Market Update: End of the smooth summer ride?

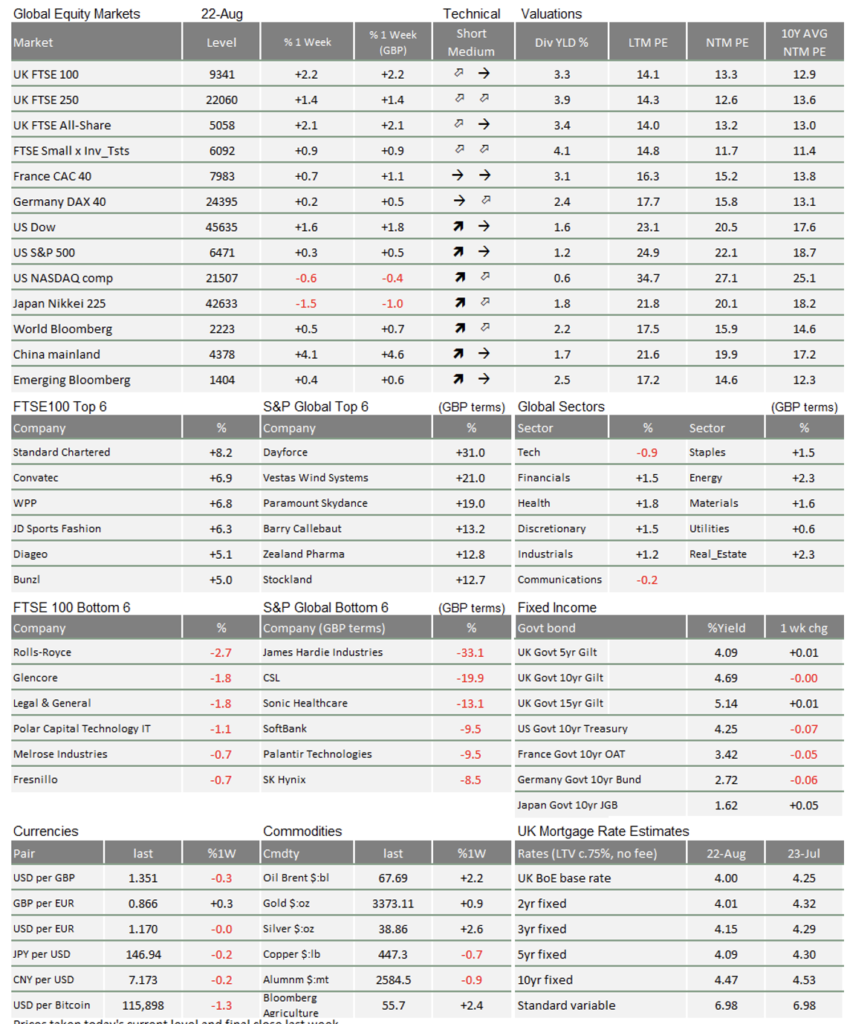

The Bloomberg World stock market index gained 0.5% for last week, bond prices are mixed (UK yields are up). Underneath that, US large cap stocks did less well, while China and the UK have risen, to the point where the FTSE 100 continues to make new all-time highs. The broader financial media came up with a number of explanations for the different moves, but from our vantage point of view we are not convinced that it was much more than a typical summer lull. The exception from the norm is that this one comes after a long and seasonally unusual market rally, that may have some investors more itchy to take some profits.

Here follows what we observed over the course of last week, but would not particularly attribute much of the tepid market action to.

Fed chairman Jerome Powell’s speech in Wyoming raised hopes that there will be a rate cut on September 17th, although he was more guarded about the possibility of further cuts. US 10-year bond yields have dropped about 0.05% while broad stocks have gained 1%.

There is little market reaction despite the news being important, for example if we just think back to the US attack on Iran’s nuclear installations. Last week we had the Trump-Putin summit, followed by European leaders paying homage in Washington. These were significant political events for Europe, but nothing created a discernible market reaction.

The FTSE 100 has had a good week, with broad strength. The weakest stock is down only 3%, (Rolls Royce for this week), and there have been gains in nine out of the eleven GICS sectors (Global Industry Classification Standard). The not brilliant UK inflation report (see our separate article) caused another rise in bond yields but, overall, rate expectations are still for two more rate cuts to 3.5% by next summer. And, of course, inflation is not generally bad news for stocks. The continued price pressure in non-core goods turns out to be good news for Unilever, one of the best contributors to market gains this week.

