Market Update: Flowing with the tide

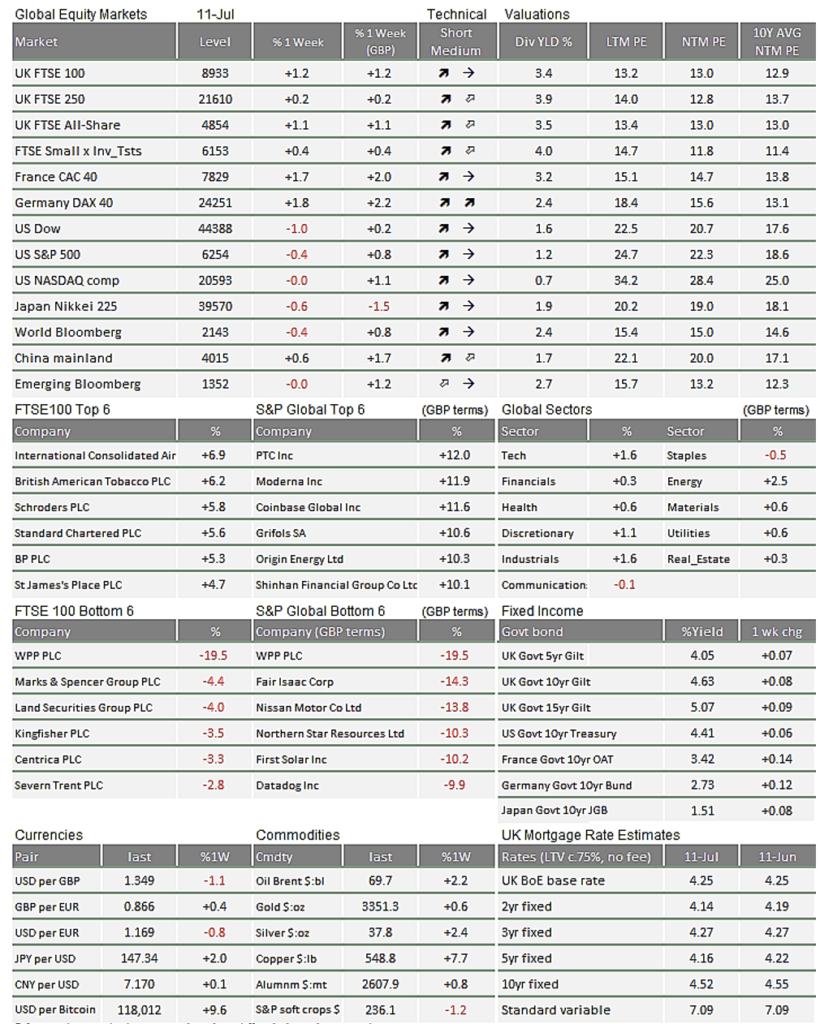

Markets keep rising steadily and gently, on an incoming tide of liquidity. Investors appear to have plenty of cash and are happy to deploy it into risk assets, largely thanks to expectations of interest rate cuts. Both intraday and day-to-day stock market volatility (average price movements) are back to lows. Markets are also increasingly optimistic about economic growth, especially in the US. If that sounds like the exact same description as last week, that is because it is. Markets’ summer love-in continues.

TheQ2 earnings season has kicked off with some of the more domestically-focussed US stocks reporting buoyant revenues and earnings. With tariff impacts not yet fully felt, some companies had stopped giving future earnings guidance. But many are now feeling brave enough to suggest that they think consumers be resilient.

Stocks are benefitting from the difference between actual trading volatility (how much prices move in a day) and implied volatility (the cost of insuring your assets against losses). Both have fallen recently, but actual volatility much more so – perhaps because traders are still nervous about what Donald Trump might do next. That difference makes it extremely profitable to sell options and buy the broad market, creating upward momentum.

Rachel Reeves’ deregulation push is underappreciated.

