Market Update: Global Growth Tailwinds

Global growth tailwinds

China’s surprise stimulus package dominated market news in a week when oil prices fell too, both of which bode well if the US avoids a big slowdown.

Will Chinese stimulus lead to long-term profit?

China’s placed a big bet that its sudden stimulus package will halt its economic slowdown, but it’s not certain to pay out.

Global liquidity is improving

We look into market liquidity as central banks’ policies are boosting growth potential by increasing the amount of money available to capital markets.

Central bank Pivot 2.0

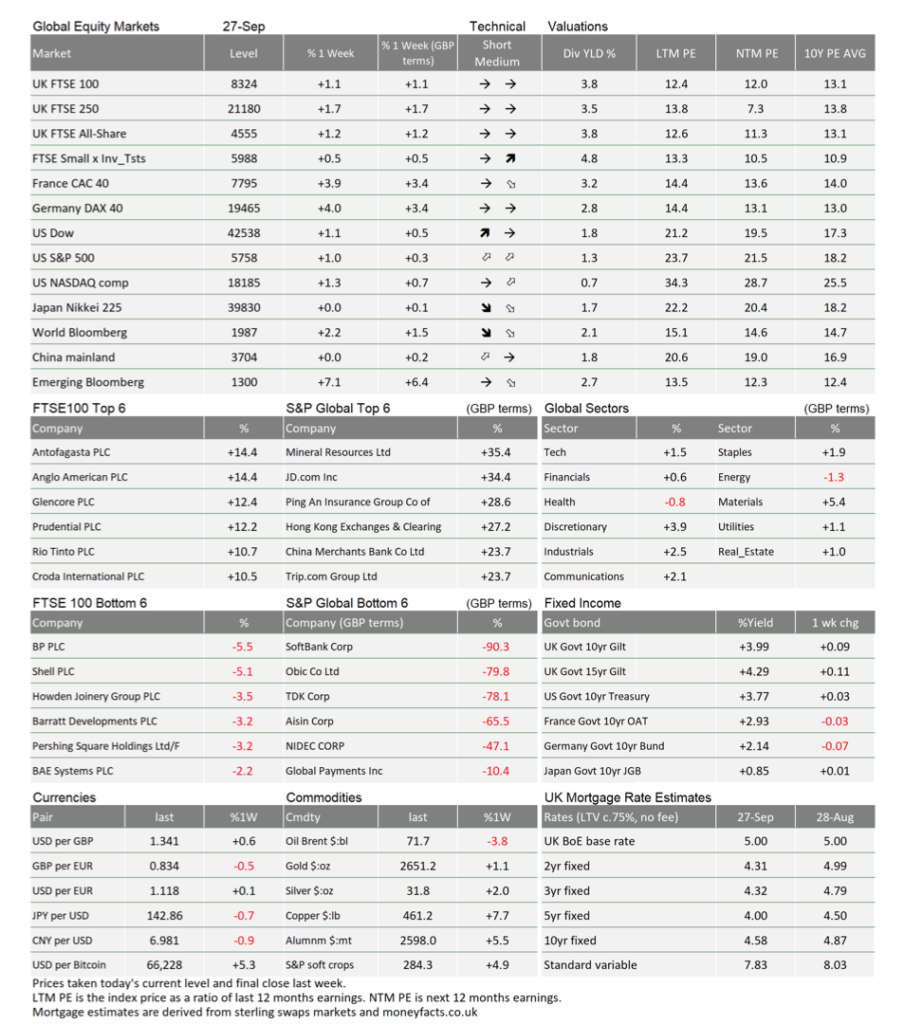

Rarely do non-US stories dominate global capital markets as much as last week. China announced a double shot of economic stimulus that surprised most – and Chinese stocks surged in response. European equities, particularly luxury goods brands, also jumped, in a hopeful sign of what returning Chinese consumer demand could do for global growth. Strangely, this was accompanied by falling oil prices. That is the opposite of what you would expect, given the (supposedly) improved outlook for global demand and the supply risks from escalating Middle Eastern tensions. The good news is that lower energy prices should themselves support growth. All of this bodes well for markets.

China stimulates global risk appetite.

Chinese stimulus was the biggest story of the week. First came a slew of positive monetary measures on Tuesday, followed by fiscal promises on Thursday. It was an extraordinary turnaround from the week before last, when China’s central bank shocked markets by keeping policy tight, and we (among others) thought this showed a strong hawkish bias (preferring more restrictive financial conditions). Our verdict is essentially this: China’s policy drive will be impactful, but does not quite reach the ‘bazooka’ levels we saw in 2015-16.