China also continues to be as good a performer as in previous weeks, with markets apparently unaffected by the ongoing tariffs at a 30% rate and with no sign yet of a trade deal with the US. Chinese investors seem to be the main driver, driven by their own high cash balances and growing confidence that the economy is at least stable.

Meanwhile, in an interesting global capital market development, Kenya announced that it is swapping its Dollar-denominated borrowing from China into Renminbi loans. We observe China continuing to occupy the global leadership vacuum left by the exit of the US.

In the US, the Magnificent 7 tech giant’s shares had a poor week and thus paused in leading markets higher as they had done so decisively over that smooth and extraordinary rally that started on April 9th with Trump’s announcement that his ‘reciprocal’ tariffs would be paused for 90 days. This week’s most watched corporate news will be tech giant Nvidia’s results. In all but one of the past seven quarters’ earnings releases, Nvidia’s share price dropped in the week before the report only to move higher thereafter. So we should not read too much into this week’s bout of softness in US large cap stocks.

However….

While China’s investors are starting to deploy their high cash balances, US investors may now have run down their “excess” cash balances which resulted from the pandemic largesse. Those cash balances have probably been a factor in maintaining high valuations and supporting more speculative investments such as meme stocks and crypto-currencies. We will keep a watchful eye on this dynamic.

As we mentioned at the start, political and geopolitical news may grab our attention but often it has relatively little direct effect on markets. It is only when events cause significant change to companies’ normal business that investors start selling or buying.

One way to think about the situation is to ask a “reverse” question – For example, “What might happen to cause the Euro to suddenly decline against the Dollar?”

Intuition might come up with a scenario such as “Trump indicates support for Russian annexation of the Donbas region”. But further consequential thinking might challenge that intuition: Could this mean a sharp acceleration in Europe’s defence spending that might actually force the Euro stronger? Yields might rise in expectation that growth would go higher; Europe would have to spend its own savings, reducing the trade deficit with the US, slowing European capital outflow and attracting US savings capital.

Another example: as we know, Trump’s economics adviser and now Fed board member Stephen Miran theorised that US tariffs would cause the US dollar to strengthen, and yet from the point where investors realised tariffs would be a reality, the dollar fell. The DXY basket index which indicates the dollar’s relative strength is 5% lower from April 2nd(“Liberation Day”) and 9% lower since Trump’s election victory.

Still, markets seem especially desensitised in recent weeks and that may be because of the increased frequency of seemingly important news. It is not that investors care less now, or that the news is not important. Rather, each event shows that unexpected new paths and scenarios open up swiftly. Assigning probabilities to different potential paths fails quickly because we can barely see one step ahead, let alone two. We have learned to be humbler about what we think we know and, therefore, markets become less reactive.

Jerome Powell has just spoken at the Federal Reserve’s Jackson Hole Central Bank Symposium. The annual event has been increasingly important in clarifying central bank thinking, and the Fed’s chairman has used it well to communicate the US rate setters’ own internal discussions and conclusions since his appointment by Trump in 2018.

In what will be his last Symposium speech, Powell said rates were currently mildly restrictive which led most to believe that he wants to cut rates by 0.25% on September 17th.

Since 2018, the Fed has changed the decision-making framework away from “seeking inflation that averages 2% over time” to making decisions around employment, based on “shortfalls from its maximum level”. It is therefore probably fair to conclude from this, that Powell acknowledged that soft employment demand will probably lead to lower rates, everything else being equal.

But he also said that while the jobs market “appears to be in balance, it is a curious kind of balance that results from a marked slowing in both the supply of and demand for workers. This unusual situation suggests that downside risks to employment are rising”. However, the implication is that employment supply may also be weak (a way of saying that anti-immigration policies reduce labour supply). Because of this, the immigration impact will come through more slowly, which to us implies that rates might not go down as far in the medium-term.

He further acknowledged tariffs will cause a one-off inflation spike. He also said that the after-effects will take time to fully work their way into the economy and that they won’t allow the spike to become an on-going problem like the price level rises that followed the post pandemic consumption surge. “Taking time” implies a reactive approach to inflation data, while the new framework points to a more forward-looking approach to employment data.

For more background, in our second article, we look at how the US may be running towards the end of the “excess cash” era, and he may well touch on the future size of the central bank’s balance sheet in other questions later. Powell is also likely to make uncontentious statements about the benefits of independent rate setters. We predict that whatever he says, Donald Trump will be upset.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.