Market Update: Bank of England the only fan of Sunak’s spring budget?

Budget announcements are inherently political affairs. Even so, Rishi Sunak’s Spring Statement was a particularly political broadcast. The Chancellor talked up the 5p per litre cut to fuel duty with the fervour of a vegetable market stallholder (By contrast, Germany just slashed a litre of petrol by 30 cents), as he did with the rise in the National Insurance Contributions threshold. Reminding MPs of his avowed fiscal responsibility, he noted the fuel tax cut would last for only one year. But Sunak saved his most crowd-pleasing (in terms of Tory MPs) announcement for last: the 1p cut to income tax, which will be brought in from 2024, timed to land just before the next General Election.

Budget announcements are inherently political affairs. Even so, Rishi Sunak’s Spring Statement was a particularly political broadcast. The Chancellor talked up the 5p per litre cut to fuel duty with the fervour of a vegetable market stallholder (By contrast, Germany just slashed a litre of petrol by 30 cents), as he did with the rise in the National Insurance Contributions threshold. Reminding MPs of his avowed fiscal responsibility, he noted the fuel tax cut would last for only one year. But Sunak saved his most crowd-pleasing (in terms of Tory MPs) announcement for last: the 1p cut to income tax, which will be brought in from 2024, timed to land just before the next General Election.

In truth, there were few new measures revealed – and even fewer that will have any short-term impact. But more interesting than the Chancellor’s attempt to ‘sell’ this Budget was who he was selling it to. This was intended for Tory backbenchers first and foremost, who have been searching for evidence of Sunak’s tax-cutting credentials for a long time, and with many still wary of the current leadership after the ‘partygate’ PR fiasco. But Sunak was also making a clear pitch to the Conservatives’ electoral targets: lower paid workers who rely on cars. This was apparent from the policies as much as the rhetoric around them.

The National Insurance threshold will rise to £12,570, meaning those earning amounts around that level will see a fall in their overall contribution. But the other side of the equation is welfare spending, which naturally accrues more to those not in work than those in work. There was no increase in Universal Credit, meaning that the unemployed, students (facing higher loan repayments) and those on fixed income pensions will not receive comparable help. The cut to fuel duty underlines this distinction, as does the focus on “working families”.

Coming against the backdrop of the highest levels of inflation in decades (now at 6.2%) most citizens face a dramatic fall in discretionary spending power. The Office for Budget Responsibility (OBR) estimates real household disposable incomes will fall by 2.2% this year, the biggest drop since records began in 1956.

