Market Update: Stock market highs don’t feel so high

Betting games, Matt, 21 June 2024

Stock market highs don’t feel so high

A record breaking week for equities headlined a very mixed bag of economic and political developments, but there is definite fuel for optimism.

Markets unfazed by Labour lead

Is it good news for investors if the City isn’t spooked by the very likely new Labour government?

Commercial property – crisis, what crisis?

High interest rates, debt refinancing and sluggish rents spell problems for commercial property, yet for some investors this creates opportunity.

Stock market highs don’t feel so high

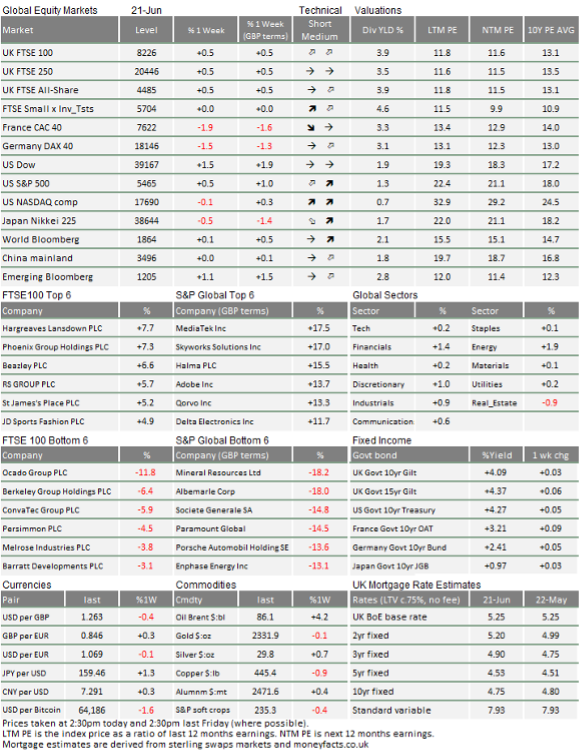

It was another mixed week for capital markets. Global stocks reached another all-time high on Thursday, but the mood feels subdued. This is partly seasonal: US traders had a shortened week due to the “Juneteenth” national holiday (celebrating the abolition of slavery), and after we finish writing, the June “triple-witching” occurs. $5.5 trillion of equity options will expire, which could spur volatility. The lack of elation is also down to the fact that returns are so unevenly spread. US mega tech stocks have been steaming ahead, but much of the global stock market is lethargic. The same seems to be true for economies. Global growth is not weak per se, but there are plenty of soft patches.

US economy resilient, Europe’s confidence knocked by politics.

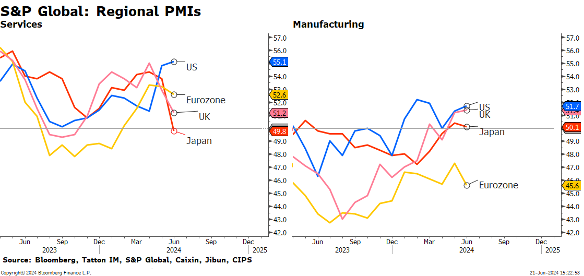

The interim readings for June’s regional Purchasing Manager surveys show that US business sentiment remains upbeat, especially in the service sector. The service PMI came in well above expectations at 55.1 while the manufacturing PMI moved up to 51.7. Readings above 50 indicate expansion ahead.

Businesses are less confident in Europe, thanks to increased political risk. S&P Global’s “flash” survey data (the first 80% of responses) pointed to weaker confidence in the UK regarding future output, probably fuelled by political uncertainty. The services PMI remained positive (a reading of 51.2) but dropped sharply from 52.9 to its lowest level for seven months. Manufacturing actually beat expectations of a fall, rising from 51.2 to 51.4.

Both France and Germany undershot expectations in services and manufacturing. Germany’s service PMI is at least still positive at 53.5, but France’s slid to a despondent 48.8. European manufacturers expect tougher times across the board. Political upheaval is making confidence surveys difficult to interpret, and the final readings might differ more than usual.

US markets strong but even – like the economy.

US strength is not evenly spread. The S&P 500 found a new all-time high, but returns are driven by just a few stocks. Investors are used to the “magnificent seven” tech stocks beating the rest but, after Nvidia briefly overtook Microsoft the world’s biggest company by market cap, recent days have felt more like the magnificent one. The AI chipmaker’s stock has jumped nearly 40% in the last month alone, and is up an eye-watering 171% year-to-date. That accounts for more than a third of 2024’s returns for the entire S&P 500, according to Apollo Global Management.

