Market Update: AI trade starting to eat itself

Flipping the narrative

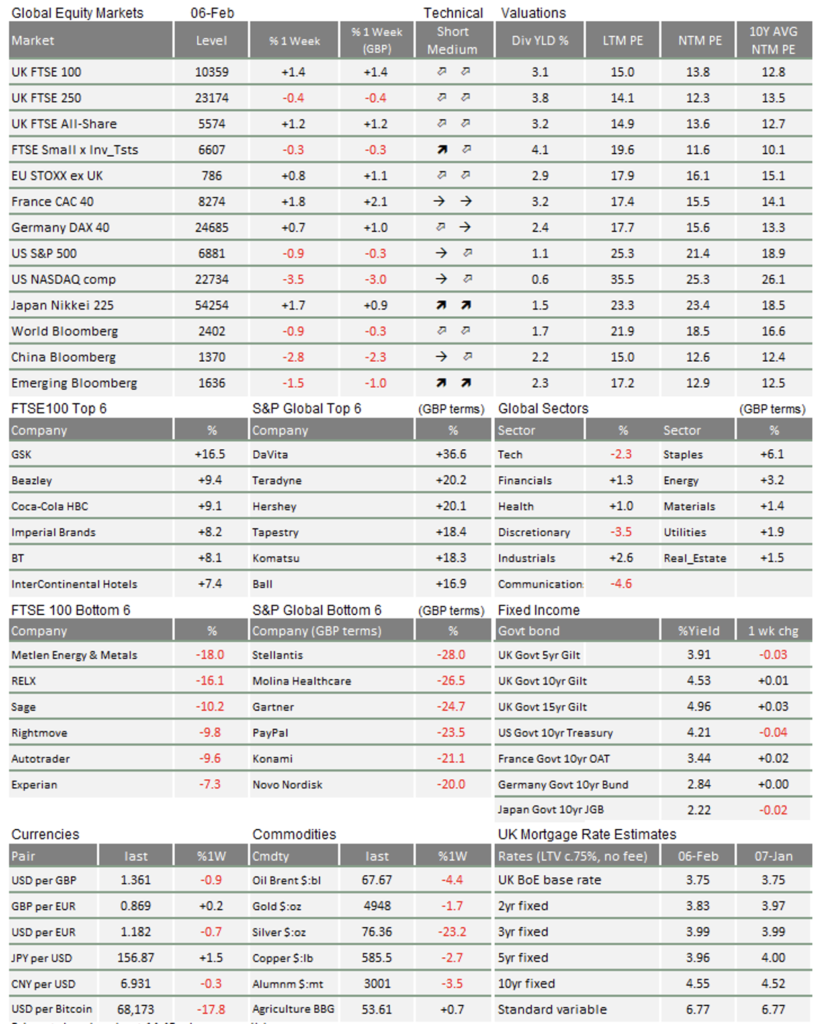

US tech stocks dragged down overall global equity returns this week – the Nasdaq Composite index down nearly 3% in sterling terms. The AI theme that propelled the sector for years is now causing a crisis of confidence, over a potential growth shock.

Other markets fared better. Japanese equities soared (and not merely due to currency impact), showing markets’ approval of Prime Minister Takaichi (not a fan of a strong yen) ahead of a weekend election she’s expected to win. UK stocks held up, despite political turmoil. International investors expect similar fiscal policy regardless of who is Labour leader – and markets were buoyed by the Bank of England’s surprisingly dovish voting margin on interest rates. European equities were similarly helped by the ECB’s benign inflation outlook.

Does Trump know who he’s getting?

Markets were calmed by the nomination of Kevin Warsh as the next US Federal Reserve chair, set to take over once Jerome Powell’s term ends in May. Warsh is considered to be strong-willed and relatively economically orthodox. Judging by his past comments and Trump’s repeated demands for lower interest rates, the prospective new Fed chair is also a surprisingly hawkish pick, one that is unlikely to be pliable if he differs from Trump’s views.

Warsh’s hawkish streak is more about wanting to reduce the amount of US government bonds on the Fed’s balance sheet than short-term interest rates. He believes that AI productivity will reduce costs, lowering inflation and allowing the Fed to cut rates. Trump likely would not have picked him without that last part. But he also wants to end the financial system’s reliance on central bank liquidity, which has lasted since the 2008 global financial crisis.

Warsh is said to favour a “hard dollar”, but that does not necessarily mean a strong dollar in the near-term. He dislikes the current Fed’s current role as economic saviour (known as “the Fed put-option”) and would prefer the Fed to be very much the lender of last resort.

Many are sympathetic to this aim, but we have to be aware that an effective reduction of Fed liquidity could impact risk markets. It will probably lead to higher volatility and lower price-to-earnings valuations – just as we saw in the autumn.

On the plus side for markets, Warsh’s likely arrival will probably mean deregulation for US banks. Steven Miran, Trump’s de facto representative on the Federal Open Markets Committee, has argued that reducing the Fed’s balance sheet cannot happen without cutting regulation for private banks – since they will need to pick up the slack in terms of money creation. US investors will see it as positive if Warsh’s appointment is swiftly followed by deregulation and the freeing up of bank capital.

The AI shock to growth

The AI sell-off became the biggest theme of the week. This started with software companies threatened by Anthropic’s new Claude Cowork AI, but the sell-off spread to even the big winners of the AI boom, like Nvidia and Oracle. What at first appeared to be a short-term risk appetite problem is now looking like a macroeconomic growth risk. If new AI tools displace workers en masse, even the companies that gain the most from AI will lose customers. We dedicate a separate article to this topic.

January’s US labour market data has disappointed: ADP reported only a slight gain in private sector jobs, while the Challenger, Gray and Christmas aggregation of layoff announcements was the highest since 2009. Hiring from US companies has been weak for some time now, without hurting overall economic output. But we know that the US economy is sensitive to its stock market, not just through the so-called ‘wealth effect’ but from the cost-cutting actions of companies in reaction to lower share prices. If US markets keep falling at the same time consumers worry about their livelihoods, the labour market could, in theory, rapidly deteriorate.

Markets struggled with illiquidity back in November, and we worried then that the losses could impact economic confidence and, eventually, growth. Instead, US growth signals have improved since then – and they could do so again. However, more so than in November, markets are already directly affecting economic confidence.

The offsets are working

The good news is that bond yields fell, despite the potential for further Fed bond sales. Bond gains have offset some of the equity losses for investors (bond prices being the inverse of yields). More importantly, they signal lower borrowing costs for households and businesses. US businesses in particular are very sensitive to borrowing costs – and the US Senior Loan Officer Survey data (published a week ago) suggests that loan demand is ready to pick up once interest rates and yields come down. The traditional sectors outside of tech actually stand to gain more from any fall in borrowing costs, reinforcing the capital market rotation we have seen this year.

We should also bear in mind that the AI macro risk seems much more pronounced in the US than elsewhere. As we mentioned earlier, prospects look better in the UK, enhanced by the Bank of England appearing more dovish this week. The BoE held rates steady but four rate-setters voted for a cut to 3.5%. If inflation pressures keep declining, they will get their way in March. The ECB will also be encouraged by European inflation coming in below the 2% target, opening up a path for rate cuts.

When markets are unsettled, we think it important to not lose sight of the sunny outlook. Bouts of productivity growth – like the one we expect from AI – are ultimately what drives investment returns and the economy over the long-term. Markets never go in a straight line along that growth path, especially considering the current pro-growth, high valuation positioning. Disruption is real and brings extra risks, but disruption also creates its own balancing forces, and those are likely to play out.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.