Market Update: A dovish hawkish rate cut for Christmas

We are into the last active investment days of a truly remarkable year. After a short note on last week’s events, we offer some thoughts about 2025 and an outlook for 2026.

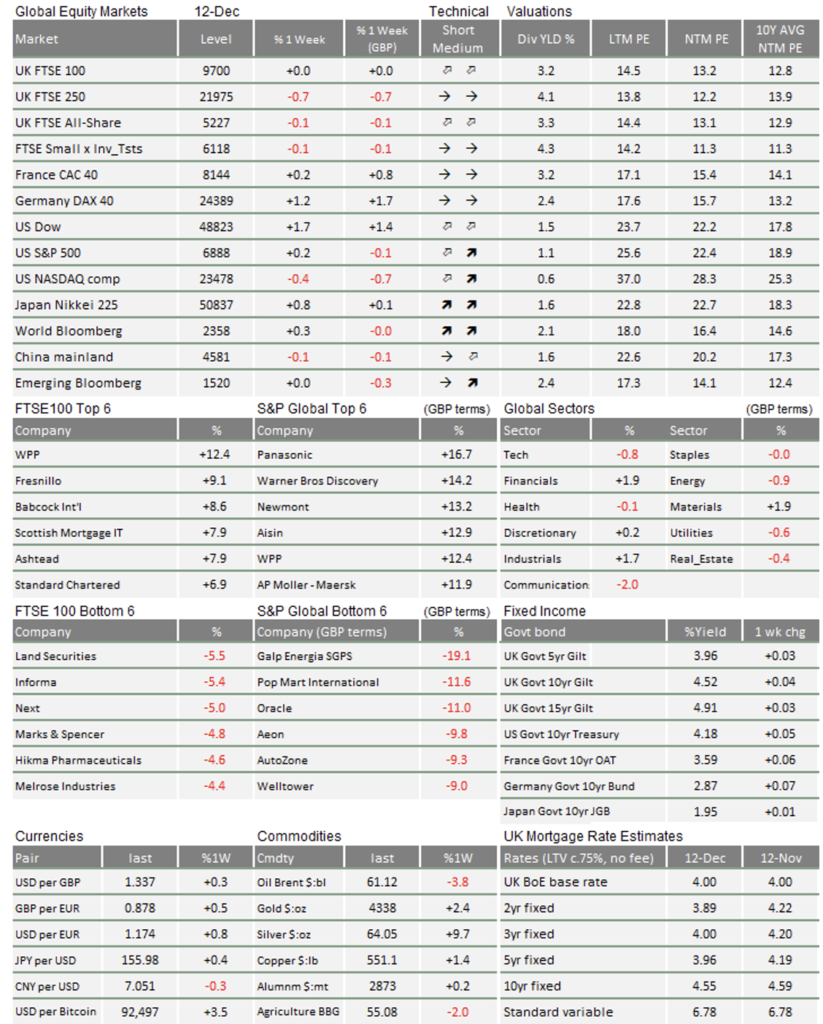

Most equity markets were solid last week but this was one of the few occasions when the major tech firms underperformed. US cloud computing giant Oracle took another blow, when its earnings results showed debt-fuelled capex expansion had accelerated faster than sales. Oracle spent $12bn on capex in the second quarter, up from $8.5bn in the previous quarter and way above analyst estimate of $8.25bn. Cloud sales increased 34% to $7.98bn and infrastructure business revenue gained 68% to $4.08bn, but both metrics fell (just) short of analysts’ estimates. Subsequently, its shares fell 10%. Its cost of capital has risen, and it needs to raise more money to meet spending plans for the next two years.

Then, on Friday afternoon, Broadcom disappointed investors when its CEO said that they had (only) $73 billion in AI product orders to be shipped over the next six quarters. Its shares fell over 8% before the open. Both companies show how difficult it is for anybody outside the ‘Magnificent Seven’ tech companies to compete, to generate results in the near-term which satisfy investors. The current optimism about big tech’s capex splurge could therefore dwindle, if the spenders drop away.

Before Oracle’s disappointment, on Wednesday, US assets had gained across the board after the Federal Reserve gave markets what they wanted and expected: a 0.25 percentage point rate cut to a mid-point of 3.625%. Perhaps more importantly, the Fed acknowledged that liquidity has become a little tight. We wrote previously that the US government shutdown combined with the Fed’s longer-term wish to constrain money, had increased volatility in risk markets.

The Fed will begin buying $40bn of government bills per month for six months (at least). While similar, this is not exactly the same as the Fed’s previous quantitative easing programs. It is clearly time-limited to six months (QE was open-ended, although this program could be extended), and it is focussed on short maturities as opposed to the QE program of buying longer maturity bonds. Most importantly, unlike the QE of Ben Bernanke, there is no intention to drive down risk premia. With government spending back on track, liquidity will likely improve into the end of the year.

Overall, despite equivocal comments from Fed chair Jerome Powell, the markets deemed the rate and liquidity outlook to have improved and therefore the cut to be a lot less hawkish than expected. Given smaller companies have been suffering from higher rates much more than large ones, smaller and mid cap stocks were last week’s winners and bond yields fell slightly, as did the dollar. We note that cryptocurrencies are not benefitting quite as much as their fans had hoped, though. There may be more crypto pain to come before the year is out.

Last week’s US 2025 National Security Strategy release has made clear that our erstwhile ally is intent on disengaging from Europe to pursue an agenda in Latin America. This has boosted Europe’s defence stocks somewhat, after three months of lacklustre performance. Europe’s leaders are displaying a growing sense of urgency, accessing locked-up Russian financial assets so they can support Ukraine. This meant declaring an emergency which allowed a majority vote (rather than unanimity) and removing the effective veto power of Hungary’s Viktor Orban.

European stocks are doing better in general again, buoyed by the likelihood of more joint-enterprise fiscal expenditure. As Europe will be a big issuer of bonds, European government bond yields have shifted up. In the past six months, the US 10-year yield has declined from 4.5% to 4.1%, while Germany’s 10-year yield has risen from below 2.5% to 2.85%. One can see this as a recognition of potentially higher growth in Europe, or that Europe needs to attract capital from global investors. Either way, the Euro has resumed its upward trajectory.

Lastly, the shouting match after the UK budget seems to have subsided, and we see evidence that domestic investors are putting some of the money back into risk assets, after being a little defensive before the event.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.