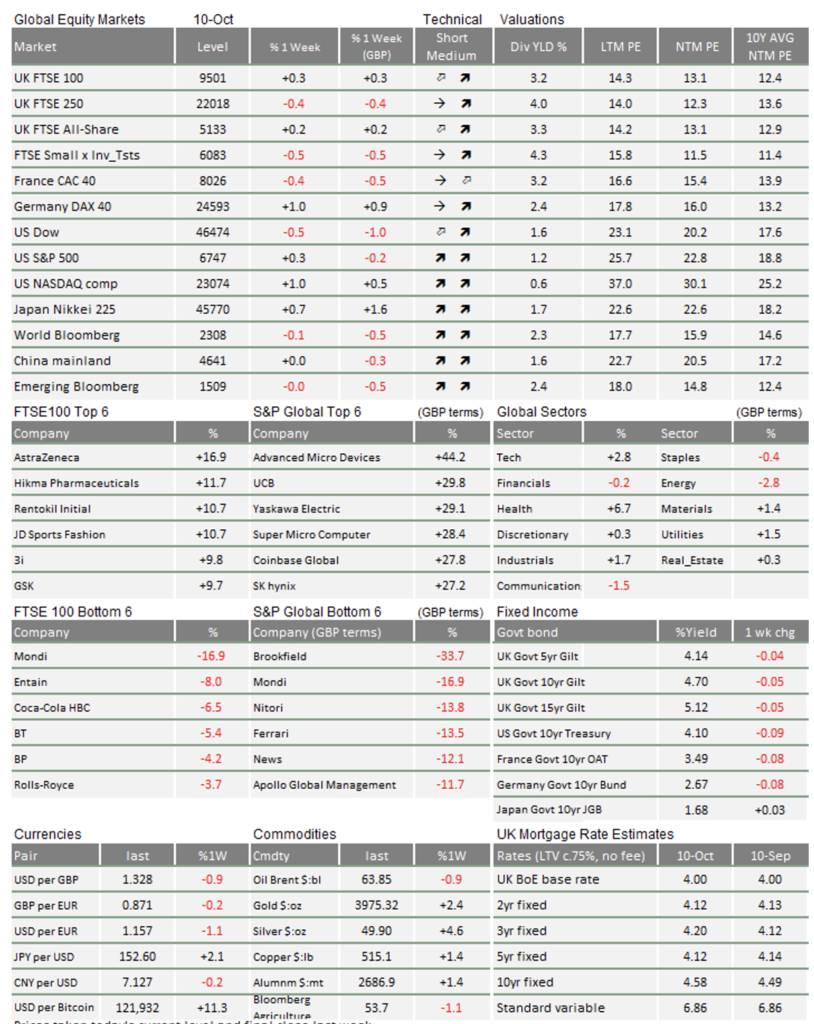

Stock markets keep pushing at all-time highs earlier this week, but with less enthusiasm than a few weeks ago. Then, late on Friday, a renewed Trump tariff threat against China’s rare earth export restrictions was enough to immediately send markets down 2%.

Solid growth in corporate earnings has been investors’ main source of excitement over the last six months, and that growth does not look under any immediate threat. But the same investors are looking increasingly nervous. Doubts are creeping in about whether AI companies are all they are cracked up to be and, relatedly, there are signs that the long period of low volatility could come to an end. There are few reasons to panic – but the reasons to be wholly positive are weaker than they were.

The UK needs a ‘debt restructuring’

The autumn budget is fast approaching and everyone expects tax rises. If the government has to raise taxes (and the ‘budget black hole’ warnings suggest it does), putting up base rate income taxes would do the least economic harm. To maintain Labour’s electoral pledges, though, it looks more likely the treasury will raid banks or savings.

The UK is in this situation because of a debt problem – but not the debt problem you might think. It is not so much that the state has overspent, rather that bond yields are too high relative to Britain’s low growth. Our cheap bond prices (the inverse of yields) are not attracting foreign investors to the extent they should.