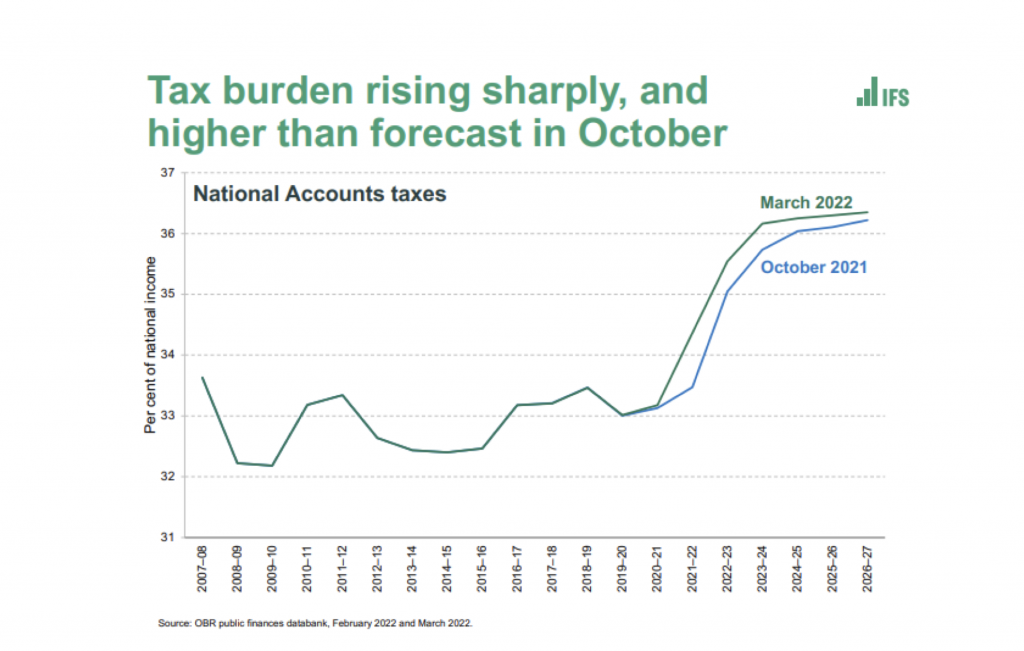

The Chancellor insists that the £3,000 bump in the National Insurance threshold will cancel out his previously announced 1.25% rise in contributions for 70% of workers. But Sunak’s claim that this amounts to “the biggest net cut in personal taxes in over a quarter of a century” was rejected by independent researchers at the Resolution Foundation and the Institute for Fiscal Studies (IFS). Resolution estimates total tax contributions will increase for seven out of eight workers. Only those earning £11,000-£13,500 will pay less National Insurance, while only those earning £49,100- £50,300 will pay less income tax in 2024. Most households will be 4% worse-off in real terms, while the poorest households will be 6% worse-off after inflation. IFS director Paul Johnson agrees that most will end up paying more, calling it “the effect of inflation and fiscal drag.”

The IFS chart below shows how the overall tax burden will increase sharply and, despite the “giveaway”, is greater than the Chancellor expected to take six months ago:

The Chancellor has long argued for fiscal restraint, reportedly insisting on tax rises even as Boris Johnson considered scrapping them some months ago. His Budget commentary on Wednesday was full of tax-cutting rhetoric, but the fiscal hawkishness ultimately shone through. The Treasury is continuing with fiscal tightening that began towards the end of last year, unaffected by the economic woes likely to hit Britain.

This is certainly the view of bond markets, where the UK inflation break-evens moved down this week – meaning less predicted economic growth. We have discussed before the effect of ‘fiscal drag’ on developed economies this year. Coming off the unprecedented bout of peacetime public spending, the winding down of various support measures has resulted in a big expansion of public debt. As such, while fiscal spending was a significant contributor to overall growth during the worst of the pandemic, it is now substantially net negative. This is true in the US and across Europe too, but Sunak has been faced with the pandemic occurring so soon after Brexit. The diminished public income means the tightening agenda will be particularly pronounced in the UK.

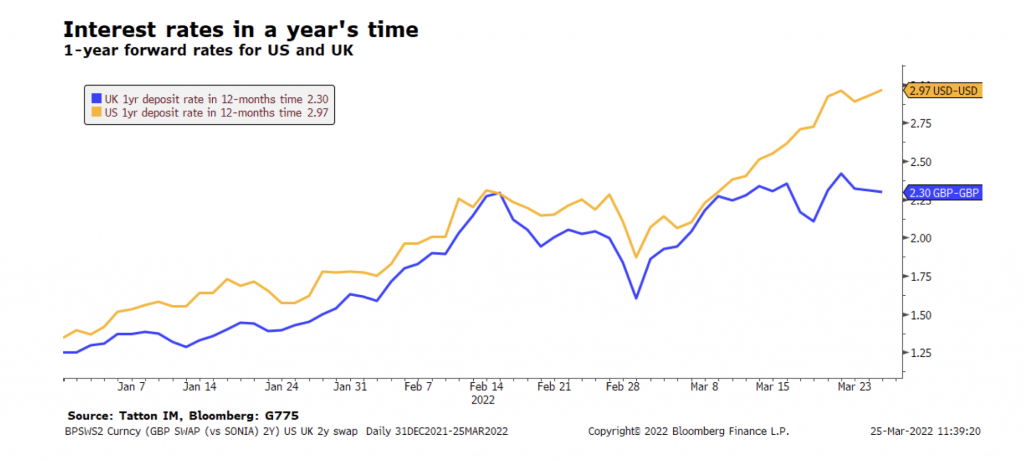

This will affect the UK’s monetary policy, relative to others. Central banks around the world are battling against soaring inflation and have begun a sharp tightening cycle (though at different paces). Last year, the Bank of England (BoE) was at the forefront of this tightening, raising interest rates in December and signalling that further hikes would be needed. Indeed, the bank followed this up with another rate rise just last week, leaving benchmark interest rates at 0.75%.

Over that time, though, the market implied outlook for future monetary policy has softened. Markets no longer expect that the BoE need be as hawkish in taming inflation as the US Federal Reserve (Fed), for example (see chart below). We discuss central bank policy in a separate article, but this reversal is significant. The reason the BoE’s expected outlook has softened is because of the tight fiscal situation facing Britain. Fiscal drag from the Treasury will act as a dampener on demand, reducing the overall demand-driven inflation pressure in the UK. This makes the inflation-fighting job easier for the BoE, thereby allowing policymakers to signal a lower path for future interest rates.