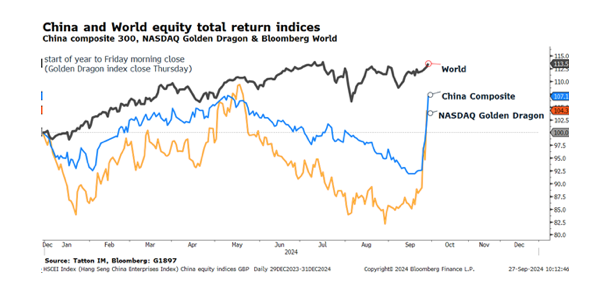

Markets seemed to ignore the second clause in that assessment. Chinese stocks had their best week since 2008, and consumer-facing companies were particularly strong. European luxury goods maker LVMH also burst up on each policy announcement, thanks to its Chinese demand exposure. Interestingly, the Nasdaq ‘Golden Dragon’ index – featuring Chinese companies with a dual listing in the US – showed stronger gains than China’s broad stock market. This probably points to a ‘short squeeze’ on bearish positions among US investors, which makes for a slightly less positive story. The key takeaway, though, is that Beijing is no longer restricting financial conditions – plugging what was a drain on global liquidity.

Liquidity, in short, is very good for markets. It should support global growth and risk sentiment. This is already playing out, notably in the dollar’s continued slide. UK assets might be benefitting from this mood too; domestic commentary has been negative about government policy but international investors are more positive – judging by UK stocks and the value of sterling.

Slightly less positive was Shigeru Ishiba becoming Japan’s Prime Minister. Regular readers will know we are positive about Japan’s corporate reforms and export competitiveness, but Ishiba is seen as a conservative candidate who might undo some of the reform efforts. Japanese equities sold off and the yen strengthened after his appointment. This disappointment undid positive moves beforehand. Please note this is not shown in our data table, as it came after Japan’s stock market closed.

Oil’s fall will ultimately be another benefit.

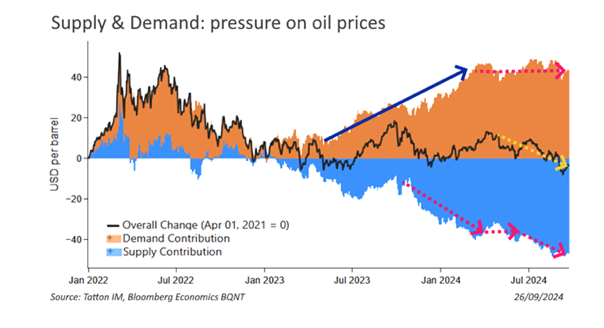

If Chinese demand was going to rebound strongly, we would generally expect oil prices to follow suit. But we saw the opposite. Brent crude, the international benchmark, dropped below $72 per barrel (pb) for a loss of almost 5% since Tuesday. US oil benchmark West Texas Intermediate was near $68pb. Prices were similarly unaffected by the massive escalation of the Israel-Hezbollah war.

Oil’s fall is a supply-side story. There was encouraging news from Libya, Africa’s largest producer, whose production has been severely hurt by a civil war. Libya’s government is split between the West and the East, but its central bank is responsible for international oil receipts. So, when the western government removed Siddiq al-Kabir as central bank governor on 26th August, the eastern government forced a shutdown of the main Libyan oil fields. On Thursday, the East and West signed an agreement to appoint Naji Essa as interim central bank head, after surprisingly positive negotiations. This could meaningfully boost global oil supply.

Meanwhile, Saudi Arabia is reportedly abandoning its unofficial $100pb target. The Kingdom will ramp up production from December to regain lost market share, after OPEC+’s failed attempt to control prices. We said Saudi Arabia might have to do this, since periods of OPEC+ cohesion are usually temporary. The quick return of Libyan oil might be the straw that breaks the camel’s back, possibly pushing prices to $50pb.

The chart above shows how demand and supply changes have netted out since January 2022. The 2023-24 period of strong economic growth, which resulted in rising global oil demand from the second half of 2023 to early 2024, has ended, and demand impetus has flatlined. Supply pressures broadly offset this, but recent supply increases have gone beyond demand, pushing oil prices lower.

Ultimately, this is good for the global economy. After the energy shock, lower energy prices are firmly seen as disinflationary, supporting consumers and non-energy businesses. Markets are currently very optimistic about how quickly central banks will cut rates – and energy disinflation supports that optimism.

Growth and inflation outcome?

One of the reasons energy disinflation is so important right now is that China’s weak consumer demand and overproduction has forced down global goods prices for so long. That has been a huge part of the ‘soft landing’ story (central banks being able to cut rates without the economy contracting), and that story has underpinned most of the upside in stock markets this year. If China boosts demand, its disinflation impulse might fall away. In which case, we could do with energy prices staying where they are or moving sustainably lower. We will therefore have to watch the oil news.

If energy prices stay subdued – and Beijing makes good on its promises – the outcome should be positive. One might argue that, for all the talk of a ‘soft landing’, US growth is slowing. It is hardly a good thing when the world’s largest economy weakens. But if Chinese growth does return (and history should caution us, that it is an ‘if’) then that should at the very least counterbalance a slowing US, leaving us with a decent global environment.

The actual outcome could be much better, though. Yes, the US economy is growing slower than it was a year ago, but there is considerable disagreement about how slow it currently is – and where it might go from here. The most recent signs actually suggest near-term growth could be improving. It is too early to say, but if so we might be moving back to a global scenario where the US and China expand in tandem. The world’s two largest economies have been moving on different cycles since the pandemic, but if they move together then it could be a very strong sign. We will know more this week, when important US jobs data comes out. US news will soon dominate markets again.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.