Market Update: Anxiety under the surface

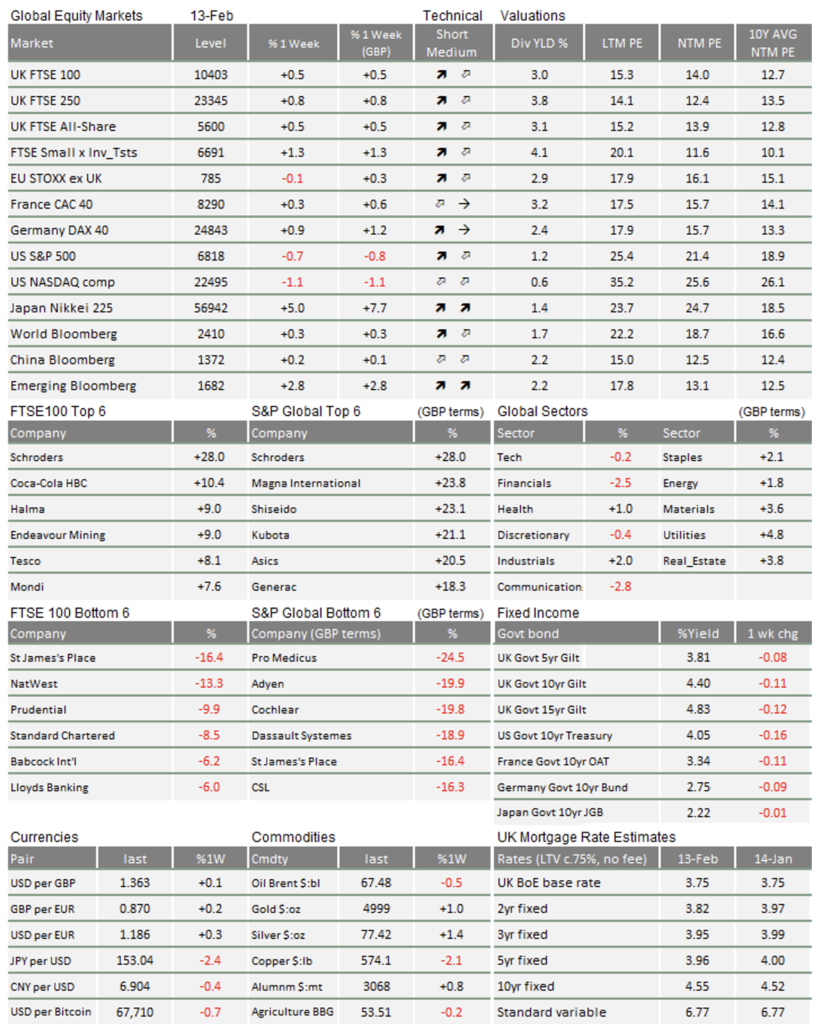

Stock markets were flat in aggregate last week. That is an improvement over the frantic action we have seen recently and, towards the end of the week, there was even some relief for beleaguered tech stocks. Below the surface, however, things look less calm. Price volatility for individual stocks has stayed extremely high – even though volatility at the overall market level has dropped.

That is an extension of the AI winners and losers theme we have been talking about for some time. Investors are laser focussed on the rapid rollout of new AI tools and the disruption they could cause across multiple industries. These anxieties make markets more fragile than they seem.

