Market Review June 2018: The Rise & Rise of Populism

Populism was once again at the forefront of the political landscape in June with Italy and Germany taking centre stage. This, coupled with Donald Trump’s insatiable desire for the limelight, made June a fairly volatile and unpredictable month in the equity markets.

Below we review the rise of Populism and the ongoing trade war, which has driven up the markets “fear gauge” and caused the risk of contagion throughout the global economy.

The Rise & Rise of Populism

The month started with Italy forming Western Europe’s first populist government, made up of two parties bound by their dislike for the EU.

The prospect of a populist and Eurosceptic government in Italy, the third-largest economy in the eurozone, has already rattled markets and worried its EU partners with the German European Commissioner Günther Oettinger controversially suggesting that the financial markets would teach Italians not to vote for populists.

This episode is just the latest chapter in an ever-increasing move towards populist policy which has swept across the political landscape in recent times.

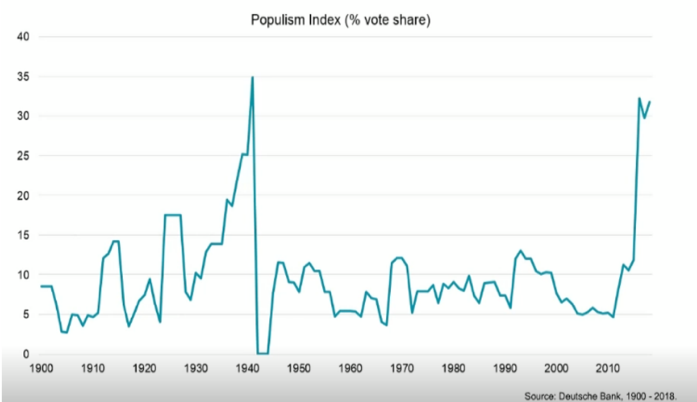

Of course, populism has always been around in various disguises, Russia experienced populism during the 1870s and 1880s, a similar though politically less radical version of populism grew up in the United States during the 1890s and reappeared in many different forms in Latin America during the post-war years.

Of course, populism has always been around in various disguises, Russia experienced populism during the 1870s and 1880s, a similar though politically less radical version of populism grew up in the United States during the 1890s and reappeared in many different forms in Latin America during the post-war years.

However, this “new-age” of populism feels different, for one thing, the populist problem (if that’s what it is) appears to have migrated towards Western Europe where it did not have much of a hold before, and not only that, it appears to be in a much more widespread form. Whereas previous populism was generally contained nationally, this new age of populism has assumed a more international form.

In fact, today, populism is climbing to levels not seen since the 1940’s and it appears likely to not only be a threat to the traditional or mainstream parties, but also to the EU as more of its members appear to be having their heads turned by the appeal of nationalism and self-governed border control.

The Trade War Gathers Pace

The trade war between the US and China escalated in June and threatened to impact other major economies as the rhetoric turned into more than just words causing global investors to fret over the wider economic fallout of President Trump’s “America First” agenda.

The US, determined to crack down on what Trump deems to be unfair trade practices by major trading partners, reversed its decision to put proposed tariffs on hold by slapping $50 billion of tariffs on “strategically important” Chinese exports. In a tit-for-tatresponse, China retaliated almost immediately with its own $50 billion of tariffs on items such as beef, dairy products, sea food, tobacco and soy beans – a list that appears aimed directly at Trump’s Republican base ahead of the US Mid-term elections in November.

With uncertainty surrounding what happens next, the equity markets and the valuations of risk assets have fallen as the risk of a trade war intensifies. As equity valuations fell, the VIX index, a measure of market volatility nicknamed Wall Street’s “fear gauge”, surged amid concerns that other economies may be hit in the cross fire of the ongoing tensions. The concern rose as US Treasury Secretary Stephen Mnuchin tweeted that further restrictions and tariffs would not be solely directed at China but at any country that threaten U.S. intellectual property rights on technology.

With uncertainty surrounding what happens next, the equity markets and the valuations of risk assets have fallen as the risk of a trade war intensifies. As equity valuations fell, the VIX index, a measure of market volatility nicknamed Wall Street’s “fear gauge”, surged amid concerns that other economies may be hit in the cross fire of the ongoing tensions. The concern rose as US Treasury Secretary Stephen Mnuchin tweeted that further restrictions and tariffs would not be solely directed at China but at any country that threaten U.S. intellectual property rights on technology.