It would be wrong to call this a bubble in the usual sense. The meteoric rise in Nvidia’s shares is based on the meteoric rise in its profits, present and future. It almost feels as though investors are reluctantly buying into the chipmaker, not out of any exuberance but just a solemn acknowledgement that, lacking any AI chipmaking challenger, it is the only one that can make any money right now. Abundant AI investment does not yet seem to be having a significant impact on either productivity or living standards. It surely will in the long-term but, for right now, that limits the growth impact beyond an extremely narrow group of tech giants.

This might explain why there is such a significant gap between US economic data (strongish) and how Americans feel about the economy (extremely negative). Jobs are being created – as the stellar figure for May showed – but the unemployment rate is up, thanks to increases in labour participation, mostly in the “prime age” group of 25 to 54-year olds. Thankfully for markets, that means the US Federal Reserve (Fed) does have scope to cut interest rates in the Autumn, despite strong aggregate growth and above-target inflation. But, it would be a shame if the capital that this rate cut releases just ends up adding a few billion more to Nvidia’s market cap.

UK policy outlook solidifies.

With relative quiet in the US, the Fed was for once not the main central bank making headlines. The Bank of England (BoE) kept rates unchanged with a “finely balanced” 7-2 vote, but Governor Andrew Bailey strongly suggested the bank would cut at its August meeting. Judging by markets’ implied rate expectations, investors are not fully convinced that the BoE will move this summer – thanks to ambivalent comments from some committee members and an uptick in services inflation. But after strong hints from Bailey and headline inflation falling to the 2% target in May, it would amount to an upset if the BoE did not bring the Base Rate down too.

BoE stasis is disappointing for Rishi Sunak, who was hoping for a last-minute rate cut to appease voters. Just like monetary policy, the election outcome looks like a done deal, with Labour’s 20 point lead over the Conservatives not budging an inch. Markets seem pretty non-plussed. Increased policy certainty is coinciding with signs of growth picking up, fuelled by household spending on property. We should not get ahead of ourselves, but Britain might be in for a brighter summer. This certainty is stabilising sterling too, which, thanks to the French snap election damaged euro, means the pound is strengthening relative to the euro.

Loose Japan policy puts pressure on China.

The weakest major currency, though, is yet again the yen. The chasm between decades-high US interest rates and near-zero Japanese rates continues to put pressure on the latter’s currency. At its most recent meeting, the Bank of Japan (BoJ) reduced its bond buying program and bolstered expectations of a July rate rise. But calling the BoJ “hawkish” feels silly, considering Japan’s financial conditions are the loosest in the world. The BoJ clearly wants to motivate domestic investment and is happy to give the private sector capital to do so, but it feels at the moment like corporates have forgotten how to invest.

A loose BoJ and weak yen makes things tough for China. The renminbi has weakened against the dollar this year, but Beijing is still maintaining its official exchange rate band. It has therefore appreciated around 10% versus the yen – which means a massive appreciation of Chinese exports to the rest of Asia. This is one of the reasons financial conditions in China are so tight (though government obstinance seems to be another), despite its economy crying out for support.

Bearing that in mind, a renminbi devaluation of around 10% against the dollar does not seem unreasonable, and would likely help China export its way out of malaise. The renminbi-dollar rate is political though, on both sides of the Pacific. Beijing does not want destabilisation, given US politicians – particularly Donald Trump – hate Chinese currency devaluation. A sudden drop, like in 2015, is unlikely, though a more gradual decline is possible. China needs to play nice at the moment, which bodes well for the global economy. Like seemingly everything else, it is a mixed bag.

This week’s writers from Tatton Investment Management:

Lothar Mentel

Chief Investment Officer

Jim Kean

Chief Economist

Astrid Schilo

Chief Investment Strategist

Isaac Kean

Investment Writer

Important Information:

This material has been written by Tatton and is for information purposes only and must not be considered as financial advice. We always recommend that you seek financial advice before making any financial decisions. The value of your investments can go down as well as up and you may get back less than you originally invested.

Reproduced from the Tatton Weekly with the kind permission of our investment partners Tatton Investment Management

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

The information contained in this article is intended solely for information purposes only and does not constitute advice. While every attempt has been made to ensure that the information contained on this article has been obtained from reliable sources, Vizion Wealth is not responsible for any errors or omissions. In no event will Vizion Wealth be liable to the reader or anyone else for any decision made or action taken in reliance on the information provided in this article.