Starting with matters close to home, Chancellor Reeves used her Mansion House speech on Tuesday to talk about the need for deregulating UK industry – particularly financial services. Her speech was not well received by the press (as evidenced by Morten Morland’s cartoon in the Times), or by many City of London figures. Perhaps that was more about what she did not say – there was no mention of likely tax rises – than what she did.

Nevertheless, her comments about cumbersome regulation and the need to encourage greater risk-taking were valid. If the government follows through on these themes – a big if – it could benefit UK savers greatly. We have written at length about the need to get savers invested in the UK stock market, so her comments about emphasising the benefits of equity investing are welcome. Had a Chancellor of different political colours said what she said, we suspect the City’s reception would have been warmer. But follow-through is key. It remains to be seen whether this government has the time, energy and political capital to enact these changes.

On the fiscal front, the only thing Reeves did say was that Labour’s fiscal rules are not up for debate. There was nothing new in this point – but re-emphasising it calms UK bond markets. Long-term government yields went up again this week, thanks to higher-than-expected inflation (we cover UK inflation separately) but the difference between UK and US yields is unchanged. Admittedly, that difference is still uncomfortably wide.

Powell’s potential exit doesn’t scare bond markets.

Donald Trump stepped up his campaign against Federal Reserve chair Jay Powell this week, by reportedly penning a letter firing the central banker. The dismissal would nominally be over the Fed’s $2.5bn renovation project, but everybody knows the real issue is that Powell has not cut interest rates as much as Trump wants.

Central bank independence is a cornerstone of the global financial system, and Trump’s previous threats have rattled bond traders. This one barely moved bond yields, though. Indeed, this week’s slight increase in US yields has more to do with stronger growth signals (covered in a separate article). Why are bond traders so calm?

A few explanations stand out. Markets might simply consider it an empty threat. They might also think that replacing the Fed chair will not materially alter the Fed’s rate-setting procedure. Or perhaps investors have just become numb to Trump’s disruption. We suspect it is a bit of all three, but with emphasis on the second.

Unlike the White House, the Fed is run by committee, and Powell’s views seem to match the committee’s consensus. His job is to convey their views, not his own. There is little indication that the leading candidates to replace Powell would be more amenable to Trump’s rate-cutting demands (certainly not Treasury Secretary Scott Bessent, while Kevin Warsh was a notable hawk in his time on the FOMC). And in any case, past experience tells us that US bond sell-offs – the main threat posed by a Trump-controlled Fed – are the surest way to make the president back down.

This is not to say that attacks on Fed independence are nothing to worry about. But for now, markets’ nonchalance looks justified.

Chinese stocks benefit from abundant liquidity.

Chinese stocks had a good week, and are well up from a month ago. The media commentary put this down to Trump’s conciliatory tone towards China (he is reportedly angling for a sit-down with president Xi Jinping) and recently stronger growth numbers. Those factors played a part but, just as with US stocks, we think the rally is underpinned by strong liquidity.

Recent figures of money supply growth continue to show that Chinese households and institutions have cash, even if they are reluctant to spend it. That cash buffer would previously have gone into bank saving accounts or property – but those areas now yield minimal returns. Meanwhile, the government is actively encouraging its citizens to buy stocks. There is even talk of Chinese interest rates falling close to zero. That provides a supportive flow into equities, even if underlying company profits continue to be weak.

As such, the near-term outlook for Chinese stocks could be improving, with valuations likely to move higher. For international investors, though, they remain fundamentally risky. Beijing’s history of crackdowns, and the potential decoupling of China from the west, increases the risk of your assets becoming stranded. This risk is why western investors are anxious about holding China-listed assets, even if it is no more than a “neutral” allocation. We do not see that changing soon but even a slight increase in international investors’ allocations to China would be strong fuel for Chinese markets.

Like all markets right now, abundant liquidity keeps things grinding higher.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.