December 2018 Market Commentary – A Quiet Christmas?

What were your expectations for December? A quiet wind down to Christmas perhaps? Everyone leaving their offices early, attending various Christmas parties and not much happening in the second half of the month?

Nothing could be further from the truth, December was one of the most eventful months of the year and while there was some encouraging news and data releases, it was largely overshadowed in the mainstream media by falling stock markets as global markets had their worst year since 2008. As we’ve mentioned previously, saving and investing is for the long term, years like the one we’ve just experienced will inevitably occur from time to time.

The month started with the leaders of the G20 nations meeting in Argentina, where Donald Trump and Xi Jinping agreed a temporary truce in the trade war leading to hopes that 2019 might see an early end to the respective tariffs and the threat to world trade.

Meanwhile, Theresa May survived a vote of no confidence, Angela Merkel’s successor emerged and Emmanuel Macron continued to see his popularity plummet amid further riots and demonstrations by the French “gilets jaunes”.

UK

Amid an overly gloomy set of high street reports and news of HMV entering administration, retail sales were up more than expected in the last two months of the year, helped by a mixture of low expectations and prolonged Black Friday promotions.

Whilst December is a month most will want to forget, there was at least a couple of good news stories that you may have missed. The first being the release of data from the Office for National Statistics which confirmed that growth in the economy for the three months to October, the period immediately after the World Cup, was 0.4%. Wage growth also continued to rise with the latest figures for October showing wages have risen at 3.3%, the fastest rate for a decade.

And secondly, as terms of the country’s exit from the European Union continue to be mapped out, the foundation of its business climate remains attractive as evidenced by the U.K. topping the Forbes’ Best Countries for Business poll, which measures countries that are most hospitable to capital investment. It is the second straight year the UK has topped the charts, pipping Sweden to the award.

Like all major world stock markets, the FTSE 100 index of leading shares was down in December, falling by 4% to 6,728. The FTSE started the year at 7,688, meaning that it fell by more than 12% in the year. The pound ended the year at $1.2746, virtually unchanged in December but down 6% for the year as a whole. However, a weak pound may provide some protection to exports in the coming 12 months as our BREXIT plan crystallises.

Brexit

On New Year’s Day there were just 88 days to go until the UK, in theory, leaves the European Union. In contrast the Referendum which saw the victory for ‘Leave’ was 941 days ago.

December was notable for plenty of drama in the House of Commons as Theresa May survived a vote of no confidence by 200 votes to 117, meaning that she cannot now be challenged as party leader before December 2019. Her New Year message contained yet another plea for MPs to support the deal she has negotiated, an appeal which is likely to fall on deaf ears.

As January progresses, we will know more with December’s ‘meaningful vote’ in the Commons now scheduled for the week commencing 14th January – when there will be just 74 days to go to 29th March.

Europe

The big news in Europe was all about the gilets jaunes (yellow jackets) who took to the streets to demonstrate against the rising cost of living, climate-change inspired fuel increases and the President’s seeming lack of concern about the lives of ordinary people. Reports that Emmanuel Macron spent a total of €30,000 (£27,000) on make-up and haircuts in his first three months as President did little to placate the ‘ordinary people’.

Across the border in Germany, Angela Merkel’s eventual successor emerged as Annegret Kramp-Karrenbauer (commonly known as AKK or ‘mini-Merkel’) who took over as leader of the CDU and will almost certainly become the next German Chancellor.

Unsurprisingly, both the German and French stock markets had poor months in December. The German DAX index was down by 6% to 10,559 and the French index by 5% to 4,731 – meaning that the markets respectively ended down 18% and 11% for the year as a whole.

US

As already mentioned, December opened with Donald Trump agreeing a temporary truce with Chinese leader Xi Jinping. Sadly, that truce appeared to use up all of Trumps goodwill as the 49th President of the United States went on to fall out with both the Chairman of the Federal Reserve Bank and a large band of American politicians, actions which didn’t go down well with the markets.

The Fed – worried about inflation, raised US interest rates from 2.25% to 2.5%. This was the highest level for a decade and led to a very public fall out between Trump and Federal Reserve chairman Jerome Powell.

The President then fell out with the Democrats in the Senate, threatening a “very long shutdown” of the US government if they refused to fund his $5.7bn (£4.5bn) plans for a border wall with Mexico. Shutdowns of the US government are nothing new, but coming on top of the row with the Federal Reserve this added to the general stock market unease and meant that the normal ‘Santa rally’ became the ‘Santa rout’ with the Dow Jones index falling 6.8% in one week and facing its worst December since 1931.

What does this mean for 2019?

A strong first week of 2019 does not make a strong year, but the series of recent upward surges informs us that market valuations have recently undershot economic reality as much on the downside as they overshot it at the turn of 2017/18.

Overall the developments since Christmas have provided us with more reassurance that Q4 market action has once again been excessively emotional in light of the likely future path of global economic growth. Whilst economic growth may not be returning to the ‘old normal’ as quickly as perhaps anticipated by many a year ago, economic growth is expected to be steady and expansionary in 2019 rather than falling off a cliff towards global recession.

Mere mention of the word recession sends shivers down the collective spine of many in the industry, as the first thought that comes to mind is 2008: the global financial crisis (GFC) and the staggering Great Recession that accompanied it. But, remember that 2008 was the second-worst pullback in the U.S. economy on record, topped only by the Great Depression. In other words, from a recession standpoint, it was much more of an anomaly than a norm.