Looking back over the last century, it is clear that efforts have been made globally to remove or loosen trade restrictions in favour of unified strong economic growth. What history has also shown is that although progress has been made, the progression hasn’t always been smooth. The cost of the economic progress made may now be beginning to show, with several of the globe’s major trade relationships (NAFTA, TPP, and even the European Union itself) coming under direct fire with questions about their longevity.

It is therefore hoped that the latest escalation of the US China trade war, will ultimately prove to be another stepping stone on the path to deeper global trade integration and prosperity.

One thing that is for sure is that we can expect these tensions to continue to be a looming threat for the foreseeable future. After all, history shows that the path to trade liberalisation hasn’t always been a smooth ride.

How Vizion Wealth are Managing your Portfolio

Here at Vizion Wealth we believe that during times like these it is worth reaffirming our Investment philosophy and staying focused on the fundamental market data rather than reacting to the “noise” being generated on an almost daily basis. Markets go up and down and an over-reaction to short term movements can result in investors missing out on longer term gains.

If you ignore the controversial headlines, the fact is the world economy is still in relatively good shape, currently growing at almost 4%, a level not seen since before the 2008 financial crisis. This is of course positive news for investors over the long term. We therefore continue to pay attention to the headline grabbing events as they evolve, but we do not base our decisions on short-term market movements, but rather the longer term macroeconomic conditions.

Through our choice of fund managers, we have access to a wide diverse range of assets that spread the risk of our portfolios across hundreds of underlying securities across the globe in different countries, currencies and industries. While we focus on medium to long term investment outcomes, we monitor our portfolios on a daily basis and stand ready to modify our portfolios as the fundamental picture evolves. Due to our underlying active approach to investing we see volatility as an opportunity to purchase assets which are valued below their fundamental value which in the longer term we believe will enhance the returns of our portfolios.

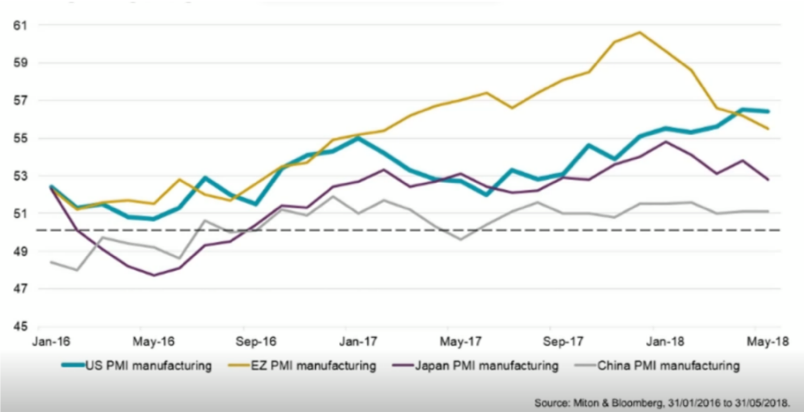

To back up our stance, the table below shows the PMI data which is used to display the health of the major economies. What it shows is that growth in the Eurozone and Japan has started to slow whilst the US is continuing to grow quite strongly. Anything below 50 is consistent with contraction whilst anything above 50 is consistent with expansion. So, as you can see, the major economies are still growing it is just the level of growth which is starting to slow. With this in mind, we expect risk assets to continue to add value albeit there may be a few more speed bumps and periods of uncertainty along the way.

Who are Vizion Wealth?

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

Our approach to financial planning is simple, our clients are our number one priority and we ensure all our advice, strategies and services are tailored to the specific individual to best meet their longer term financial goals and aspirations. We understand that everyone is unique. We understand that wealth means different things to different people and each client will require a different strategy to build wealth, use and enjoy it during their lifetimes and to protect it for family and loved ones in the future.

All of us at Vizion Wealth are committed to our client’s financial success and would like to have an opportunity to review your individual wealth goals. To find out more, get in touch with us – we very much look forward to hearing from you.

DISCLAIMER

INFORMATION IS BASED ON OUR CURRENT UNDERSTANDING OF TAXATION LEGISLATION AND REGULATIONS. ANY LEVELS AND BASES OF, AND RELIEFS FROM, TAXATION ARE SUBJECT TO CHANGE.

THE VALUE OF INVESTMENTS AND INCOME FROM THEM MAY GO DOWN. YOU MAY NOT GET BACK THE ORIGINAL AMOUNT INVESTED.

PAST PERFORMANCE IS NOT A RELIABLE INDICATOR OF FUTURE PERFORMANCE.