From a market perspective, this will make it hard for sterling to maintain the strength it showed against other currencies earlier this year. Tightening elsewhere should put upward pressure on the dollar or euro, while sterling is unlikely to be as supported.

A more accommodative BoE is also a positive for growth, but this is balanced against the negative impacts of fiscal and energy price drag. However the Chancellor tries to package this Budget, it shows a tighter fiscal stance ahead. And, while that will help contain inflation pressures, it could do the same to growth.

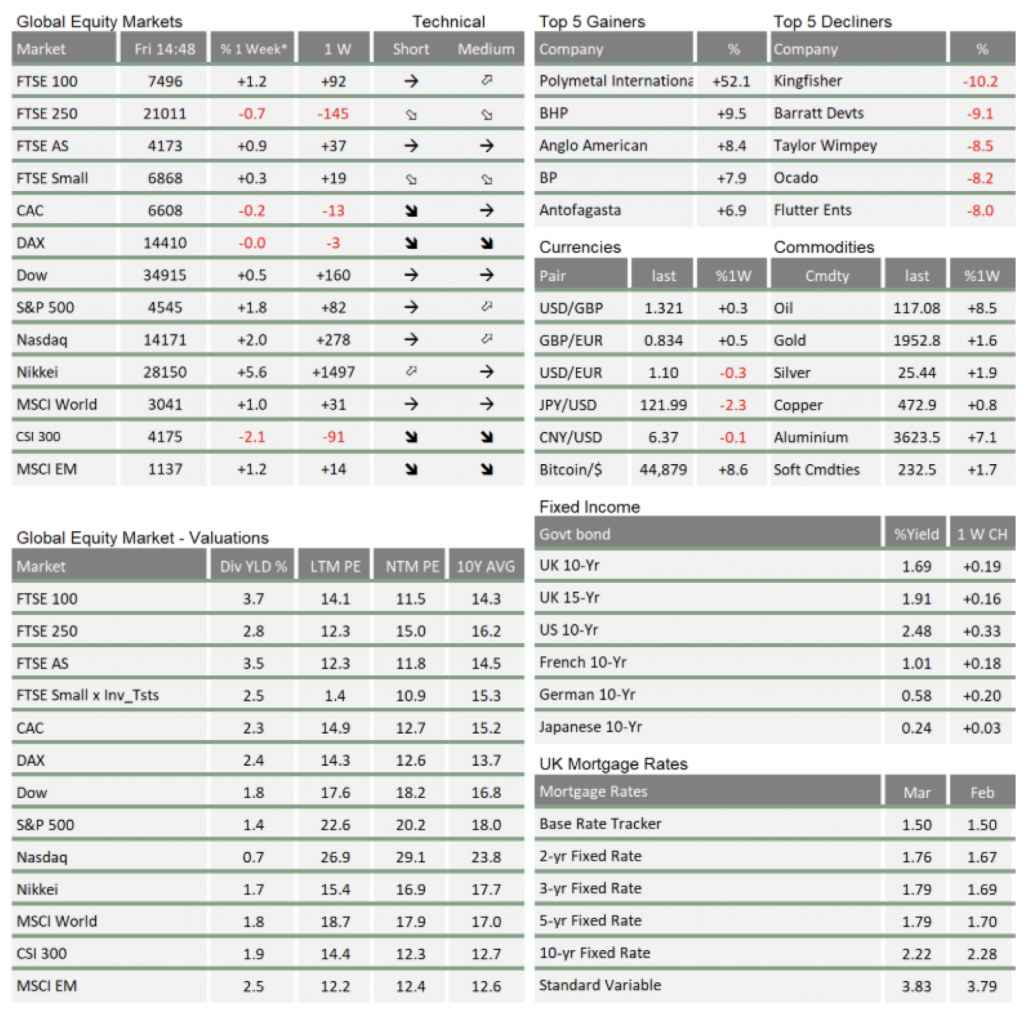

* The % 1 week relates to the weekly index closing, rather than our Friday p.m. snapshot values

** LTM = last 12 months’ (trailing) earnings;

***NTM = Next 12 months estimated (forward) earnings

Please note: Data used within the Personal Finance Compass is sourced from Bloomberg and is only valid for the publication date of this document.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.