Intangibles at risk from AI

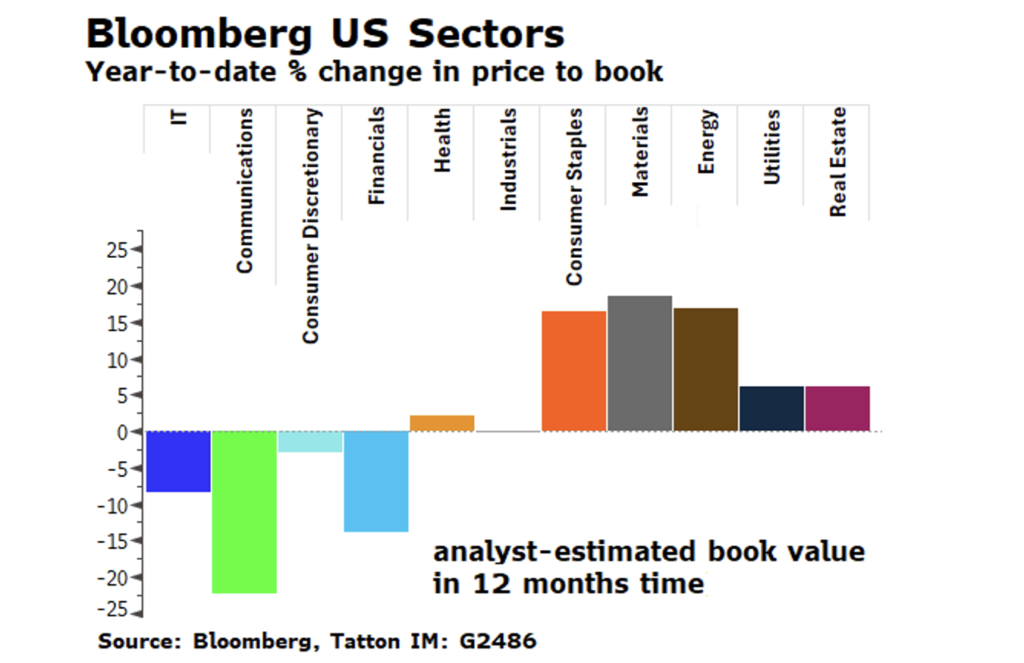

Any company that looks vulnerable to AI displacement is seeing its share price targeted by leveraged traders (i.e. hedge funds) at the moment. That is driving some significant stock price volatility – though gains elsewhere are covering up the volatility at the index level. This is related to the theme of market rotation we have written about this year, but it is unlike a classic cyclical rotation. Instead, a handful of AI winners are seeing share price gains while potential losers are being punished. Nevertheless, the losers have been those with high valuations, particularly on a ‘price-to-book’ (p/b) ratio. In particular, service and tech firms tend not to have easily-valued physical assets. Most of their value is in employing highly skilled people, so that shows in high p/b ratios. US sectoral shifts in p/b ratios, since the start of the year, are shown below:

Of course, AI is a global tool. Large UK wealth managers were also punished. St James’s Place shares dropped 13% after startup Altruist released an AI tool designed to automatically generate personalised tax strategies for investors. Quilter and AJ Bell saw similar losses (though all recovered slightly into the end of the week), as the AI threat seems to be concentrated most on bigger firms with large technical departments.

By contrast, smaller firms now have greater opportunity to compete – not just in finance but across all kinds of services. That is good news for smaller businesses, although this was not reflected in public-listed small cap stocks last week. We suspect investors are hesitant to buy just yet, as AI advancements are happening so rapidly that it is unclear who the winners might be. Until the dust settles, everything except basic energy or materials could be at risk.

Disruption challenges the growth narrative

The biggest economic risk right now is not AI replacing us; it is how companies react to share price turbulence. When shares fall, executives usually try to cut costs to maintain profit margins and that can mean job cuts. The danger is that the rise of AI puts highly valued employees at risk – lowering demand from a crucial income cohort and weakening the economy. We saw this from brewer Heineken last week, announcing 6,000 layoffs, reportedly due to AI productivity savings.

In contrast, the US labour markets showed some decent strength for January – with 130,000 jobs added, against expectations of 70,000. But the worry is that January’s data is already out of date. This week’s initial jobless claims in the US rose sharply, for example. Labour markets all over the world have been in something of a stasis for a while, with little signs of hiring but no firing either. There is a growing risk that AI news-flow – even if not AI itself – could rapidly change that equation.

That goes against the stronger growth narrative we began the year with. JP Morgan analysts, for example, have been bullish about US and global economic prospects for 2026, arguing that rising consumption will push up employment. We worry this might have it the wrong way round. We will have to watch company announcements on AI integration closely in the months ahead.

The rotation continues

It went slightly under the radar, but Alphabet (Google) issued a 100-year sterling bond last week. The US tech giant’s century debt says interesting things about big tech’s financing preferences, and the fact it was issued in sterling says interesting things about the UK bond market. We should not read into what it says about other UK bond yields too much, but it does suggest that there is significant demand for long-term debt in the UK market. That is an encouraging sign for our market.

The UK’s latest growth data was mild (a 0.1% month-on-month expansion in December) but full-year growth of 1.3% for 2025 is a little better than many expected a year ago. There is concern in some quarters about how the government’s budget deficit might be affected if there is a change of Labour leadership but, for now, markets still expect a mildly tight fiscal policy that puts emphasis on lowering interest rates. With rates likely to fall at the Bank of England’s next meeting, that seems to be working.

The UK’s debt outlook is better than in the US, where the Congressional Budget Office just upped its long-term forecasts for both the deficit and overall national debt. This is partly due to Donald Trump’s likely fiscal expansion this year, which now looks certain ahead the midterm elections. The US treasury could really do with some more tax revenue – which is why the president will almost certainly veto the bill, just passed by US Congress, which aims to block tariffs on Canada. With a Supreme Court ruling on tariffs still dangling over the White House, the outlook for US treasury bonds is uncertain.

This again plays into the theme of investors rotating away from the US. This is benefitting other global stock markets, particularly in Asia.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.