Market Update: Markets revisit risk-off

This has been one of the busiest weeks for potentially market moving information in a long time. We’ll start with market moves, and see what that tells us about the way in which the information has added up, and what are currently the most important factors.

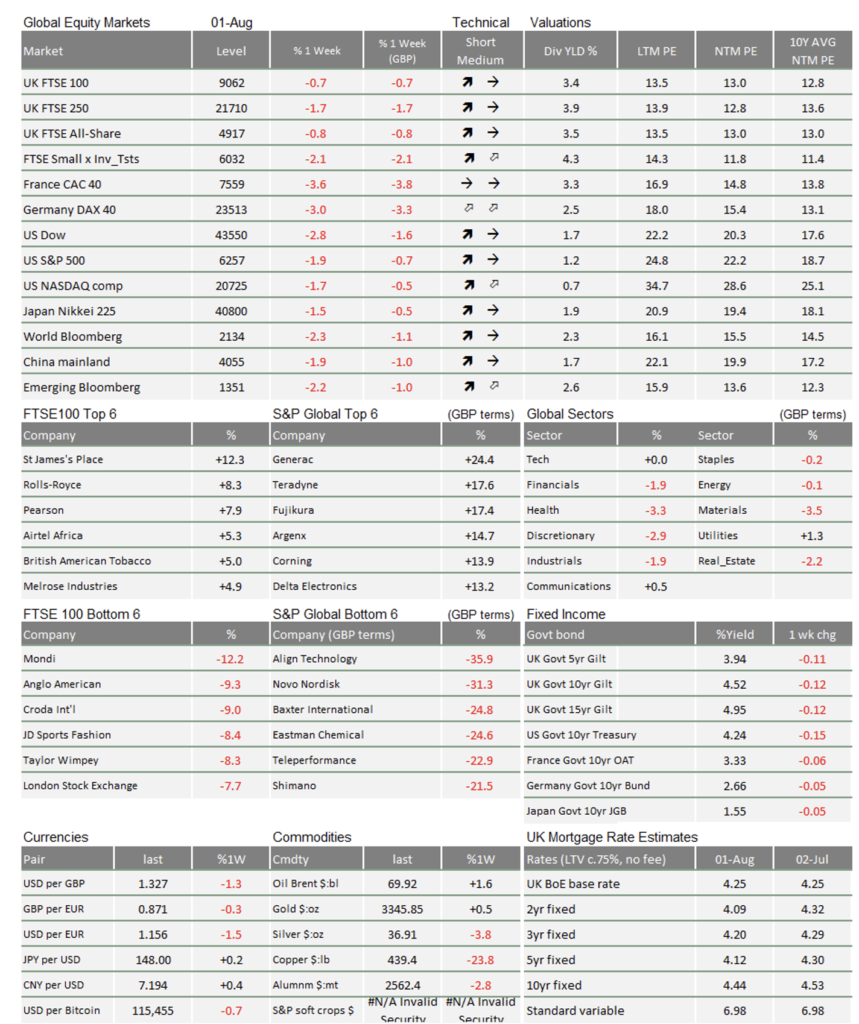

World equity markets started the week relatively positively, but are now negative, with European markets clearly fearing the worst. US indices held up the best – mostly because of the Magnificent Seven US tech giants, but on Friday the ISM manufacturing sentiment survey showed unexpected weakness and pulled down domestic stocks.

Bond yields dipped into the middle of the week, moved back up and then fell sharply (and so bond prices have risen).