What’s more, the Great Recession was consumer-driven, sparked by record levels of debt. Consumer-led recessions, in particular, tend to be extraordinarily painful. Why? Because as personal debt levels rise, people are forced to use income to pay down debt.

10 years removed from the Great Recession, the picture today looks much brighter. For starters, the consumer is in far better shape than a decade ago. The same holds true for banks. It’s no secret that over-leveraged financial institutions leading up to the GFC played a large part in the nightmare of 2008. Fortunately, banks today are on much more solid footing, with capital ratios drastically improved in the ten years since.

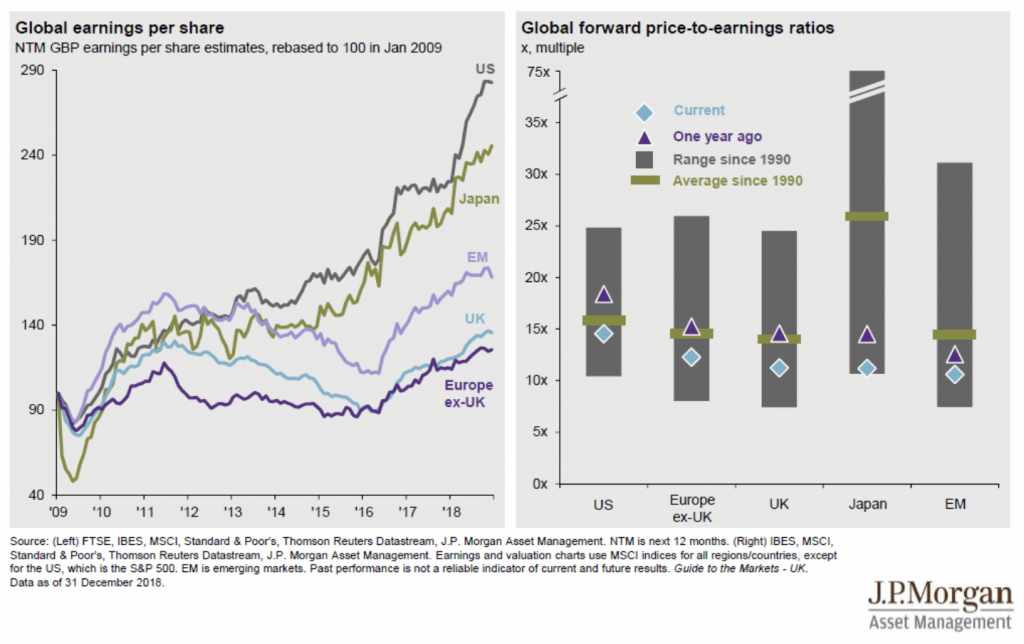

Recent and forecasted global GDP growth are positive, with the IMF forecasting global GDP at 3.7% for 2019. Global equity valuations also look attractive on a forward price to earnings ratios with European, Japanese, UK and Emerging Market share valuations all currently sitting in the bottom quartile range based on valuations since 1990.

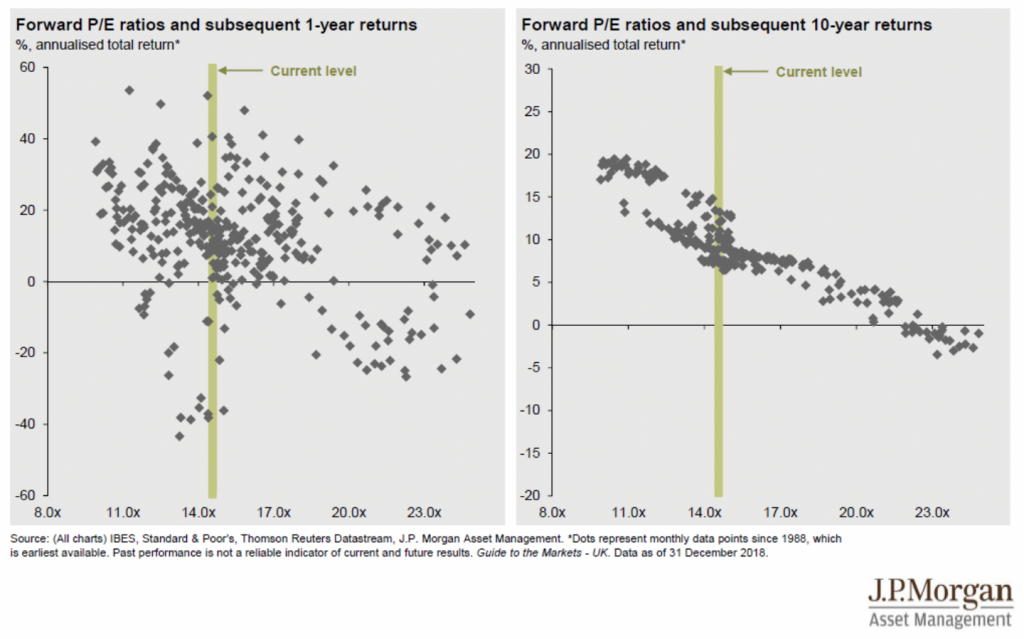

This is of course not an immediate buying signal, but what history does teach us, is that based on current valuations, long term returns (over 10 years) in these asset classes are likely to be extremely favourable. The charts below show current US equity market valuations and subsequent returns.

As we enter 2019, many uncertainties exist, however, this could be the perfect time to reassess the overall risk of your investments, consider drip feeding monies into recently fallen markets and review your overall finances. Feel free to call us at any time if you wish to discuss the current economic environment, your financial strategy and investments.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.