Post-Brexit, global investors have considered Britain’s market unattractive. For UK stocks, this is because of weak productivity and poor financial liquidity. For bonds, it is largely because our national debt is poorly structured, with too much long-term bond issuance and not enough short-term. As we have argued before, this bond imbalance is a legacy of historical pension fund regulation.

The problem can be solved. The government could issue more short-term bonds (aided by interest rate cuts) and use the money to buy back its own long-term bonds at significantly cheaper prices than it sold them. This would be even more effective in easing government finances than the Bank of England reducing their bond sales . The media would inevitably accuse the government of ‘fiscal dominance’, but we know many UK bond managers that would welcome the move. If the treasury can properly match bond demand to bond supply, lower its long-term interest costs and improve its balance sheet in the process, what is not to like?

AI heading for near-term reversal?

Lately, there has been a cacophony of debate about a potential bubble in AI investment. This was prompted by concerns of circular ‘vendor financing’ – like Nvidia’s deal with OpenAI, which looks a lot like giving a company money to buy your own microchips. Given how genuinely profitable many of the big tech companies are, bubble talk is exaggerated. Big tech price-to-forward-earnings valuations are significantly lower than in the run up to the dotcom bubble, for example.

There are reasons to be concerned, though.

AI-related earnings have been one of the main drivers of global stock markets, and a massive part of that has been demand for cutting edge microchips. However, we note that the H100 rental index (from Silicon Data, tracking the hourly price of hiring Nvidia’s H100, the GPU at the heart of the AI computing revolution) has fallen 29%.

While a decline was expected, the fall in the H100 rate is towards the bottom of the expected -20% to -30% range. Oddly, Nvidia’s older chips are still going up in price, and everyone expects demand for high-tech computing to drive long-term returns. But the H100 rent index’s fall tells us that there is currently more than enough ‘compute’ supply.

This suggests that Nvidia and its peers – the world’s biggest stocks – could be vulnerable to a share price correction, as investors reassess their high valuations. This does not mean we are negative about AI investment overall. Indeed, over the long-term, the users of AI should benefit from lower chip costs. The problem right now is that many of the biggest tech companies have become so interconnected, on the financing side, that a squeeze on chip earnings could threaten short-term profits across the sector.

Volatility could return, as the shutdown keeps markets in the dark

If markets’ leading lights are not shining as brightly, investors will struggle to get more optimistic. That, combined with the tapering of global liquidity we have discussed recently, means we should not be surprised if market bullishness runs out of steam soon.

This could lead to increased volatility. US stock index volatility has fallen to quite low levels, in both actual and implied terms (how much it costs to insure your stocks). But when you look at individual stocks – and particularly the biggest ones in the S&P 500 – volatility has noticeably increased in recent weeks. Rising individual stock volatility amid a calm index can indicate rising tensions, and it may be a signal of shifting market narratives. And since equity ‘risk’ is usually identified with how sharply prices move, equities are getting riskier, and index-level volatility may well start to rise.

The US government shutdown is an unhelpful addition to this mix. Not only could it hurt the economy, but it means the US is not publishing its usual economic data. Markets feed off information, and when there is not much information available they fixate on what they have.

Last week, the Federal Reserve (unaffected by the shutdown) published August US consumer credit data that came in well below expectations. This particular data series is two months behind and varies substantially, so investors usually take it with a pinch of salt. Meanwhile the JP Morgan-Chase credit card weekly spending looked very soft at the end of September. Without the usual dataflow, minor datapoints are making people nervous.

Today’s US consumer sentiment data from the University of Michigan shows people are unhappy, but not getting unhappier. Current conditions have improved slightly, but consumers are slightly more pessimistic. Inflation expectations for next year remained high at 4.6%, though down from last month’s 4.7%.

The markets remain unconcerned today and the growth and profit outlooks remain solid. However, a patch of volatility is becoming more likely.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.