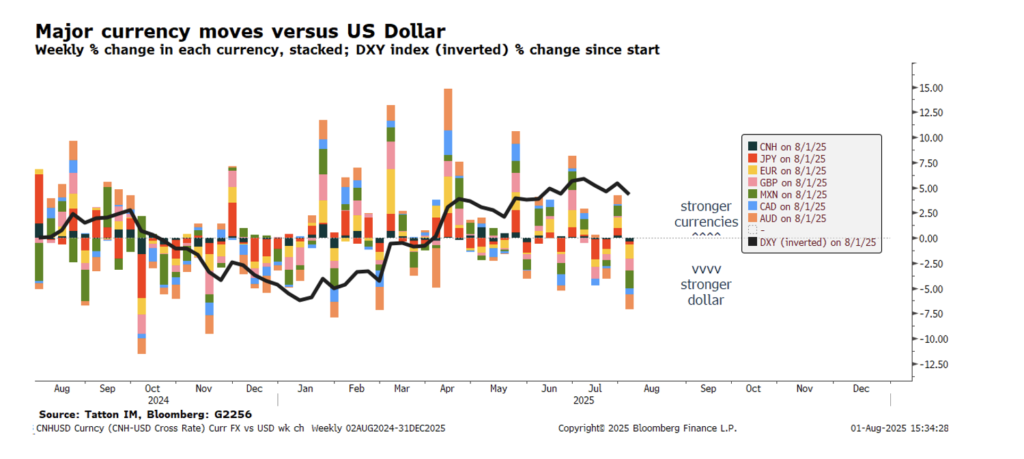

The dollar was stronger up until Friday afternoon, having had the best week against almost all currencies in a year. After the aforementioned ISM business surveys, it sold off. The chart below shows each major currency’s move against the dollar stacked up, and the performance of the DXY index, a measure of the dollar’s movements against other currencies (inverted, so a move down in the black line indicates dollar strength):

The currency moves amplified the outperformance of US equities before Friday’s reversal. In sterling terms, France’s CAC40 is down -3.4% from last week while the Nasdaq 100 is indicated at +0.7%.

Gold is a bit weaker amid the dollar’s strength while commodities were holding up but have had a bad finish to the week.

In sum, markets have switched to risk-off mood, with the defensive global quality (tech) stocks being a magnet again.

Of course, it could have been worse. The long list of important known unknowns at the start of the week included:

- Likely trade deals ahead of Trump’s August 1st deadline for reciprocal tariffs

- Central bank meetings including the Fed and the BoJ.

- GDP Q2 data for US and Europe.

- Inflation data across the world.

- Consumer and business confidence measures.

- US employment measures.

- China policy announcements.

- 5 of the Mag7 and many other global companies reporting Q2 earnings and outlooks.

- The US treasury announcing how it saw the next few bond auctions stacking up.

- A trade deadline for most

The EU-US trade deal came over last weekend and initially felt like a victory of level-headedness. It appeared to be the same as that agreed with Japan, perhaps even a little better. However, a difference of interpretation came to light in the press conference held with President of the EU Commission, Ursula Von Der Leyen, and Trump regarding pharmaceuticals which suggested there were still items not yet fully agreed. European stocks, such as auto manufacturers, did well initially but stumbled thereafter. Meanwhile, Macron and others were highly critical of the Commission, which also suggests the trade deal could fall apart.

GDP growth data was also underwhelming if not terrible, showing a slightly positive second quarter of +0.1% qq. Deflating optimism about prospects saw the Euro give up a significant amount of ground against the dollar and against other currencies.

