Market Update: Damp back to school week

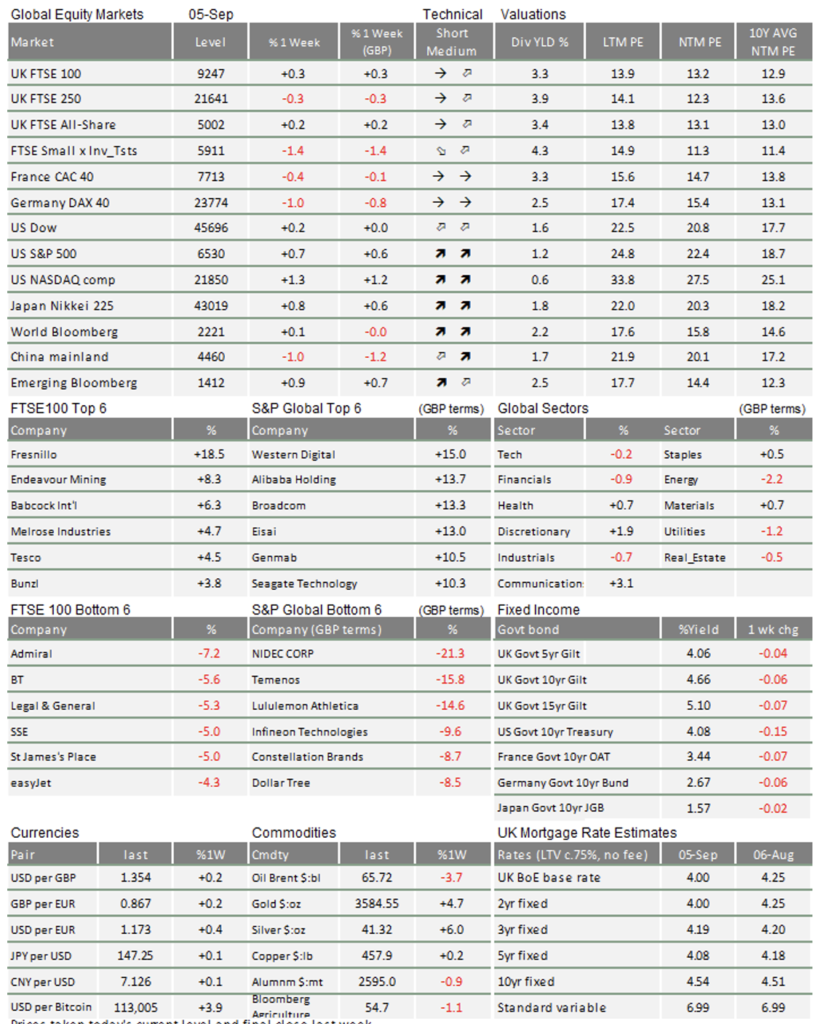

The ‘Back to School’ week often gets a lot of attention. Traders return from their holidays and reassess their market outlooks. So, after the summer’s strong equity rally, it is no surprise that investors are doing a bit of soul searching. There was no shortage of economic or political narratives to latch on to last week, but in the end relatively little change in stock markets to report. Most major indices are roughly where they were last Friday.

Bond yields initially continued their ascent – fuelling more panicked debate about inflation and government debt sustainability – but, in the last few days, even they reversed back to where they had started. Markets seem to be weighing up previous gains in light of a variable economic outlook. We consider that a healthy sign.

Bond vigilantes strike fear?

30-year government bond yields kept rising in the early part of last week across the western world, though they dropped back quite sharply from Wednesday. Just like theweek before last, the media commentary put this down to fears about higher inflation, unmanageable debt piles and markets’ general disapproval of government policies. But as we pointed out before, that does not really line up with how the underlying bond components have moved. The main driver has been an increase in real (inflation-adjusted) yields, which are supposed to reflect investors’ long-term growth expectations, rather than inflation or credit risk.

We often talk about the power of ‘bond vigilantes’ to send policymakers a message and, more often than not. force their hands. But right now, it is unclear what that message is. If it is not markets getting bullish about growth (and few think it is) then it could reflect an increase in the ‘term premium’ – the return investors demand for lending over the long-term rather than the short-term. That would essentially mean investors want to get their money back sooner, possibly because they do not trust government’s long-term credibility on debt. Given that most expect an increase in the supply of bonds (governments borrowing more), it is understandable that bondholders might demand a higher return for tying themselves in for longer.

But we still do not see this as a panic signal. It is easy to get carried away with the ‘hell in a handbasket’ narrative on government debt – particularly in the UK, with talk of looming “gilt crisis” (from former Chancellor Kwasi Kwarteng, architect of the ‘mini budget’ gilt panic, no less). But we should remember that this is not just a UK story, and we saw a similar yield spike last Autumn. There was crisis talk back then too, but long-term yields quickly came back down.

In the US, concerns over last Friday’s court ruling – that Trump’s tariffs are illegal – dimmed the only fiscal bright spot in the outlook for government debt (lower tariff revenues means more borrowing). However, once the 30-year treasury hit 5%, it was attractive enough to swing the balance back to more optimist buyers than pessimist sellers.

High yields weigh on valuations, but earnings look good

Bond yield talk usually revolves around the impact on government finances but, for investors, the impact on relative equity valuations is arguably more important – in the short-term at least. Higher bond yields make stocks less attractive by comparison, which might explain why markets failed to move ahead last week. Investors were already nervous that stocks have become historically expensive in terms of price-to-earnings ratios – particularly in the US.

However, valuations can stay high if people are confident that companies will keep growing their profits. And as discussed last week, US earnings growth is rebounding. The recovery in corporate earnings expectations has been the main driver of the recovery rally since April’s ‘Liberation Day’ sell-off. Investors have paid little attention to high bond yields during that time.

US equity valuations are historically high on the traditional price-to-forward-earnings measure. But when economic growth is strong, companies tend to do better than their current earnings projections – making the current price look more reasonable. Alternative equity valuation metrics which are sensitive to these factors look less stretched in the US, especially for investors’ favourite big tech stocks.

It is not just big tech doing well though. In fact, European banks have outperformed the US mega-caps since January.

Cause for a pause

After a long summer rally in equities, investors seem to have paused to reflect on whether asset prices have gone too far. Recent growth signals have been mixed – with US jobs market data coming in weaker than expected on Thursday and Friday. Interestingly, markets took the uninspiring economic news as good news for rate cut expectations, pushing up stock markets as we write. There are signs of nervousness as well, like the recent surge in gold prices, which is typically a ‘risk off’ move.

Gold’s rally over the last few weeks could be related to higher bond yields (investors might be swapping bonds for gold) but it is often interpreted as a sign of geopolitical stress. China’s military parade in front of Vladimir Putin and Kim Jong Un (but not Donald Trump, to the president’s apparent displeasure) fits that bill.

We are not convinced that either gold’s rise is related to military tensions. Gold has been on an upward trend for years – for a variety of reasons we have covered before – and it could be that investors just currently see that momentum as attractive.

With an uncertain outlook, that makes sense. The world’s largest economy is sending some mixed-to-weak signals. Markets are trying to work out if that is a bad thing because it weighs on profits, or a good thing because it makes more decisive interest rate cuts more likely. Lower rates would benefit companies beyond the cash rich top 10 mega caps, which explains the undeniable positivity in the smaller end of the US stock market lastweek. With so much up in the air – and after a strong recovery rally from April – it is good that markets are taking time to think. It sets us up for more well-founded gains if and when the economic outlook becomes clearer.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.