Market Update: And the roller coaster rolls on

Another topsy-turvy week ends with more volatility and lower markets. Stocks were boosted midweek, after investor darling Nvidia reported even better than optimistically expected corporate earnings growth for the previous and current quarters – a rejoinder to the crescendo of ‘AI bubble’ chatter. Nvidia was not even the best of the Magnificent Seven; Alphabet (Google’s parent company) rose as Warren Buffett bought into the company.

The bounce unwound on Thursday. Another fall in cryptocurrencies lead stocks lower – a signal that liquidity remains tight. A rising US dollar does not help, since it reduces the value of non-US investors’ available cash relative to global markets. This is especially true for Japan. The new prime minister’s escalation with China hurt the currency, bond and stock market all in one.

We see conditions building for a rotation – out of the high growth stocks and perhaps into some of the less loved areas of the global market.

The Fed’s divided and so is the US economy

Deep divisions at the US Federal Reserve have put a December interest rate cut, previously considered a near-certainty, in doubt. The Federal Open Market Committee (FOMC) minutes highlight “strongly differing views” on monetary policy. The Fed has at least signalled it will reduce its quantitative tightening (QT) sales of government bond, which should ease some near-term liquidity pressure on markets.

The FOMC does not name names, but Trump ally Stephen Miran was undoubtedly one of the rate cur advocates. Trump’s appointees have polarised the FOMC, and this will continue as the president appoints more positions next year.

A divided Fed also reflects a divided US economy. Nvidia’s results prove that the tech sector is still able to grow profits and, with the recent uptick in tech firms’ debt issuance, lower interest rates could exacerbate the ‘AI bubble’ debate. On the other hand, consumer-focussed firms like Home Depot and Target show a much weaker outlook.

US growth outside of big tech is going through a soft patch. The US economy has shrugged off many tough moments in recent years and will probably do so again. But getting out of this will likely take a policy response from the Fed or, more likely, from the White House. Perhaps Trump’s promised ‘tariff dividend’ could be on the way, should the budget bill’s Q1 taxreceipts prove insufficient.

Investors take profits; cryptos sell off

Bond markets reacted late – and only mildly – to stock volatility. If investors were worried about growth, you would expect lower global yields. Stable yields suggest that bond investors are looking through the soft patch to a bounce back in the future. Indeed, in Japan, longer-term yields have actually risen, thanks to Prime Minister Takaichi’s looser fiscal policy and pressure on the central bank to lower rates, despite inflation being above target. Perhaps the US (though probably not the UK in Europe) will follow suit.

We suspect that recent equity selling is largely down to investors crystallising profits after a tremendous post-April rally. Unsurprisingly, the biggest winners this year are leading this latest sell-off – like Korea’s gangbusters stock market. Investors seem less worried about fundamental profitability; they are just need some liquidity.

We have pointed out the link between tight liquidity and volatility before, and last week’s nosedive in cryptocurrencies was a clear sign. While many would disagree, we see cryptocurrencies as liquidity-fuelled assets and thus prone to speculative swings. They have had a torrid time in the last month, exacerbated by the market’s high level of debt leverage (a result of cryptos’ growing connectedness to mainstream financial markets).

Cryptocurrencies could fall further but this will probably become less of a problem for other risk markets. The overall liquid market cap of cryptocurrencies, relative to US stocks, has fallen from 6% to under 4%. If it falls further, crypto losses become less of a drag on overall liquidity.

Liquidity creates rotation

Market liquidity will almost certainly come back in the short-term, thanks to money now flowing out of the Treasury General Account (TGA – the US government’s current account) and the Fed’s QT reduction. That will help markets but, over the medium-term, US policymakers are moving away from the ‘abundant liquidity’ model from the pandemic, towards an ‘ample’ liquidity provision. This is partly to deal with the split between the asset market haves and the real economy have nots.

Nevertheless, this change to the way liquidity flows through the system could cause a significant capital rotation in equity markets. If there is less money around, people have a stronger preference for money now versus money later – increasing the appeal of so-called ‘value’ stocks over growth. This will not necessarily impact the likes of Nvidia (as they are profitable in the short-term too) but previously unloved areas might see more attention.

If that is right, there could be greater opportunities for the discerning investor. Rather than following broad market trends, 2026 could be the year that active investors prove their worth.

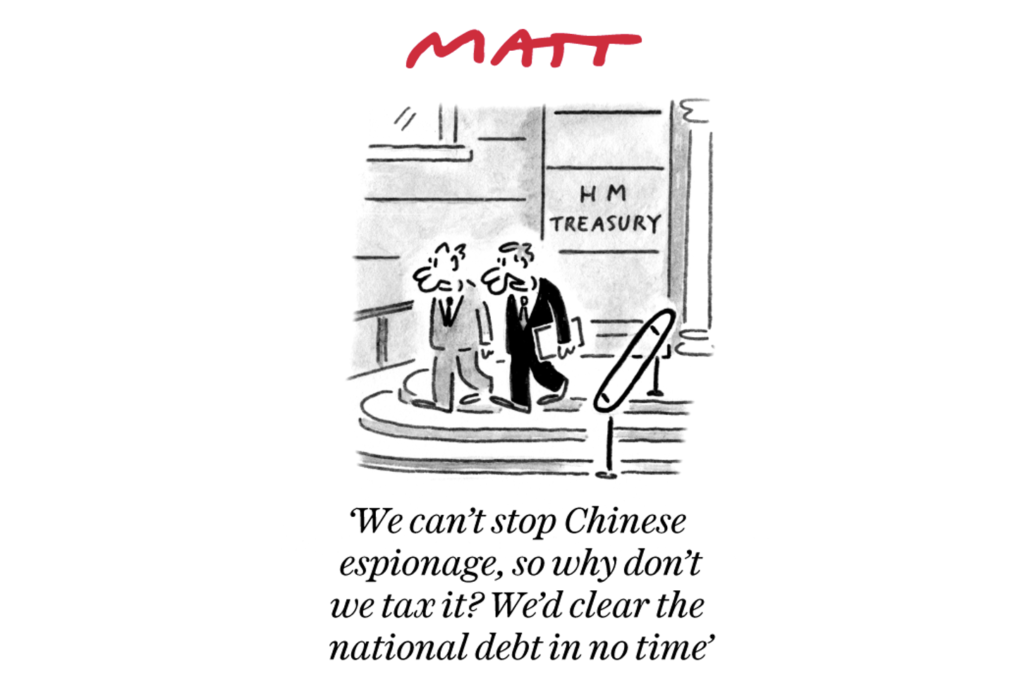

A nervous budget buildup

We end with a brief note on this week’s UK budget – a budget whose buildup has felt longer than any in living memory. There is not much we can say about it that has not already been said; tax rises in some form are almost certain, and the more straightforward the better, even if people do not like them. In economy terms, we hope there is some relief for under pressure small businesses. We talk about one of the biggest issues for small business – the UK’s high energy prices – in a separate article.

The government has changed its messaging many times in the budget buildup, but has always maintained that the bond market reaction is central to its policies. That means UK bonds (gilts) should remain stable, even if it is hard to see much upside. The talk a few months ago of a looming gilt crisis was greatly exaggerated – as we said from the beginning. Lower gilt yields, and hence easier borrowing conditions, are important for the UK economy, even if they fail to inspire.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.