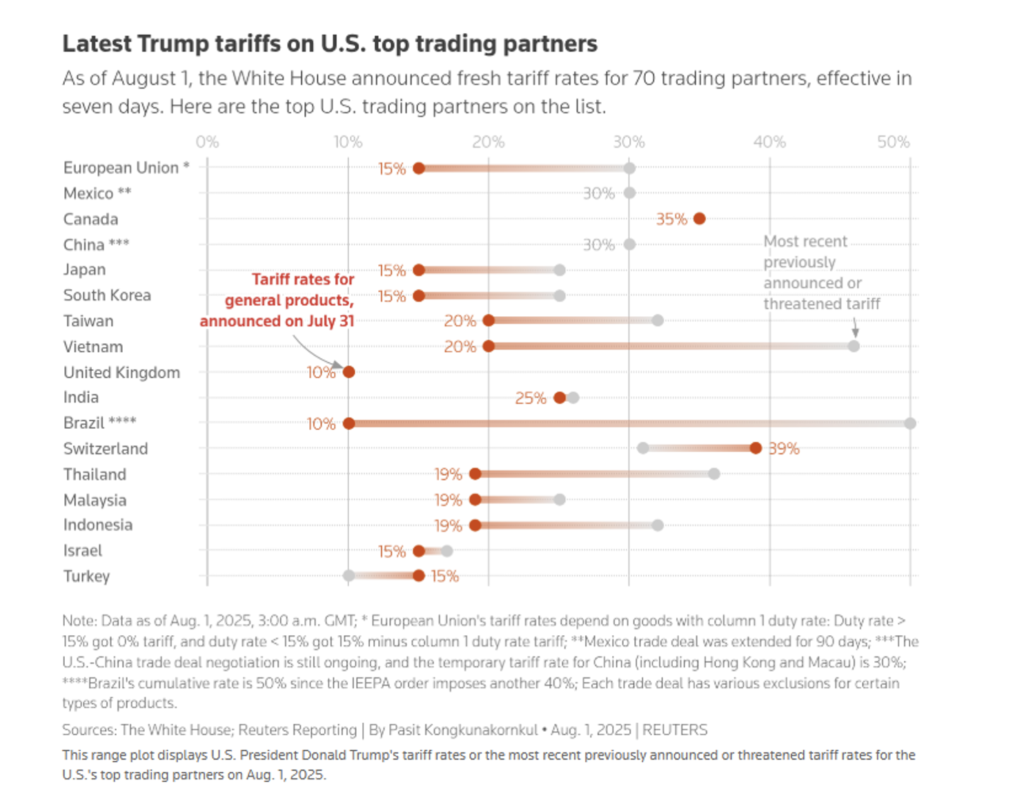

For some other countries, the deals achieved felt like victories (or, at least, that was how the country leaders portrayed the results). Below is Reuters graphic on where the headline tariff levels sit for the US’ main trading partners:

Mexico has joined China in having an extended period for negotiations. This is likely to be because both nations have relatively strong negotiating positions because of the potential impacts on consumer prices and the supply of intermediate goods to US domestic businesses. Indeed, Trump’s approval rating regarding how he’s handling the economy has slipped sharply, and he seems to be less sure of his power in these relationships.

Perhaps because of that, he has come down hard on Canada and Switzerland. Overnight, the effective rates have been jacked up again to 35% and 39% respectively. Mark Carney can’t get a break. But, countries that have balanced trade, or run a deficit with the US, have ended up with what appears to be the minimum of 10%. For the UK, it almost seems like a victory.

The imposition of a tax will never feel good at the point it happens. Yet we have made the point repeatedly that the US budget deficit is untenable in the long-term and maybe not even in the medium-term. While we can’t yet tell how much revenue this will generate, US government finances should benefit.

And investors have been worried about that deficit. The rise in government bond risk premia is probably good evidence. This week, the US treasury announced its funding plans for the rest of this quarter and to the end of the year. We cover aspects of this in the article below. The problem for markets and the Fed is that this tax lands on a very sensitive spot – the tariff price shock landing on a labour market which may be prone to wage-price spirals.

The Federal Reserve Open Markets Committee (FOMC) left rates unchanged on Wednesday as expected. The statement and press conference highlighted that inflation was relatively contained now but would certainly rise in the near future because of tariffs.

The issue for the central bank is that the labour market may have softened in terms of declining demand for employees but the administration’s immigration policies are highly likely to mean declining supply of employees. This situation was backed up by the employment report which showed that the non-farm payroll growth for July rose by only 73,000, but average hourly earnings rose to +3.9%, more than expected.

The carefully worded FOMC statement did not directly point to the policy dilemma but Trump has responded again, this time calling on the Fed’s board to dismiss “Moron” Powell and force interest rates down. Unsurprisingly, bond yields have risen again despite US Treasury Secretary Scott Bessent’s attempts to restrain any rise in yields.

European equities have not had a happy week but, for the US major indices, it has been decent because of Q2 earnings and guidance from the core of the Magnificent Seven US mega tech companies. In particular, Apple got a major boost from solid sales in China, emphasising yet again how important China is, both in terms of supply of product and demand. Indeed, Apple has had a difficult period since Trump’s election victory because of the worsening of US-China relationship. Nvidia, which is also sensitive to Chinese demand, will report much later – on 27th August.

This week’s surfeit of information answers some questions and then leads us to the next ones. Tariffs are significantly higher than was expected in March. They are probably also still higher in the aggregate total effective rate than we expected after Trump’s tariff suspension on April 9th. Finally, demand, which was initially boosted, has slowed. High inventories held down price rises but are now back down to near-normal levels, meaning that tariff effects on price will inevitable start coming through (all of which is backed up by trade, inflation and GDP data).

Nevertheless, the ripples caused by the massive policy changes in Q2 have calmed and that will leave us able to see the longer-term impacts more clearly through the rest of the year. The most obvious impact will be the flow through of price rises as tariffs are actually imposed and feed through. How transitory will those price rises be, and how much will demand be affected? As we enter August, markets seem to have become less sure about a muddling through to an essentially good outcome, while monetary liquidity support has started to wane. Even if not particularly much has changed in comparison to July, August is often a month with heightened market volatility.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.